ASML Holding Bloomberg ASML.US

Reuters ASML.AS

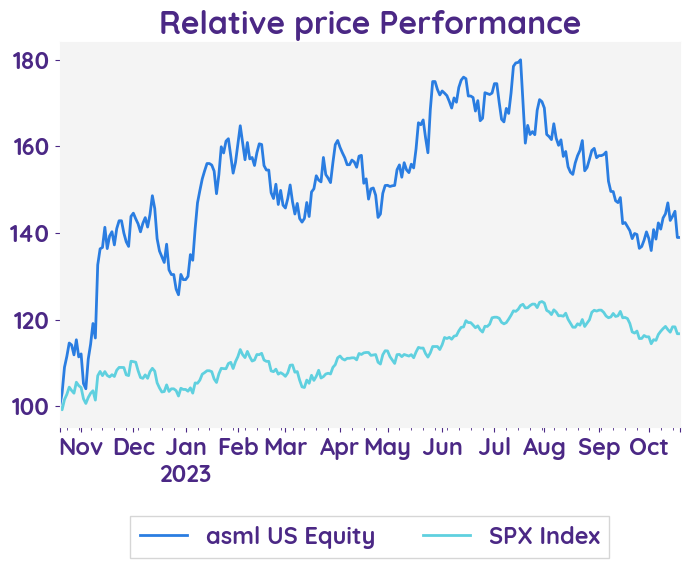

ASML's profit declined in Q3 2023, but the company remains optimistic about future growth.

Earnings Result

ASML's third-quarter results for 2023 showed a strong performance, with net sales of €6.7 billion and a net income of €1.9 billion. This exceeded their previous forecast and indicates continued growth towards their target of 30% for 2023. The gross margin for the quarter was 51.9%, higher than expected, driven by the product mix and one-off cost effects. Looking ahead, ASML anticipates further growth in the fourth quarter, with net sales projected between €6.7 billion and €7.1 billion and a gross margin between 50% and 51%. Overall, the company remains optimistic about its financial performance and future growth.

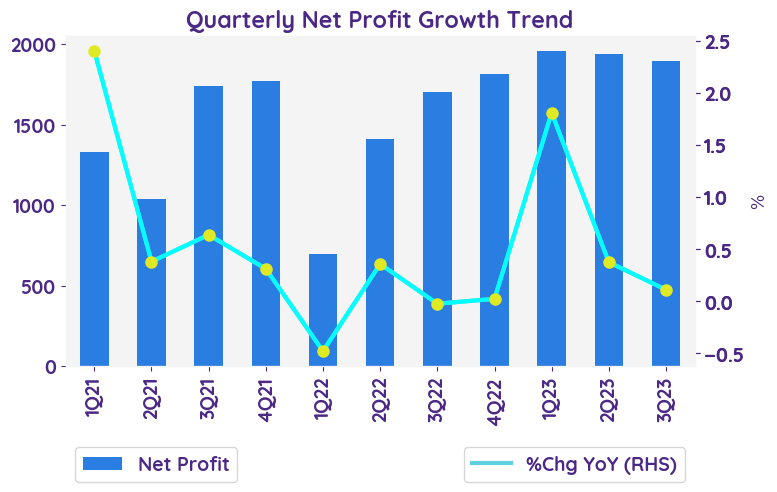

Net profit growth QoQ and YoY

The net profit for ASML in Q3 2023 exceeded expectations, reaching €1.9 billion. However, this is slightly lower than the €1.942 billion net profit in Q2 2023

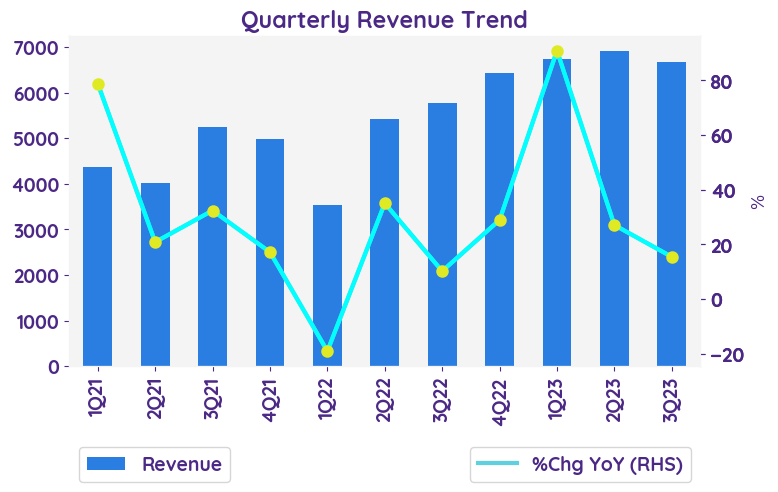

Revenue growth for each business

ASML reported net sales of €6.7 billion in Q3 2023, which fell short of expectations. However, this represents a 15.5% YoY increase from the €5.78 billion reported in the same period the previous year.

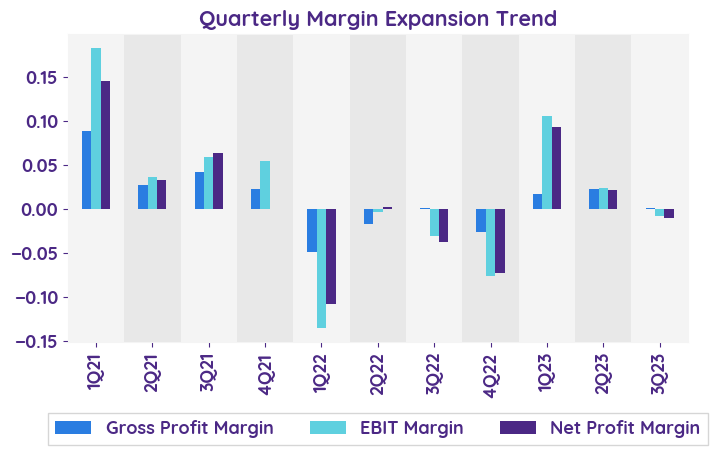

Gross Profit

The gross profit for ASML in Q3 2023 was €3.462 billion, with a gross margin of 51.9%. This exceeded expectations and was primarily driven by the DUV product mix and some one-off cost effects. The company expects a slight improvement in gross margin for 2023 compared to 2022.

Net Booking

In the Q3 2023 earnings report, ASML reported net sales of €6.7 billion and net income of €1.9 billion. They also confirmed their expectation to grow net sales towards 30% in 2023. Additionally, they reported quarterly net bookings of €2.6 billion, with €0.5 billion being EUV.

Outlook

ASML expects Q4 2023 net sales between €6.7 billion and €7.1 billion with a gross margin between 50% and 51%. They also confirm their expectation for strong growth in 2023 with net sales increasing towards 30% and a slight improvement in gross margin.

ASML's third-quarter results for 2023 showed a strong performance, with net sales of €6.7 billion and a net income of €1.9 billion. This exceeded their previous forecast and indicates continued growth towards their target of 30% for 2023. The gross margin for the quarter was 51.9%, higher than expected, driven by the product mix and one-off cost effects. Looking ahead, ASML anticipates further growth in the fourth quarter, with net sales projected between €6.7 billion and €7.1 billion and a gross margin between 50% and 51%. Overall, the company remains optimistic about its financial performance and future growth.

Net profit growth QoQ and YoY

The net profit for ASML in Q3 2023 exceeded expectations, reaching €1.9 billion. However, this is slightly lower than the €1.942 billion net profit in Q2 2023

Revenue growth for each business

ASML reported net sales of €6.7 billion in Q3 2023, which fell short of expectations. However, this represents a 15.5% YoY increase from the €5.78 billion reported in the same period the previous year.

Gross Profit

The gross profit for ASML in Q3 2023 was €3.462 billion, with a gross margin of 51.9%. This exceeded expectations and was primarily driven by the DUV product mix and some one-off cost effects. The company expects a slight improvement in gross margin for 2023 compared to 2022.

Net Booking

In the Q3 2023 earnings report, ASML reported net sales of €6.7 billion and net income of €1.9 billion. They also confirmed their expectation to grow net sales towards 30% in 2023. Additionally, they reported quarterly net bookings of €2.6 billion, with €0.5 billion being EUV.

Outlook

ASML expects Q4 2023 net sales between €6.7 billion and €7.1 billion with a gross margin between 50% and 51%. They also confirm their expectation for strong growth in 2023 with net sales increasing towards 30% and a slight improvement in gross margin.

| Revenue- %Chg YoY | 1Q23 | 2Q23 | 3Q23 | 4Q23 | 1Q24 |

|---|---|---|---|---|---|

| Logic | 227.0% | 60.2% | 39.4% | 33.2% | 13.3% |

| Memory | 40.1% | -25.3% | -6.4% | -36.0% | -20.8% |

| Sentiment | 2Q23 | 3Q23 | 4Q23 | 1Q24 |

|---|---|---|---|---|

| net profit | Positive | Positive | Positive | Positive |

| margin | Positive | Neutral | Positive | Positive |

| revenue | Positive | Positive | Positive | Positive |

| Stock data | |

|---|---|

| Market Cap (USD Million) | 235.13 |

| Beta | 1.83 |

| Last close | 583.25 |

| 12-m Low / High | 410.4 / 772 |

| Target price | 750.00 |

| Return Potential | 28.6 % |

| % of Buy / Sell rating | 60.0 % / 7.0 % |

| Valuation data | 12m Forward | 5-Yr Average |

|---|---|---|

| P/E | 29.64 | 39.50 |

| P/B | 16.39 | 21.20 |

| P/S | 8.00 | 8.70 |

| EV/EBITDA | 22.20 | 23.70 |

| Dividend Yield | 0.0 % |

Advanced Semiconductor Materials Lithography

ASML Holding N.V. develops, produces, and markets semiconductor manufacturing equipment, specifically machines for the production of chips through lithography. The Company services clients worldwide.

Stocks Mentioned

Related Articles