17 October 2023

Costco Wholesale

COST

17 October 2023

Costco Wholesale

COST

Bloomberg COST

Reuters COST

"Despite inflationary pressures, net income delivered a surprising performance

Earnings Result

Costco surpassed quarterly earnings predictions. 3Q23 revealed a net income jump from $4.13 billion (36 weeks prior year) to $6.292 billion (53-week fiscal year), an over $2 billion rise. Diluted earnings per share grew from $13.14 to $14.16, underscoring Costco's sustained profitability.

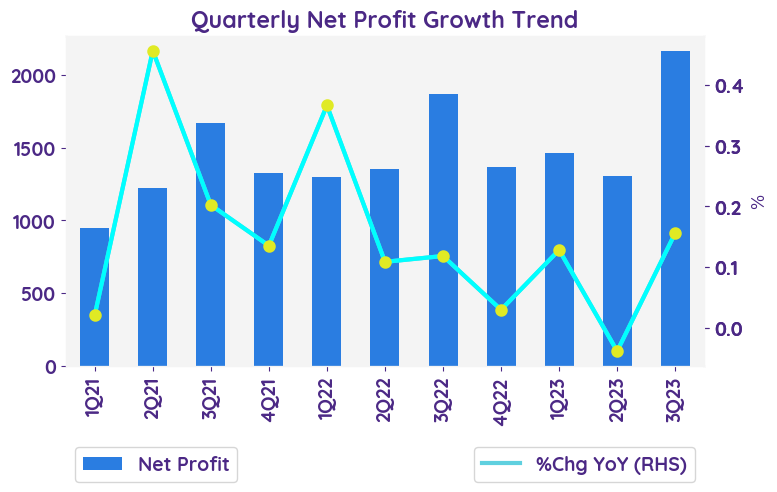

Net profit growth QoQ and YoY

In the 17-week fourth quarter, Costco reported a net income of $2.160 billion, marking a 15.6% YoY growth from last year's $1.868 billion. On a per-share basis, earnings rose to $4.86 from $4.20, a 15.7% increase. For the 53-week fiscal year, the net income reached $6.292 billion, up by 7.7% from the prior year's $5.844 billion, with earnings per share growing from $13.14 to $14.16, a 7.7% uplift.

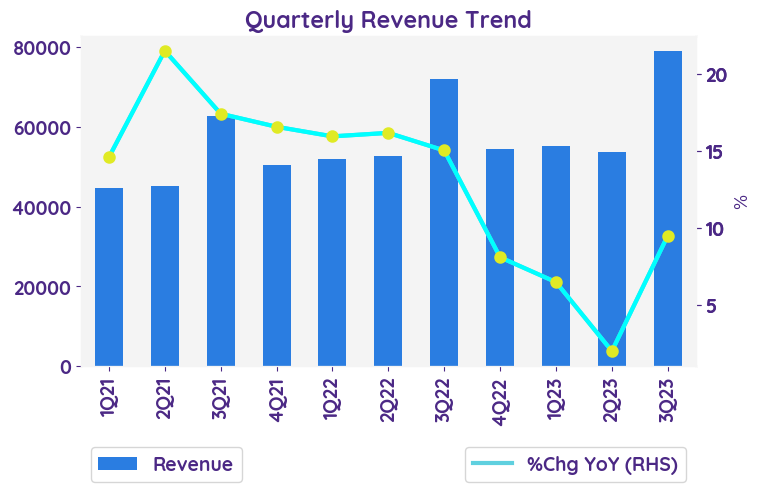

Revenue growth for each business

For Q4, U.S. revenue grew by 0.2%, Canada by 1.8%, and Other International by 5.5%. Yearly growth rates were 3.3%, 1.7%, and 2.8% respectively. E-commerce revenue declined.

Business Outlook

Costco aims to boost its digital presence, emphasizing sustainability and global expansion. Product diversification and tech enhancements will enrich customer experience, positioning Costco for growth.

E-commerce Adaptability

Costco's e-commerce strategy includes user interface improvements, sustainable practices, and leveraging technologies like augmented reality. This positions them well in the digital retail market.

Membership Loyalty

Costco's membership model ensures consistent revenue and customer loyalty, with repeat business aiding in targeted marketing and inventory decisions..

Costco surpassed quarterly earnings predictions. 3Q23 revealed a net income jump from $4.13 billion (36 weeks prior year) to $6.292 billion (53-week fiscal year), an over $2 billion rise. Diluted earnings per share grew from $13.14 to $14.16, underscoring Costco's sustained profitability.

Net profit growth QoQ and YoY

In the 17-week fourth quarter, Costco reported a net income of $2.160 billion, marking a 15.6% YoY growth from last year's $1.868 billion. On a per-share basis, earnings rose to $4.86 from $4.20, a 15.7% increase. For the 53-week fiscal year, the net income reached $6.292 billion, up by 7.7% from the prior year's $5.844 billion, with earnings per share growing from $13.14 to $14.16, a 7.7% uplift.

Revenue growth for each business

For Q4, U.S. revenue grew by 0.2%, Canada by 1.8%, and Other International by 5.5%. Yearly growth rates were 3.3%, 1.7%, and 2.8% respectively. E-commerce revenue declined.

Business Outlook

Costco aims to boost its digital presence, emphasizing sustainability and global expansion. Product diversification and tech enhancements will enrich customer experience, positioning Costco for growth.

E-commerce Adaptability

Costco's e-commerce strategy includes user interface improvements, sustainable practices, and leveraging technologies like augmented reality. This positions them well in the digital retail market.

Membership Loyalty

Costco's membership model ensures consistent revenue and customer loyalty, with repeat business aiding in targeted marketing and inventory decisions..

| Same Store Sale Growth - %Chg YoY | 2Q23 | 3Q23 | 4Q23 | 1Q24 | 2Q24 |

|---|---|---|---|---|---|

| US | 5.8% | 1.8% | 3.1% | 3.7% | 3.8% |

| Canada | 9.6% | 7.4% | 7.4% | 5.2% | 4.7% |

| Other International | 5.6% | -6.7% | -61.1% | -44.3% | -49.7% |

| Sentiment | 3Q23 | 4Q23 | 1Q24 | 2Q24 |

|---|---|---|---|---|

| net profit | Positive | Positive | Positive | Positive |

| margin | Neutral | Neutral | Neutral | Neutral |

| revenue | Positive | Positive | Positive | Neutral |

| Stock data | |

|---|---|

| Market Cap (USD Million) | 253.35 |

| Beta | 0.99 |

| Last close | 572.24 |

| 12-m Low / High | 447.9 / 576.2 |

| Target price | 610.00 |

| Return Potential | 6.6 % |

| % of Buy / Sell rating | 63.0 % / 5.0 % |

| Valuation data | 12m Forward | 5-Yr Average |

|---|---|---|

| P/E | 36.57 | 37.44 |

| P/B | 8.46 | 9.84 |

| P/S | 1.00 | 0.97 |

| EV/EBITDA | 21.72 | 22.94 |

| Dividend Yield | 0.0 % |

Costco Wholesale

Costco Wholesale Corporation is a membership warehouse club The Company sells all kinds of food, automotive supplies, toys, hardware, sporting goods, jewelry, electronics, apparel, health, and beauty aids, as well as other goods. Costco Wholesale serves customers worldwide.

Related Articles