17 October 2023

Levi Strauss & Co.

LEVI

17 October 2023

Levi Strauss & Co.

LEVI

Bloomberg LEVI.US

Reuters LEVI.US

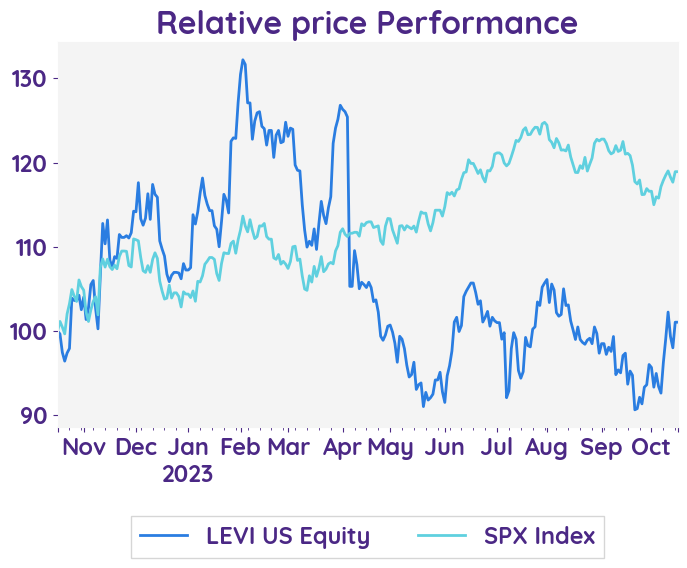

Sales weakness sparks more downbeat outlook

Earnings Result

Looking ahead, management reduced its FY guidance for both sales and EPS, with 4Q23 implied sales and EBIT margins guided below consensus but 4Q EPS helped by a lower tax rate. LEVI lowered its FY23 EPS outlook at midpoint, now expecting EPS to come in at the low end of its prior guidance range of $1.10-$1.20 (vs. consensus at $1.11), with revenue growth flat to +1% YoY (vs. consensus of +1.5%) and gross margin contraction of ~90bps (vs. consensus of -64bps). Company continues to have concerns around its wholesale business, while they’re impressed with its direct-to-consumer results.

Slightly beat with weaker-than-expected demand growth outlook

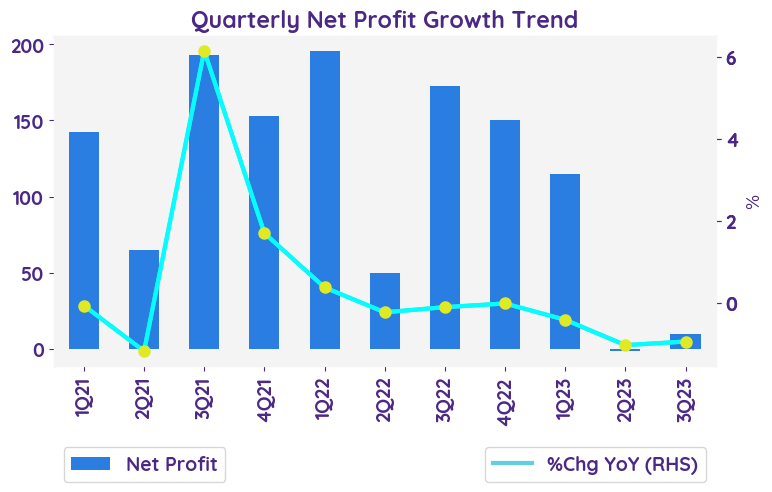

LEVI reported a slight 3Q23 EPS beat, with a revenue miss offset by better gross margins and lower tax expense. Adjusted EPS 28c vs. 40c y/y, estimate 27c. Adjusted net income $112 million, estimate $105.4 million. The middle-income consumer and below are definitely being impacted, especially in the US, but that’s also true in parts of Europe. The consumer is really feeling squeezed.

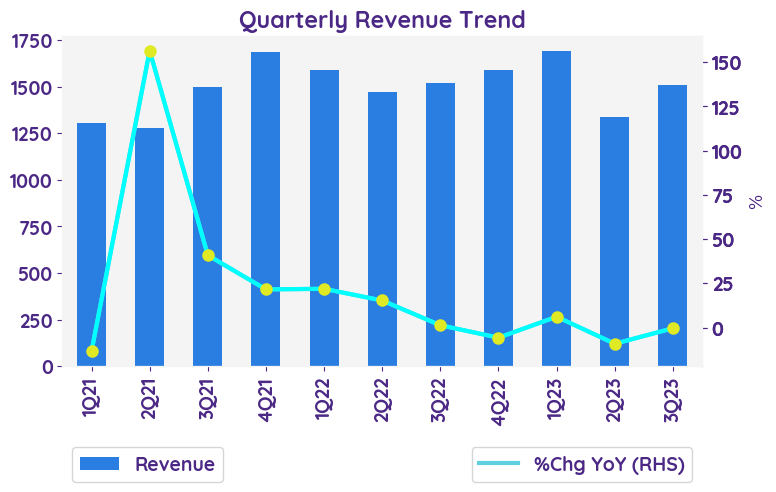

Revenue growth just short of estimates, weakness in Europe and North America offsetting growth in Latin America and Asia

Revenue growth missed estimates due to Europe and North America's downturns, counterbalanced by Latin America and Asia's upswing. Specifically, Americas and Europe saw revenue declines, while Asia and Other Brands, including strong performances from Dockers® and Beyond Yoga®, witnessed growth.Overall, the Americas and Europe experienced declines in net revenues, while Asia and Other Brands showed growth.

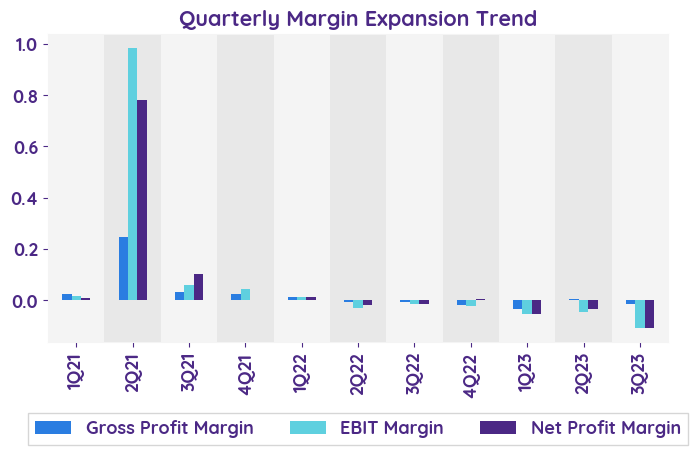

Better operating margin

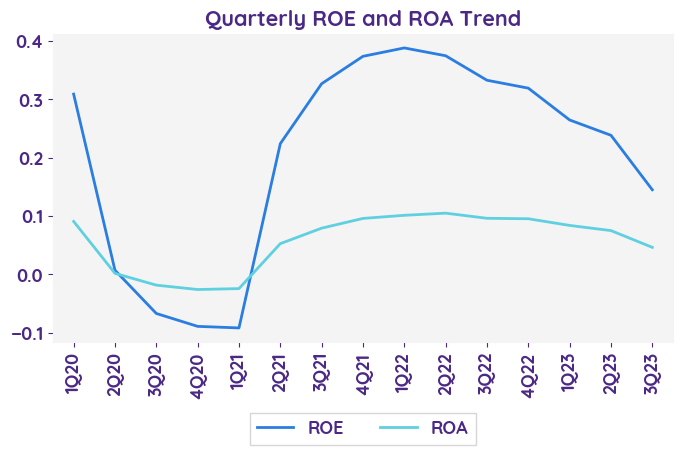

In Q3 2023, the company's operating margin dropped to 2.3% from 13.1% the previous year due to increased SG&A expenses, a Beyond Yoga® acquisition charge, and reduced net revenues. Adjusted EBIT margin fell to 9.1% from 12.4% largely from gross margin contraction. Gross margin declined to 55.6% from 56.9% in Q3 2022, due to reduced full-price sales and elevated product costs.

Inventory improvement on track

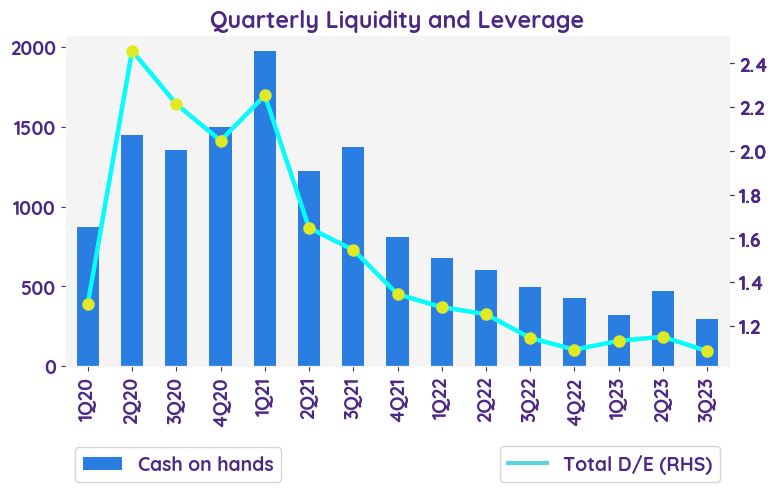

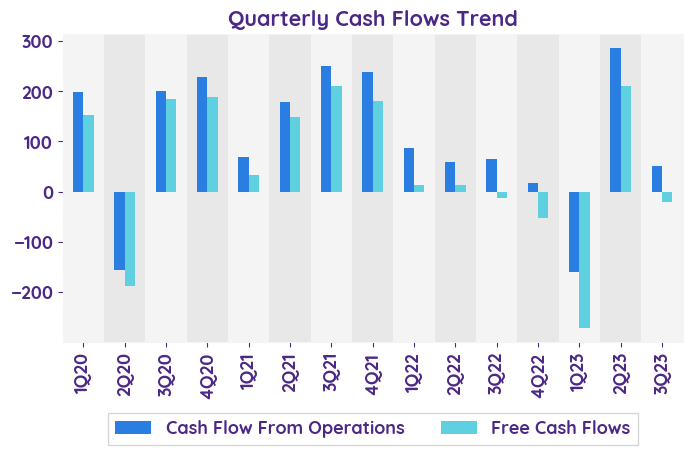

The company holds $295 million in cash, with total liquidity at $1.1 billion. Inventories rose 6%, 5% due to supplier term changes. The leverage ratio increased from 1.1 to 1.6 since Q3 2022. A robust balance sheet is evident, with positive operating cash flow, but outflows from investing and financing.

Risks and concerns

The current risk that the company is facing is an increase in total liabilities, which stood at $3,932.8 million at the end of Q3 2023 compared to $4,134.1 million in the previous quarter. This indicates a potential financial burden on the company. However, the company's plan to address this risk is not mentioned in the provided content.

Looking ahead, management reduced its FY guidance for both sales and EPS, with 4Q23 implied sales and EBIT margins guided below consensus but 4Q EPS helped by a lower tax rate. LEVI lowered its FY23 EPS outlook at midpoint, now expecting EPS to come in at the low end of its prior guidance range of $1.10-$1.20 (vs. consensus at $1.11), with revenue growth flat to +1% YoY (vs. consensus of +1.5%) and gross margin contraction of ~90bps (vs. consensus of -64bps). Company continues to have concerns around its wholesale business, while they’re impressed with its direct-to-consumer results.

Slightly beat with weaker-than-expected demand growth outlook

LEVI reported a slight 3Q23 EPS beat, with a revenue miss offset by better gross margins and lower tax expense. Adjusted EPS 28c vs. 40c y/y, estimate 27c. Adjusted net income $112 million, estimate $105.4 million. The middle-income consumer and below are definitely being impacted, especially in the US, but that’s also true in parts of Europe. The consumer is really feeling squeezed.

Revenue growth just short of estimates, weakness in Europe and North America offsetting growth in Latin America and Asia

Revenue growth missed estimates due to Europe and North America's downturns, counterbalanced by Latin America and Asia's upswing. Specifically, Americas and Europe saw revenue declines, while Asia and Other Brands, including strong performances from Dockers® and Beyond Yoga®, witnessed growth.Overall, the Americas and Europe experienced declines in net revenues, while Asia and Other Brands showed growth.

Better operating margin

In Q3 2023, the company's operating margin dropped to 2.3% from 13.1% the previous year due to increased SG&A expenses, a Beyond Yoga® acquisition charge, and reduced net revenues. Adjusted EBIT margin fell to 9.1% from 12.4% largely from gross margin contraction. Gross margin declined to 55.6% from 56.9% in Q3 2022, due to reduced full-price sales and elevated product costs.

Inventory improvement on track

The company holds $295 million in cash, with total liquidity at $1.1 billion. Inventories rose 6%, 5% due to supplier term changes. The leverage ratio increased from 1.1 to 1.6 since Q3 2022. A robust balance sheet is evident, with positive operating cash flow, but outflows from investing and financing.

Risks and concerns

The current risk that the company is facing is an increase in total liabilities, which stood at $3,932.8 million at the end of Q3 2023 compared to $4,134.1 million in the previous quarter. This indicates a potential financial burden on the company. However, the company's plan to address this risk is not mentioned in the provided content.

| Operating Income - %Chg YoY | 3Q22 | 4Q22 | 1Q23 | 2Q23 | 3Q23 |

|---|---|---|---|---|---|

| Americas | 2.9% | -5.0% | 7.5% | -21.5% | -4.8% |

| Europe | -18.5% | -18.3% | -3.0% | -1.6% | -1.6% |

| Asia | 36.1% | 1.3% | 12.0% | 18.0% | 11.7% |

| Wholesale | 1.1% | -8.1% | 2.3% | -22.3% | -8.0% |

| Direct to consumer | 1.8% | -1.8% | 12.0% | 12.9% | 13.6% |

| Sentiment | 4Q22 | 1Q23 | 2Q23 | 3Q23 |

|---|---|---|---|---|

| net profit | Neutral | Positive | Negative | Negative |

| margin | Neutral | Neutral | Neutral | Negative |

| revenue | Neutral | Neutral | Negative | Neutral |

| Stock data | |

|---|---|

| Market Cap (USD Million) | 5.68 |

| Beta | 1.29 |

| Last close | 14.29 |

| 12-m Low / High | 12.4 / 19.4 |

| Target price | 16.00 |

| Return Potential | 12.0 % |

| % of Buy / Sell rating | 62.0 % / 0.0 % |

| Valuation data | 12m Forward | 5-Yr Average |

|---|---|---|

| P/E | 11.03 | |

| P/B | 2.53 | |

| P/S | 0.87 | |

| EV/EBITDA | 7.58 | 11.51 |

| Dividend Yield | 0.0 % |

Levi Strauss & Co.

Levi Strauss & Co. manufactures and distributes apparels. The Company offers jeans, casual pants, tops, jackets, shirts, and other related products. Levi Strauss serves customers worldwide.

Related Articles