17 October 2023

Micron Technology

MU

17 October 2023

Micron Technology

MU

Bloomberg MU.US

Reuters MU.US

Mixed guidance; See near-term challenges but recovery in the longer term.

Earnings Result

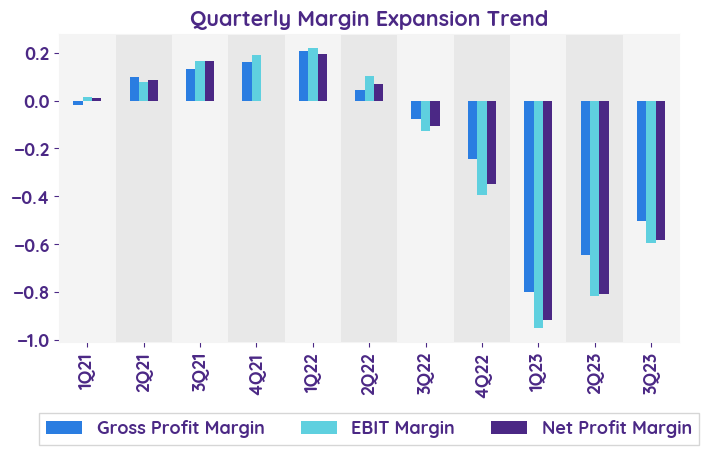

Outlook is slightly lower versus expectations, but conditions are improving, though there continues to be longer-term oversupply. The company's guidance for the first quarter includes expected revenue of $4.40 billion, a gross margin of (6.0%) ± 2.0%, operating expenses of $1.01 billion, and diluted earnings per share of ($1.24) ± $0.07. MU predicting a steeper loss than anticipated in the current quarter. MU look forward to record industry TAM revenue in 2025 as AI proliferates from the data center to the edge.

Steeper loss than anticipated

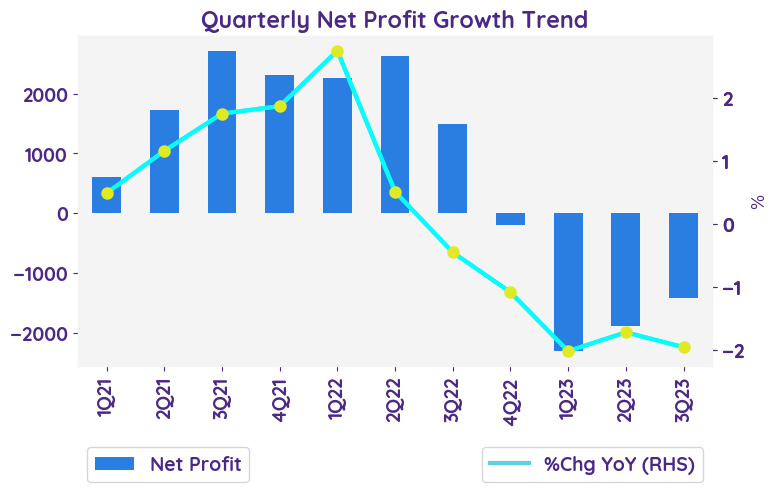

The net profit of Micron Technology Inc. showed a decline both quarter-over-quarter (QoQ) and year-over-year (YoY). In the fourth quarter of fiscal 2023, the net loss was $1.43 billion, compared to a net loss of $1.31 billion in the previous quarter. Similarly, the net loss for the full year of fiscal 2023 was $5.83 billion, compared to a net loss of $5.34 billion in the previous year. These figures indicate a decrease in profitability for the company.

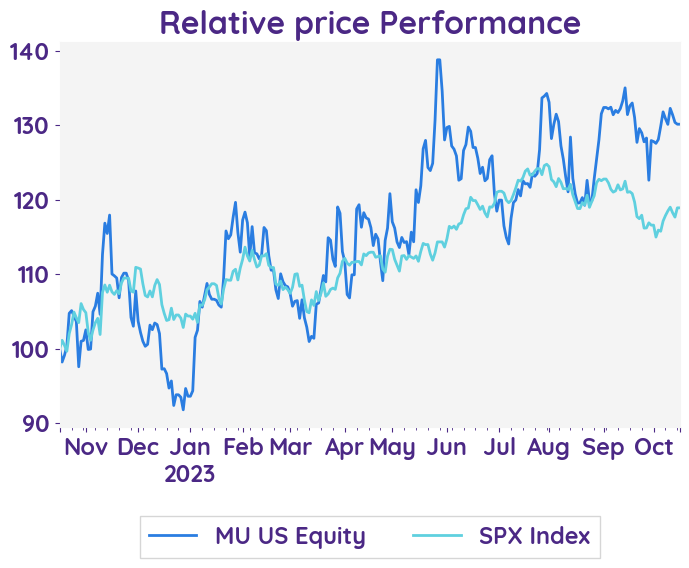

Revenue growth for each business

Sales have fallen for five straight quarters. In the three months ended in August, Micron’s revenue declined 40% to $4.01 billion. Revenue is expected to start recovering in the period. Micron predicted sales of $4.2 billion to $4.6 billion, compared with an estimate of $4.21 billion. But one additional obstacle that Micron faces is Beijing’s designation of its products as a security risk. That’s already cut into the US company’s revenue in China.

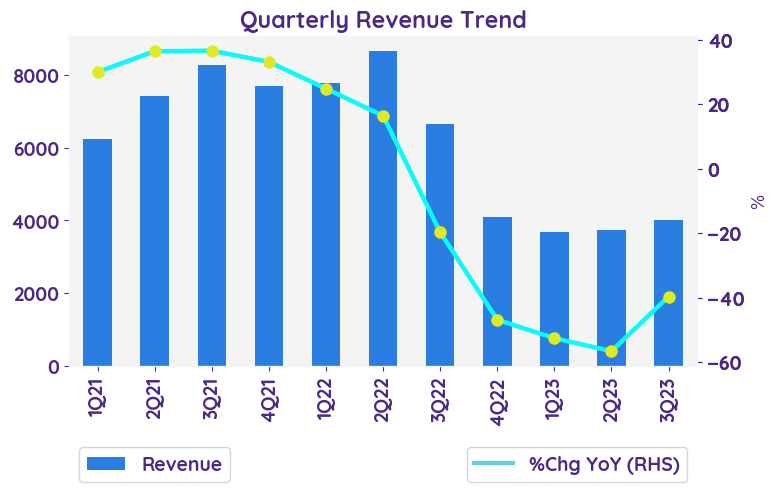

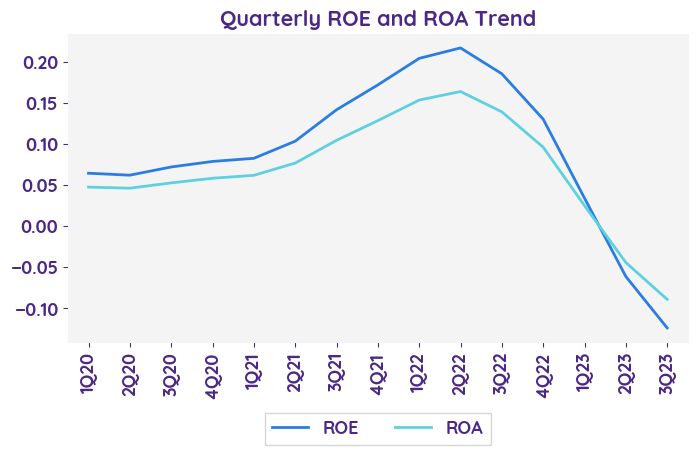

Volatile operating margin

The operating margin for the company has been fluctuating over the years. In FY 23, the operating margin was (37.0%) compared to 31.5% in FY 22. This indicates a decrease in profitability and efficiency in the company's operations. However, in the fourth quarter of 2023, the operating margin improved to 25.0%, showing a positive trend.

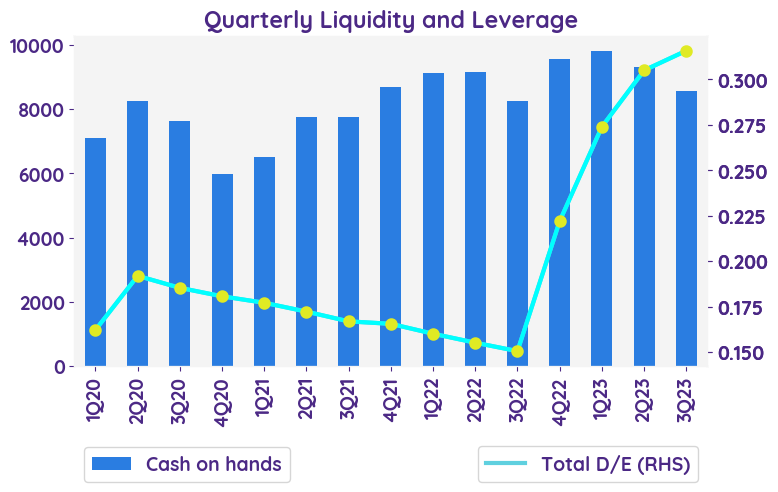

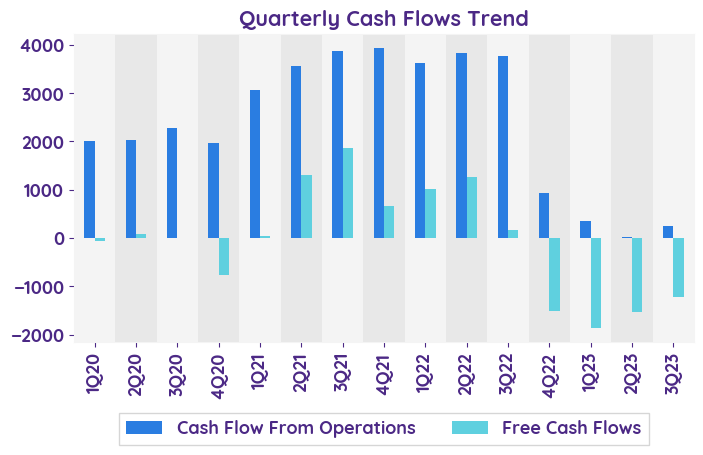

Balance sheet and cashflow

The balance sheet shows the company's assets, liabilities, and equity. As of August 31, 2023, the company had total assets of $64,254 million and total liabilities of $20,134 million. The cash flow statement shows the company's cash flows from operating, investing, and financing activities. Net cash provided by operating activities for the year ended August 31, 2023, was $1,559 million. The company also had net cash used for investing activities of $6,191 million and net cash provided by financing activities of $4,983 million.

Outlook is slightly lower versus expectations, but conditions are improving, though there continues to be longer-term oversupply. The company's guidance for the first quarter includes expected revenue of $4.40 billion, a gross margin of (6.0%) ± 2.0%, operating expenses of $1.01 billion, and diluted earnings per share of ($1.24) ± $0.07. MU predicting a steeper loss than anticipated in the current quarter. MU look forward to record industry TAM revenue in 2025 as AI proliferates from the data center to the edge.

Steeper loss than anticipated

The net profit of Micron Technology Inc. showed a decline both quarter-over-quarter (QoQ) and year-over-year (YoY). In the fourth quarter of fiscal 2023, the net loss was $1.43 billion, compared to a net loss of $1.31 billion in the previous quarter. Similarly, the net loss for the full year of fiscal 2023 was $5.83 billion, compared to a net loss of $5.34 billion in the previous year. These figures indicate a decrease in profitability for the company.

Revenue growth for each business

Sales have fallen for five straight quarters. In the three months ended in August, Micron’s revenue declined 40% to $4.01 billion. Revenue is expected to start recovering in the period. Micron predicted sales of $4.2 billion to $4.6 billion, compared with an estimate of $4.21 billion. But one additional obstacle that Micron faces is Beijing’s designation of its products as a security risk. That’s already cut into the US company’s revenue in China.

Volatile operating margin

The operating margin for the company has been fluctuating over the years. In FY 23, the operating margin was (37.0%) compared to 31.5% in FY 22. This indicates a decrease in profitability and efficiency in the company's operations. However, in the fourth quarter of 2023, the operating margin improved to 25.0%, showing a positive trend.

Balance sheet and cashflow

The balance sheet shows the company's assets, liabilities, and equity. As of August 31, 2023, the company had total assets of $64,254 million and total liabilities of $20,134 million. The cash flow statement shows the company's cash flows from operating, investing, and financing activities. Net cash provided by operating activities for the year ended August 31, 2023, was $1,559 million. The company also had net cash used for investing activities of $6,191 million and net cash provided by financing activities of $4,983 million.

| Operating Income - %Chg YoY | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 |

|---|---|---|---|---|---|

| Compute and Networking (CNBU) | -22.7% | -48.7% | -60.3% | -64.3% | -59.1% |

| Mobile (MBU) | -20.1% | -65.7% | -49.6% | -58.4% | -19.9% |

| Storage (SBU) | -25.9% | -40.9% | -56.7% | -53.2% | -17.1% |

| Embedded (EBU) | -4.2% | -18.0% | -32.3% | -36.4% | -34.0% |

| Sentiment | 1Q23 | 2Q23 | 3Q23 | 4Q23 |

|---|---|---|---|---|

| net profit | Neutral | Negative | Negative | Negative |

| margin | Neutral | Neutral | Negative | Negative |

| revenue | Neutral | Neutral | Positive | Negative |

| Stock data | |

|---|---|

| Market Cap (USD Million) | 75.85 |

| Beta | 1.25 |

| Last close | 69.08 |

| 12-m Low / High | 48.4 / 74.8 |

| Target price | 80.00 |

| Return Potential | 15.8 % |

| % of Buy / Sell rating | 74.0 % / 5.0 % |

| Valuation data | 12m Forward | 5-Yr Average |

|---|---|---|

| P/E | ||

| P/B | 1.84 | 1.52 |

| P/S | 3.63 | 2.90 |

| EV/EBITDA | 12.43 | 13.37 |

| Dividend Yield | 0.0 % |

Micron Technology

Micron Technology, Inc., through its subsidiaries, manufactures and markets dynamic random access memory chips (DRAMs), static random access memory chips (SRAMs), flash memory, semiconductor components, and memory modules.

Related Articles