สรุปสาระสำคัญ

Microsoft เผยงบ 1Q24 ดีกว่าคาด โดยรายได้เพิ่มขึ้น 13%YoY และกำไรเพิ่มขึ้น 27%YoY ผลมาจากการฟื้นตัวของกลุ่มธุรกิจที่ในช่วงก่อนมีภาพการชะลอตัว แต่ใน F1Q24 พลิกกลับมเติบโตซึ่งมีแรงหนุนหลักจากความต้องการ AI ที่เพิ่มขึ้นโดย โดย 1) รายได้กลุ่ม Azure โต 29%YoY จากไตรมาสก่อนที่โตชะลอตัว 2) ด้านกลุ่ม More Personal Computing พลิกกลับมาเติบโต 3%YoY และดีกว่าคาดที่มองว่ากลุ่มนี้จะยังหดตัวอยู่

25 October 2023

Microsoft Corporation

MSFT

25 October 2023

Microsoft Corporation

MSFT

Bloomberg MSFT.US

Reuters MSFT.OQ

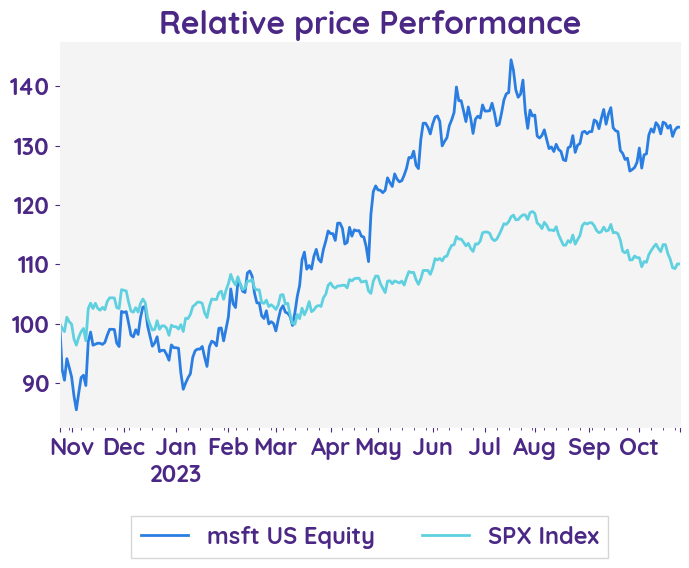

Microsoft's 1Q24 earnings surpassed expectations, driven by robust growth in Azure cloud services, showcasing the substantial benefits derived from AI advancements.

Earnings Result

In comparing the previous and current quarters of Microsoft's earnings results, it is evident that the company continues to prioritize increasing productivity and security for customers through the release of new products and enhancements. Microsoft's focus on Environmental, Social, and Governance (ESG) efforts remains consistent, aiming to have a positive impact. However, the current quarter's summary highlights potential challenges such as intense competition, investments with lower returns, cyberattacks, and regulatory requirements that may affect actual results. Despite these factors, Microsoft returned $9.1 billion to shareholders in the current quarter, indicating a strong financial performance.

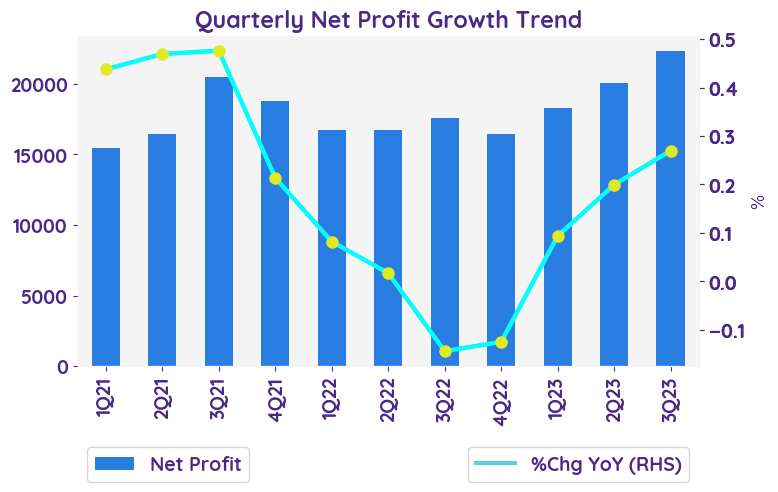

Net profit growth QoQ and YoY

Microsoft reported a net profit that surpassed projections, experiencing a 27% year-over-year increase to reach $22.3 billion.

Microsoft Sales Top Estimates

Revenue exceeded estimates and remained robust in the fiscal first quarter, ending September 30, with a 13% increase to $56.5 billion, surpassing the average projections of analysts. The company delivered growth across all business segments as detailed below: - Productivity and Business Processes: Revenue increased from $16,465 million in 2022 to $18,592 million in 2023, representing a growth of 13%. - Intelligent Cloud: Revenue increased from $20,325 million in 2022 to $24,259 million in 2023, representing a growth of 19%. - More Personal Computing: Revenue increased from $13,332 million in 2022 to $13,666 million in 2023, representing a growth of 3%.

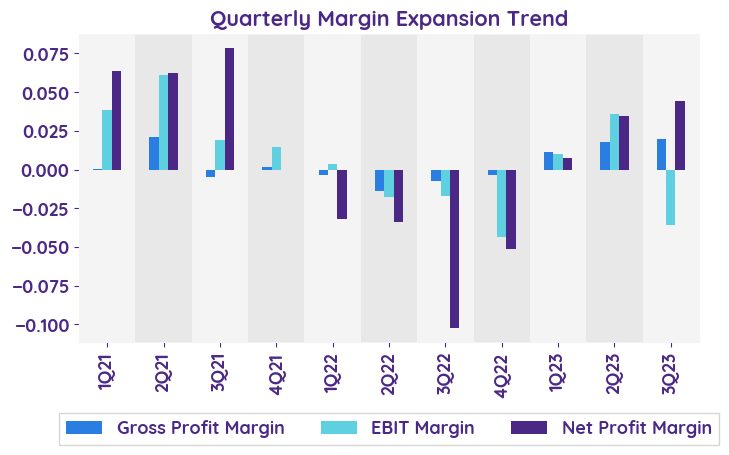

Operating margin

The operating margin for Microsoft Corporation in the three months ended September 30, 2023, was 47.6% ($26,895 million operating income divided by $56,517 million total revenue). This represents an increase from the operating margin of 42.9% ($21,518 million operating income divided by $50,122 million total revenue) in the same period in 2022.

Robust growth in cloud services

Microsoft reported strong growth in its Azure and cloud services revenue, which increased by 29% (up 28% in constant currency) compared to the same period last year. This growth contributed to the overall increase in Microsoft's revenue, operating income, net income, and diluted earnings per share. The company's focus on infusing AI across its tech stack and driving productivity gains for customers has been successful.

In comparing the previous and current quarters of Microsoft's earnings results, it is evident that the company continues to prioritize increasing productivity and security for customers through the release of new products and enhancements. Microsoft's focus on Environmental, Social, and Governance (ESG) efforts remains consistent, aiming to have a positive impact. However, the current quarter's summary highlights potential challenges such as intense competition, investments with lower returns, cyberattacks, and regulatory requirements that may affect actual results. Despite these factors, Microsoft returned $9.1 billion to shareholders in the current quarter, indicating a strong financial performance.

Net profit growth QoQ and YoY

Microsoft reported a net profit that surpassed projections, experiencing a 27% year-over-year increase to reach $22.3 billion.

Microsoft Sales Top Estimates

Revenue exceeded estimates and remained robust in the fiscal first quarter, ending September 30, with a 13% increase to $56.5 billion, surpassing the average projections of analysts. The company delivered growth across all business segments as detailed below: - Productivity and Business Processes: Revenue increased from $16,465 million in 2022 to $18,592 million in 2023, representing a growth of 13%. - Intelligent Cloud: Revenue increased from $20,325 million in 2022 to $24,259 million in 2023, representing a growth of 19%. - More Personal Computing: Revenue increased from $13,332 million in 2022 to $13,666 million in 2023, representing a growth of 3%.

Operating margin

The operating margin for Microsoft Corporation in the three months ended September 30, 2023, was 47.6% ($26,895 million operating income divided by $56,517 million total revenue). This represents an increase from the operating margin of 42.9% ($21,518 million operating income divided by $50,122 million total revenue) in the same period in 2022.

Robust growth in cloud services

Microsoft reported strong growth in its Azure and cloud services revenue, which increased by 29% (up 28% in constant currency) compared to the same period last year. This growth contributed to the overall increase in Microsoft's revenue, operating income, net income, and diluted earnings per share. The company's focus on infusing AI across its tech stack and driving productivity gains for customers has been successful.

| Revenue - %Chg YoY | 1Q23 | 2Q23 | 3Q23 | 4Q23 | 1Q24 |

|---|---|---|---|---|---|

| Productivity & Business Processes | 9.5% | 6.7% | 10.9% | 10.2% | 12.9% |

| Intelligent Cloud | 20.2% | 17.8% | 15.9% | 14.7% | 19.4% |

| More Personal Computing | -0.3% | -18.8% | -8.7% | -3.1% | 2.5% |

| Sentiment | 2Q23 | 3Q23 | 4Q23 | 1Q24 |

|---|---|---|---|---|

| net profit | Neutral | Positive | Neutral | Positive |

| margin | Neutral | Neutral | Negative | Positive |

| revenue | Positive | Positive | Positive | Positive |

| Stock data | |

|---|---|

| Market Cap (USD Million) | 2456.59 |

| Beta | 1.16 |

| Last close | 330.53 |

| 12-m Low / High | 213.4 / 366.8 |

| Target price | 400.00 |

| Return Potential | 21.0 % |

| % of Buy / Sell rating | 90.0 % / 0.0 % |

| Valuation data | 12m Forward | 5-Yr Average |

|---|---|---|

| P/E | 29.18 | 32.15 |

| P/B | 8.65 | 12.23 |

| P/S | 10.39 | 10.57 |

| EV/EBITDA | 20.61 | 19.60 |

| Dividend Yield | 0.0 % |

Microsoft Corporation

Microsoft Corporation operates as a software company. The Company offers applications, extra cloud storage, and advanced security solutions. Microsoft serves customers worldwide.

Related Articles