Bloomberg NFLX.US

Reuters NFLX.O

Netflix's Q2 2023 earnings continued growth in earnings due to password crackdown and Advertising plan

Earnings Result

In comparing the previous quarter's financial report summary to the current quarter's, Netflix continues to emphasize their adoption and growth in streaming entertainment, as well as their competitive position and core strategy. They also discuss their content offerings, monetization through pricing and tiering structures, and negotiations with SAG-AFTRA. In terms of financial figures, Netflix provides details on their consolidated revenue, operating income, net income, and earnings per share for both quarters. Additionally, they disclose their operating margin, which was 21.9% for 2023.

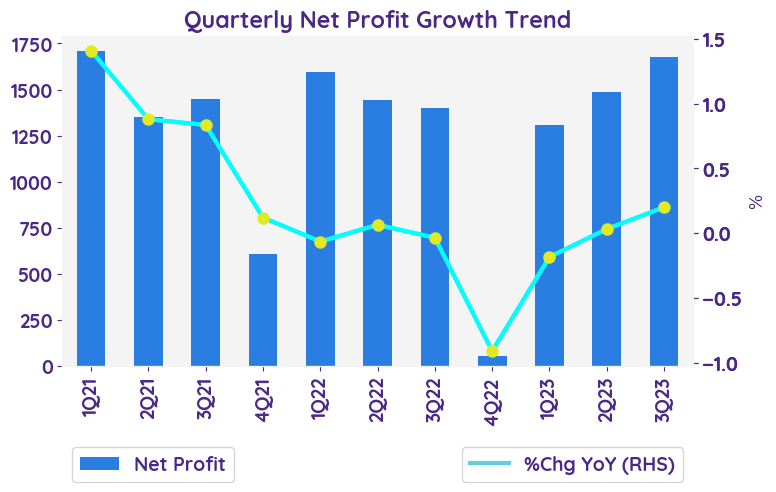

Net profit growth QoQ and YoY

The net profit growth for Q3'23 was $1.677 billion, which is an increase of 10.8% compared to the same quarter last year. The diluted EPS for Q3'23 was $3.73, showing a growth of 20.3% compared to the previous year. These figures indicate a strong year-over-year growth in net profit.

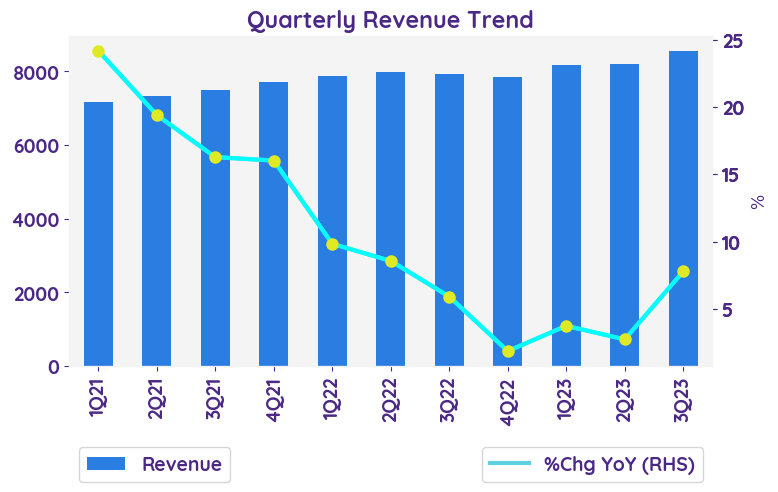

Revenue growth for each business

Revenue growth for each business: - UCAN Streaming: Revenue showed consistent growth from Q3'22 to Q3'23, with a slight increase in Q3'23. Year-over-year growth remained stable at 0%. - EMEA: Revenue experienced a decline from Q3'22 to Q4'22, but showed growth from Q1'23 to Q3'23. Year-over-year growth fluctuated, with a 2% increase in Q3'23. - LATAM: Revenue increased steadily from Q3'22 to Q3'23, with a 3% year-over-year growth in Q3'23. - APAC: Revenue fluctuated throughout the quarters, with a 9% year-over-year decline in Q3'23.

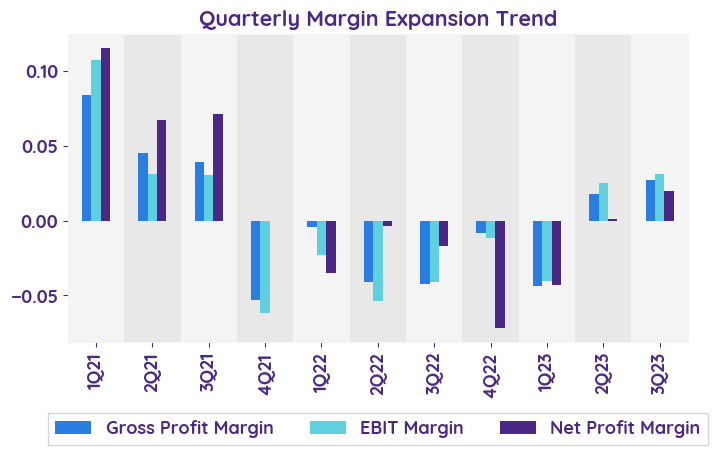

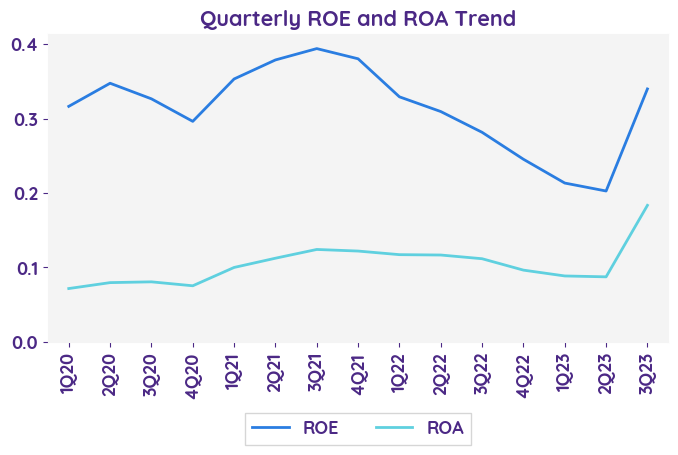

Netflix Optimistic About Operating Margins

Netflix said its operating margins have more room to run as the streamer leans on initiatives like its crackdown on password sharing, cheaper ad-supported tier, and newly announced price hikes. Operating margin for FY24 is expected to be between 22% to 23%, which would be an increase from the 18% operating margin in FY22. The company also provides transparency by disclosing the year-to-date operating margin based on FX rates at the beginning of each year. The adjusted operating margin for FY22 was 20.0%.

Company Outlook

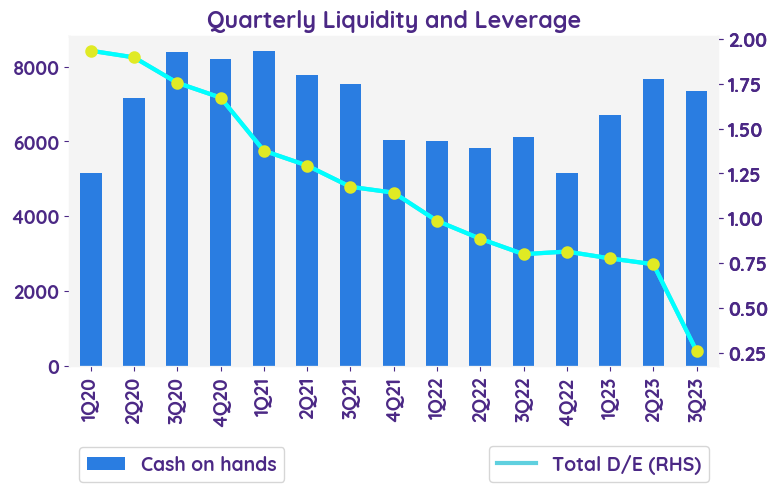

The forecast for Q4'23 is as follows: revenue is expected to be $8.7B, up 11% YoY or 12% on an F/X neutral basis. Paid net additions are expected to be similar to Q3'23. Global ARM in Q4 is expected to be roughly flat YoY. The operating margin guidance for FY23 is updated to 20%, the high end of the prior forecast range.

Future Plan

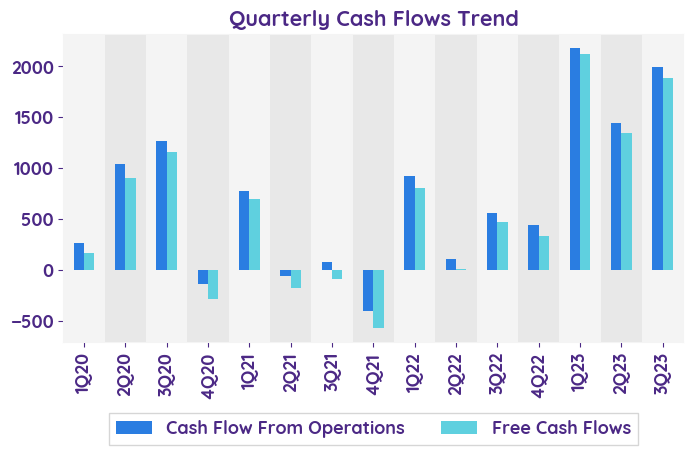

The adoption of Netflix's ads plan has been growing, with a nearly 70% increase in ad membership quarter-over-quarter in Q3'23. Additionally, Netflix is adjusting its prices in the US, UK, and France, with the ads plan remaining at $6.99 per month in the US. While ad revenue is not expected to be material to the business in 2023, Netflix remains optimistic about the long-term opportunity in the advertising market.

In comparing the previous quarter's financial report summary to the current quarter's, Netflix continues to emphasize their adoption and growth in streaming entertainment, as well as their competitive position and core strategy. They also discuss their content offerings, monetization through pricing and tiering structures, and negotiations with SAG-AFTRA. In terms of financial figures, Netflix provides details on their consolidated revenue, operating income, net income, and earnings per share for both quarters. Additionally, they disclose their operating margin, which was 21.9% for 2023.

Net profit growth QoQ and YoY

The net profit growth for Q3'23 was $1.677 billion, which is an increase of 10.8% compared to the same quarter last year. The diluted EPS for Q3'23 was $3.73, showing a growth of 20.3% compared to the previous year. These figures indicate a strong year-over-year growth in net profit.

Revenue growth for each business

Revenue growth for each business: - UCAN Streaming: Revenue showed consistent growth from Q3'22 to Q3'23, with a slight increase in Q3'23. Year-over-year growth remained stable at 0%. - EMEA: Revenue experienced a decline from Q3'22 to Q4'22, but showed growth from Q1'23 to Q3'23. Year-over-year growth fluctuated, with a 2% increase in Q3'23. - LATAM: Revenue increased steadily from Q3'22 to Q3'23, with a 3% year-over-year growth in Q3'23. - APAC: Revenue fluctuated throughout the quarters, with a 9% year-over-year decline in Q3'23.

Netflix Optimistic About Operating Margins

Netflix said its operating margins have more room to run as the streamer leans on initiatives like its crackdown on password sharing, cheaper ad-supported tier, and newly announced price hikes. Operating margin for FY24 is expected to be between 22% to 23%, which would be an increase from the 18% operating margin in FY22. The company also provides transparency by disclosing the year-to-date operating margin based on FX rates at the beginning of each year. The adjusted operating margin for FY22 was 20.0%.

Company Outlook

The forecast for Q4'23 is as follows: revenue is expected to be $8.7B, up 11% YoY or 12% on an F/X neutral basis. Paid net additions are expected to be similar to Q3'23. Global ARM in Q4 is expected to be roughly flat YoY. The operating margin guidance for FY23 is updated to 20%, the high end of the prior forecast range.

Future Plan

The adoption of Netflix's ads plan has been growing, with a nearly 70% increase in ad membership quarter-over-quarter in Q3'23. Additionally, Netflix is adjusting its prices in the US, UK, and France, with the ads plan remaining at $6.99 per month in the US. While ad revenue is not expected to be material to the business in 2023, Netflix remains optimistic about the long-term opportunity in the advertising market.

| Revenue - %Chg YoY | 3Q22 | 4Q22 | 1Q23 | 2Q23 | 3Q23 |

|---|---|---|---|---|---|

| United States & Canada | 10.6% | 8.6% | 7.7% | 1.7% | 3.7% |

| Europe, Middle East & Africa | -2.3% | -6.9% | -1.7% | 4.3% | 13.4% |

| Latin America | 11.9% | 5.5% | 7.1% | 4.6% | 11.6% |

| Asia Pacific | 6.6% | -1.6% | 1.8% | 1.3% | 6.6% |

| Sentiment | 4Q22 | 1Q23 | 2Q23 | 3Q23 |

|---|---|---|---|---|

| net profit | Neutral | Neutral | Neutral | Neutral |

| margin | Positive | Positive | Neutral | Positive |

| revenue | Positive | Positive | Neutral | Neutral |

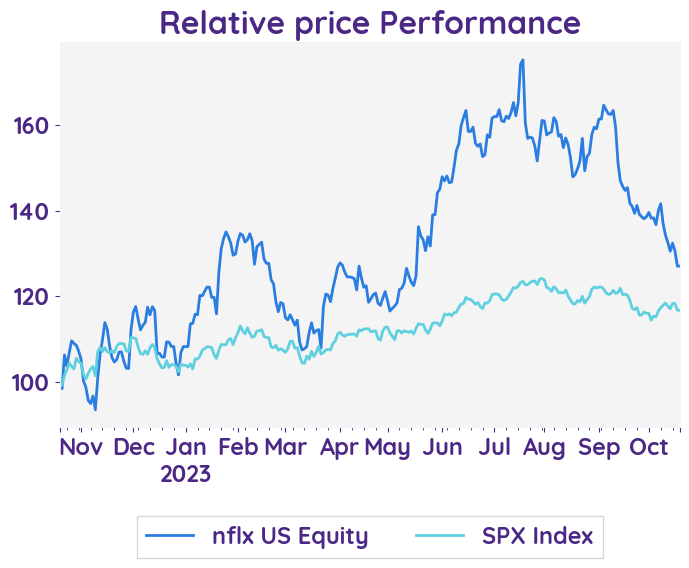

| Stock data | |

|---|---|

| Market Cap (USD Million) | 153.41 |

| Beta | 1.76 |

| Last close | 346.19 |

| 12-m Low / High | 252.1 / 485 |

| Target price | 464.50 |

| Return Potential | 34.2 % |

| % of Buy / Sell rating | 58.0 % / 5.0 % |

| Valuation data | 12m Forward | 5-Yr Average |

|---|---|---|

| P/E | 23.69 | 66.61 |

| P/B | 5.47 | 17.17 |

| P/S | 4.03 | 7.42 |

| EV/EBITDA | 17.26 | 23.93 |

| Dividend Yield | 0.0 % |

div class="round-box">

Netflix, Inc.

Netflix, Inc. operates as a subscription streaming service and production company. The Company offers a wide variety of TV shows, movies, anime, and documentaries on internet-connected devices. Netflix serves customers worldwide.

Stocks Mentioned

Related Articles