สรุปสาระสำคัญ

• Nvidia เผยงบแกร่งทุกมิติ โดยรายได้ดีกว่าคาดและเติบโตมากกว่า 3x หนุนจากรายได้ในกลุ่ม Data center โตมากกว่า 6x สะท้อนได้ว่าอุปสงค์ AI ยังคงมีแนวโน้มแกร่งต่อเนื่อง

• นอกจากนี้บริษัทให้คาดการณ์รายได้ใน 1Q25 เติบโตดีกว่าที่คาดและมองมาร์จิ้นอยู่ในระดับสูงกว่า 77% หลังมีแรงหนุนจากความต้องการ GPU และส่วนแบ่งการตลาดของ H200 ยังคงแกร่ง

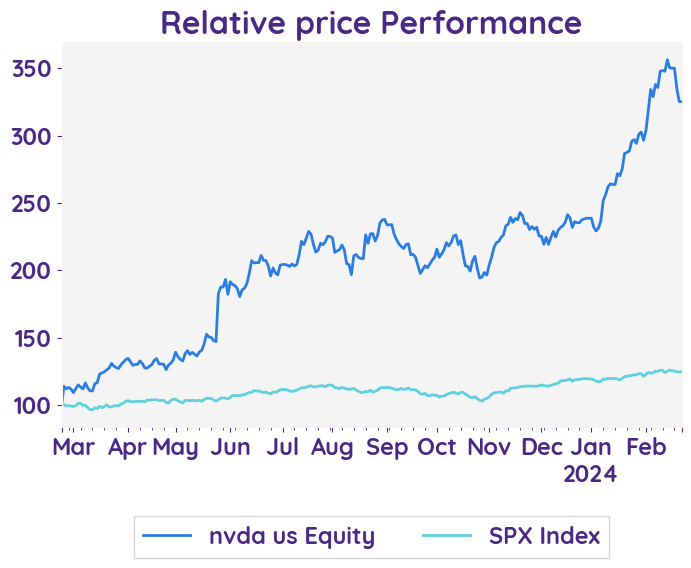

• ด้วยภาพงบและคาดการณ์ที่ออกมาดีส่งผลให้ราคาหุ้นในช่วงก่อนเปิดตลาดเพิ่มขึ้น +9.1%

Bloomberg NVDA.US

Reuters NVDA.O

Nvidia's robust first quarter forecast confirms the ongoing momentum in demand for AI

Earnings Result

In comparing the previous quarter to the current quarter, NVIDIA's outlook for the first quarter of fiscal 2025 shows a significant increase in expected revenue, with a projected $24.0 billion compared to the previous quarter's record revenue of $18.4 billion. The company also expects a slight improvement in gross margin, with a projected 76.3% (GAAP) and 77.0% (non-GAAP) compared to the previous quarter's 75.0%. Additionally, operating expenses are projected to increase, with an estimated $3.5 billion (GAAP) and $2.5 billion (non-GAAP) compared to the previous quarter's $2.03 billion. These positive outlooks indicate continued growth and success for NVIDIA in the coming quarter.

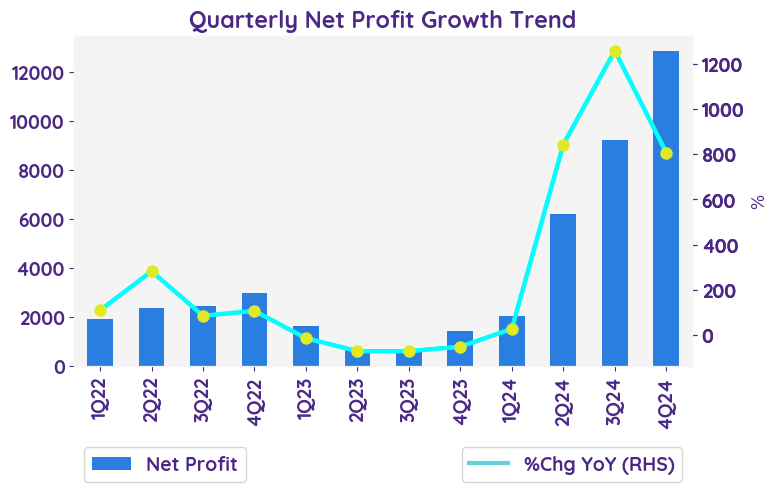

Net profit growth QoQ and YoY

The net profit of the company has shown significant growth both quarter-over-quarter (QoQ) and year-over-year (YoY), beating expectations. QoQ, the net profit increased by 33%, while YoY, it increased by 769%. This indicates strong financial performance and profitability for the company.

Revenue growth of each business

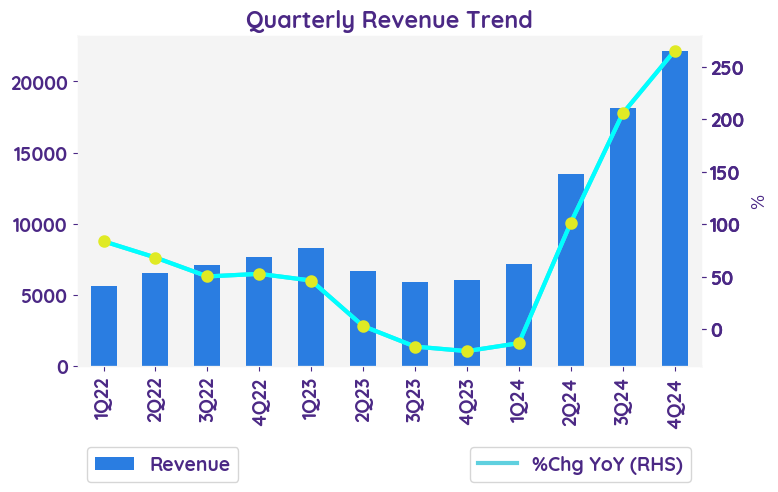

NVIDIA reported revenue of $22.10 billion, surpassing last year's $6.05 billion and beating estimates. Data center revenue reached $18.4 billion, gaming revenue was $2.9 billion (58% y/y growth), and professional visualization revenue hit $463 million. Despite a slight dip in automotive revenue to $281 million, NVIDIA exceeded expectations across all segments.

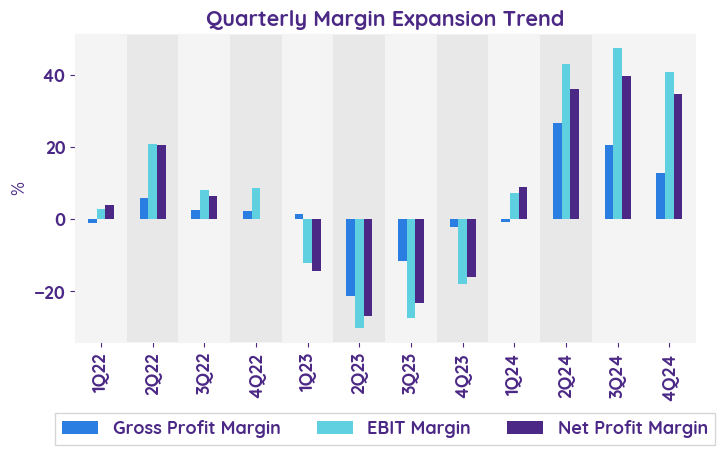

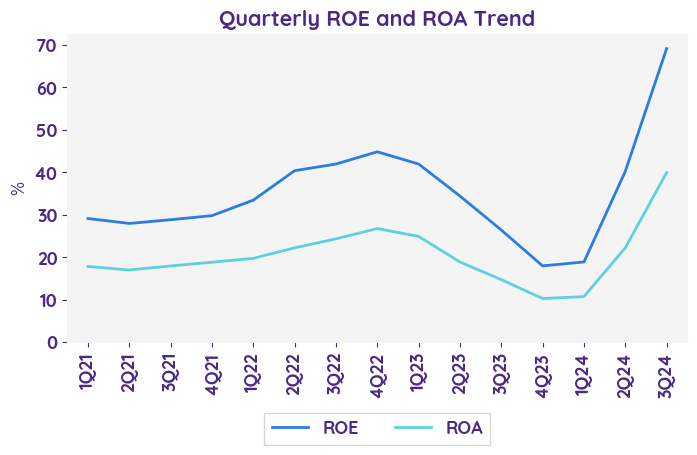

Operating margin

The operating margin for NVIDIA Corporation has shown significant improvement over the years. In Q4 FY24, the operating margin increased by 2.0 percentage points compared to the previous quarter and by 12.7 percentage points compared to the same quarter in the previous year. The non-GAAP operating margin also saw a positive trend, increasing by 1.7 percentage points and 10.6 percentage points, respectively. This indicates that the company has been able to effectively manage its operating expenses and generate higher operating income.

Business Outlook

NVIDIA's outlook for the first quarter of fiscal 2025 is very optimistic, with expected revenue of $24.0 billion, beating analysts' estimates. Additionally, the company's gross margins are expected to be higher than anticipated at 76.3% (GAAP) and 77.0% (non-GAAP). Operating expenses are also expected to be lower than expected, coming in at approximately $3.5 billion (GAAP) and $2.5 billion (non-GAAP). The outlook also includes expected income of $250 million from non-affiliated investments, which is another positive factor. With a tax rate of 17.0%, plus or minus 1%, NVIDIA's outlook for the first quarter of fiscal 2025 surpasses estimates across various financial metrics, indicating strong performance and potential for continued growth.

In comparing the previous quarter to the current quarter, NVIDIA's outlook for the first quarter of fiscal 2025 shows a significant increase in expected revenue, with a projected $24.0 billion compared to the previous quarter's record revenue of $18.4 billion. The company also expects a slight improvement in gross margin, with a projected 76.3% (GAAP) and 77.0% (non-GAAP) compared to the previous quarter's 75.0%. Additionally, operating expenses are projected to increase, with an estimated $3.5 billion (GAAP) and $2.5 billion (non-GAAP) compared to the previous quarter's $2.03 billion. These positive outlooks indicate continued growth and success for NVIDIA in the coming quarter.

Net profit growth QoQ and YoY

The net profit of the company has shown significant growth both quarter-over-quarter (QoQ) and year-over-year (YoY), beating expectations. QoQ, the net profit increased by 33%, while YoY, it increased by 769%. This indicates strong financial performance and profitability for the company.

Revenue growth of each business

NVIDIA reported revenue of $22.10 billion, surpassing last year's $6.05 billion and beating estimates. Data center revenue reached $18.4 billion, gaming revenue was $2.9 billion (58% y/y growth), and professional visualization revenue hit $463 million. Despite a slight dip in automotive revenue to $281 million, NVIDIA exceeded expectations across all segments.

Operating margin

The operating margin for NVIDIA Corporation has shown significant improvement over the years. In Q4 FY24, the operating margin increased by 2.0 percentage points compared to the previous quarter and by 12.7 percentage points compared to the same quarter in the previous year. The non-GAAP operating margin also saw a positive trend, increasing by 1.7 percentage points and 10.6 percentage points, respectively. This indicates that the company has been able to effectively manage its operating expenses and generate higher operating income.

Business Outlook

NVIDIA's outlook for the first quarter of fiscal 2025 is very optimistic, with expected revenue of $24.0 billion, beating analysts' estimates. Additionally, the company's gross margins are expected to be higher than anticipated at 76.3% (GAAP) and 77.0% (non-GAAP). Operating expenses are also expected to be lower than expected, coming in at approximately $3.5 billion (GAAP) and $2.5 billion (non-GAAP). The outlook also includes expected income of $250 million from non-affiliated investments, which is another positive factor. With a tax rate of 17.0%, plus or minus 1%, NVIDIA's outlook for the first quarter of fiscal 2025 surpasses estimates across various financial metrics, indicating strong performance and potential for continued growth.

| Revenue - %Chg YoY | 1Q24 | 2Q24 | 3Q24 | 4Q24 | 1Q25E |

|---|---|---|---|---|---|

| Data Center | 14.2% | 171.2% | 278.7% | 409.0% | 283.3% |

| Gaming | -38.1% | 21.7% | 81.4% | 56.5% | 13.3% |

| Professional Visualization | -52.6% | -23.6% | 108.0% | 104.9% | 40.8% |

| Automotive | 114.5% | 15.0% | 4.0% | -4.4% | 3.8% |

| OEM & Other | -51.3% | -52.9% | 0.0% | 7.1% | 0.6% |

| Sentiment | 1Q24 | 2Q24 | 3Q24 | 4Q24 |

|---|---|---|---|---|

| net profit | Neutral | Positive | Positive | Positive |

| margin | Neutral | Positive | Positive | Positive |

| revenue | Neutral | Positive | Positive | Positive |

| Stock data | |

|---|---|

| Market Cap (USD Million) | 1686.80 |

| Beta | 1.95 |

| Last close | 674.72 |

| 12-m Low / High | 204.2 / 746.1 |

| Target price | 754.00 |

| Return Potential | 11.8 % |

| % of Buy / Sell rating | 91.0 % / 2.0 % |

| Valuation data | 12m Forward | 5-Yr Average |

|---|---|---|

| P/E | 30.32 | 90.27 |

| P/B | 38.36 | 17.25 |

| P/S | 28.44 | 24.69 |

| EV/EBITDA | 47.48 | 74.58 |

| Dividend Yield | 0.0 % |

NVIDIA Corporation

NVIDIA Corporation designs, develops, and markets three dimensional (3D) graphics processors and related software. The Company offers products that provides interactive 3D graphics to the mainstream personal computer market.

Stocks Mentioned

Related Articles