สรุปสาระสำคัญ

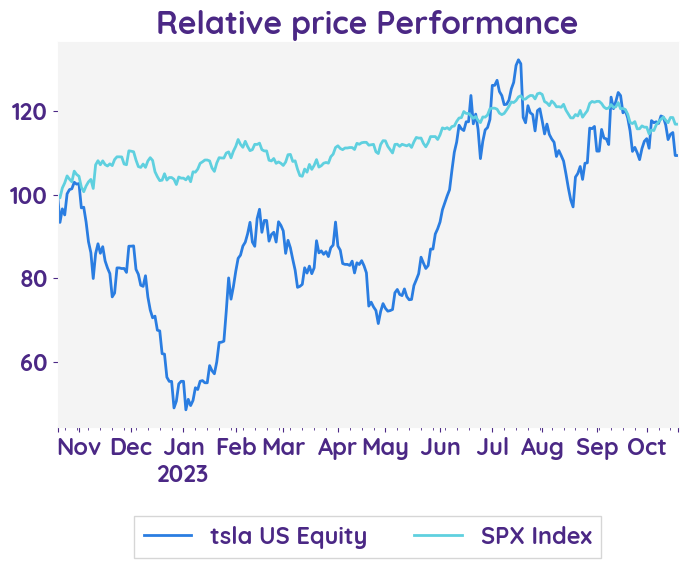

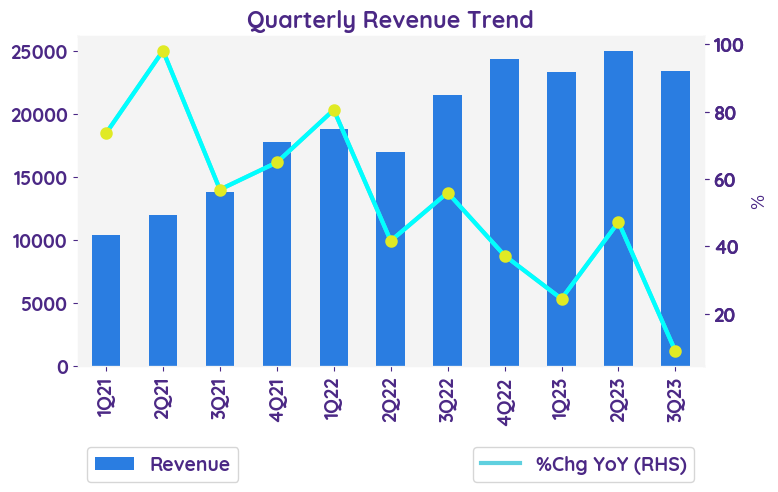

Tesla เผยงบ 3Q23 อ่อนแอและต่ำกว่าคาดทั้งรายได้, กำไรต่อหุ้นและ Gross margin อย่างไรก็ดีรายได้ยังเติบโต 13%YoY ขณะที่กำไรต่อหุ้นและ Gross margin หดตัว 43%YoY และ 22%YoY ตามลำดับ หลังได้รับผลกระทบจาก 1) การปรับลดราคาขายที่ส่งผลต่อมาร์จิ้นและราคาขายต่อหน่วย 2) ค่าใช้จ่ายที่เพิ่มขึ้นจากโครงการ Cybertruck, AI 3) ยอดส่งมอบที่ต่ำกว่าคาดหลังปรับปรุงโรงงาน อย่างไรก็ดีบริษัทยังคงเป้าหมายการผลิตปี 23 ที่ 1.8 ล้านคันเช่นเดิม รวมถึงเตรียมส่งมอบ Cybertruck วันที่ 30 พ.ย.

19 October 2023

Tesla, Inc.

TSLA

19 October 2023

Tesla, Inc.

TSLA

Bloomberg TSLA.US

Reuters TSLA.O

Tesla Q3 earnings miss estimates impact by price cuts

Earnings Result

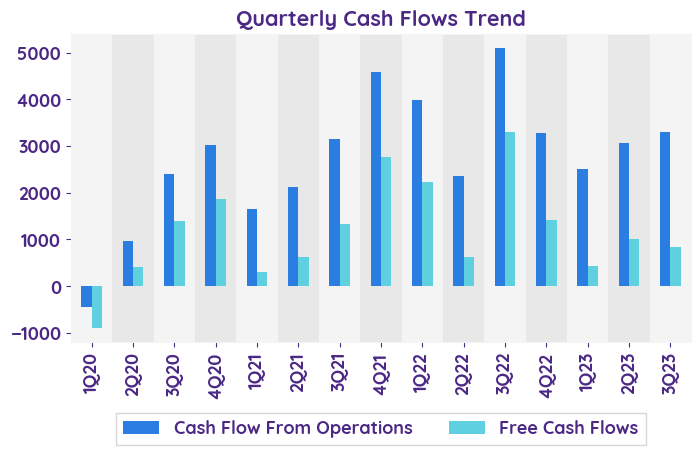

In comparing the previous and current quarter financial reports, it is evident that Tesla's outlook for the company's financial performance is positive. The current quarter summary highlights key metrics such as operating cash flow, free cash flow, net income, and adjusted EBITDA. Additionally, the summary mentions that vehicle deliveries have been steadily increasing over the trailing 12 months. While specific figures for net profit, margin, revenue, and cost are not provided, the overall trend suggests a favorable outlook for Tesla's earnings results.

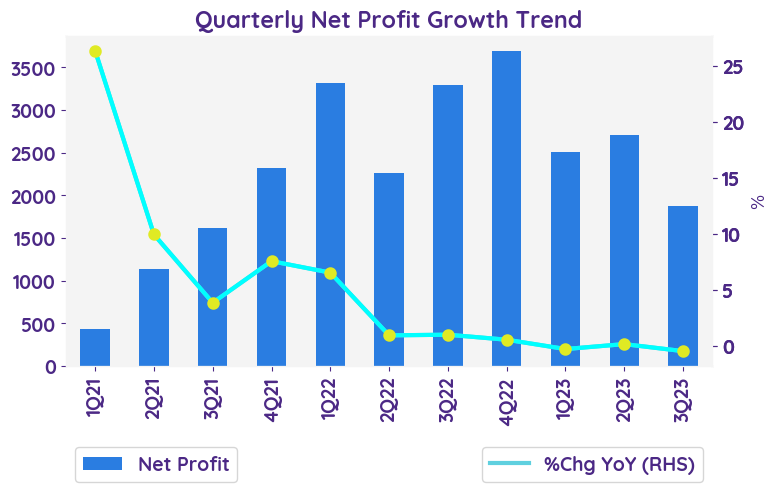

Net profit growth QoQ and YoY

The net profit of the company decreased by 44% YoY in Q3-2023. This decline in net profit can be attributed to the decrease in total gross profit and the increase in operating expenses. The company also experienced a decrease in operating margin, which further impacted the net profit. However, it is worth noting that the company's total revenue grew by 9% YoY in Q3-2023.

Revenue growth for each business

Revenue growth for each business: - Energy generation and storage revenue grew by 40% YoY in Q3-2023. - Services and other revenue increased by 32% YoY in Q3-2023. - Total automotive revenues grew by 5% YoY in Q3-2023.

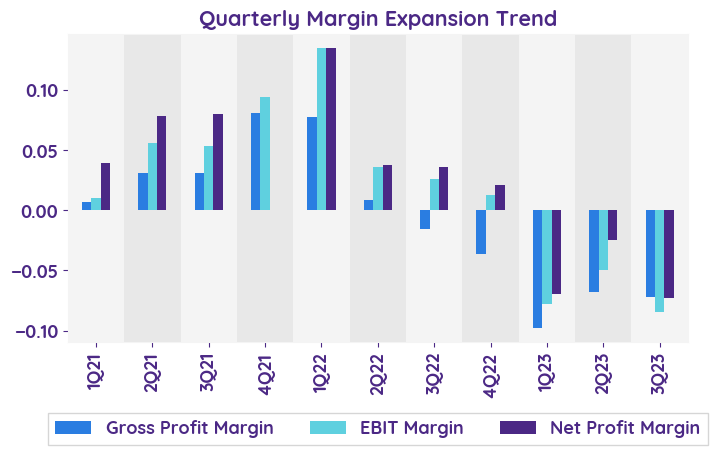

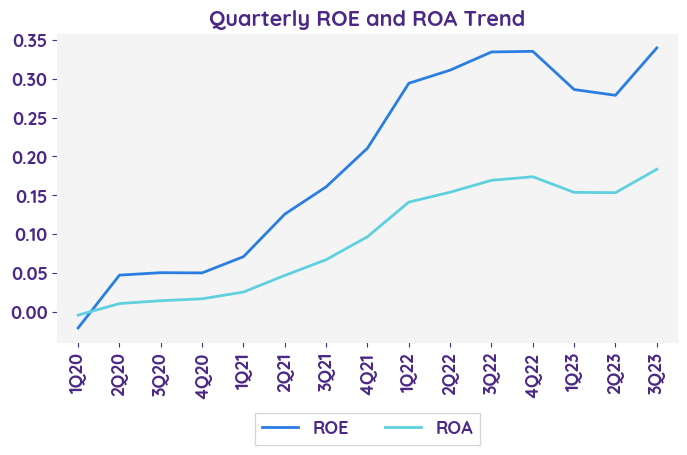

Operating margin

The operating margin for Tesla decreased from 17.2% in Q3-2022 to 7.6% in Q3-2023, representing a significant decline. This indicates that Tesla's profitability has been negatively impacted, potentially due to increased operating expenses or lower gross profit.

Gross margin

The gross margin for the company has been declining over the quarters, with a decrease of 719 basis points (bp) from Q3-2022 to Q3-2023. This decline in gross margin can be attributed to various factors such as reduced average selling price (ASP), increased operating expenses, and negative foreign exchange (FX) impact. However, the company has seen growth in vehicle deliveries and gross profit in Energy Generation and Storage as well as Services and Other, which have partially offset the decline in gross margin.

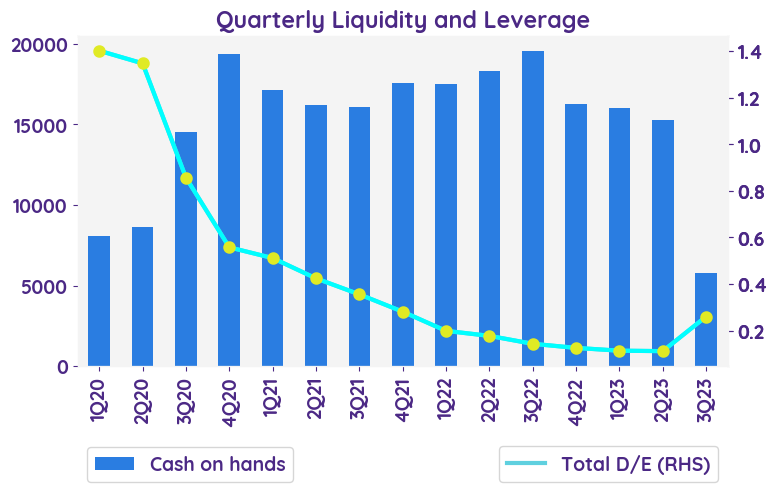

Factor affect Profitability

The factors affecting Tesla's profitability include the reduced average selling price (ASP) due to pricing and mix, which has impacted profitability. Additionally, there has been an uptick in operating expenses driven by the Cybertruck, AI, and other R&D projects. These elements have contributed to a decrease in operating income.

Production

In 3Q23, Model S/X production decreased by 31% compared to the same period last year, while Model 3/Y production increased by 20%. Total production decreased by 18%. This indicates a shift in production focus towards Model 3/Y.

In comparing the previous and current quarter financial reports, it is evident that Tesla's outlook for the company's financial performance is positive. The current quarter summary highlights key metrics such as operating cash flow, free cash flow, net income, and adjusted EBITDA. Additionally, the summary mentions that vehicle deliveries have been steadily increasing over the trailing 12 months. While specific figures for net profit, margin, revenue, and cost are not provided, the overall trend suggests a favorable outlook for Tesla's earnings results.

Net profit growth QoQ and YoY

The net profit of the company decreased by 44% YoY in Q3-2023. This decline in net profit can be attributed to the decrease in total gross profit and the increase in operating expenses. The company also experienced a decrease in operating margin, which further impacted the net profit. However, it is worth noting that the company's total revenue grew by 9% YoY in Q3-2023.

Revenue growth for each business

Revenue growth for each business: - Energy generation and storage revenue grew by 40% YoY in Q3-2023. - Services and other revenue increased by 32% YoY in Q3-2023. - Total automotive revenues grew by 5% YoY in Q3-2023.

Operating margin

The operating margin for Tesla decreased from 17.2% in Q3-2022 to 7.6% in Q3-2023, representing a significant decline. This indicates that Tesla's profitability has been negatively impacted, potentially due to increased operating expenses or lower gross profit.

Gross margin

The gross margin for the company has been declining over the quarters, with a decrease of 719 basis points (bp) from Q3-2022 to Q3-2023. This decline in gross margin can be attributed to various factors such as reduced average selling price (ASP), increased operating expenses, and negative foreign exchange (FX) impact. However, the company has seen growth in vehicle deliveries and gross profit in Energy Generation and Storage as well as Services and Other, which have partially offset the decline in gross margin.

Factor affect Profitability

The factors affecting Tesla's profitability include the reduced average selling price (ASP) due to pricing and mix, which has impacted profitability. Additionally, there has been an uptick in operating expenses driven by the Cybertruck, AI, and other R&D projects. These elements have contributed to a decrease in operating income.

Production

In 3Q23, Model S/X production decreased by 31% compared to the same period last year, while Model 3/Y production increased by 20%. Total production decreased by 18%. This indicates a shift in production focus towards Model 3/Y.

| Revenue - %Chg YoY | 3Q22 | 4Q22 | 1Q23 | 2Q23 | 3Q23 |

|---|---|---|---|---|---|

| Automotive | 57.0% | 35.1% | 20.2% | 45.7% | 55.0% |

| Services & Other | 84.0% | 59.9% | 43.6% | 46.7% | 84.0% |

| Energy Generation & Storage | 38.6% | 90.4% | 148.2% | 74.2% | 38.6% |

| Solar Deployed | 13.3% | 39.6% | -37.7% | 13.2% |

| Sentiment | 4Q22 | 1Q23 | 2Q23 | 3Q23 |

|---|---|---|---|---|

| net profit | Positive | Positive | Positive | Negative |

| margin | Neutral | Negative | Negative | Negative |

| revenue | Positive | Positive | Positive | Positive |

| Stock data | |

|---|---|

| Market Cap (USD Million) | 770.26 |

| Beta | 1.99 |

| Last close | 242.68 |

| 12-m Low / High | 101.8 / 299.3 |

| Target price | 275.05 |

| Return Potential | 13.3 % |

| % of Buy / Sell rating | 42.0 % / 17.0 % |

| Valuation data | 12m Forward | 5-Yr Average |

|---|---|---|

| P/E | 62.39 | 38.20 |

| P/B | 11.48 | 19.69 |

| P/S | 6.25 | 10.13 |

| EV/EBITDA | 35.44 | 41.83 |

| Dividend Yield | 0.0 % |

Tesla, Inc.

Tesla Inc. operates as a multinational automotive and clean energy company. The Company designs and manufactures electric vehicles, battery energy storage from home to grid-scale, solar panels and solar roof tiles, and related products and services. Tesla owns its sales and service network and sells electric power train components to other automobile manufacturers.

Related Articles