20 October 2023

Taiwan Semiconductor Manufacturing Company Limited

TSM

20 October 2023

Taiwan Semiconductor Manufacturing Company Limited

TSM

TSMC Bloomberg TSM.US

Reuters 2330.TW

Despite Major Profit Decline, TSMC's Earnings Surpass Expectations.

Earnings Result

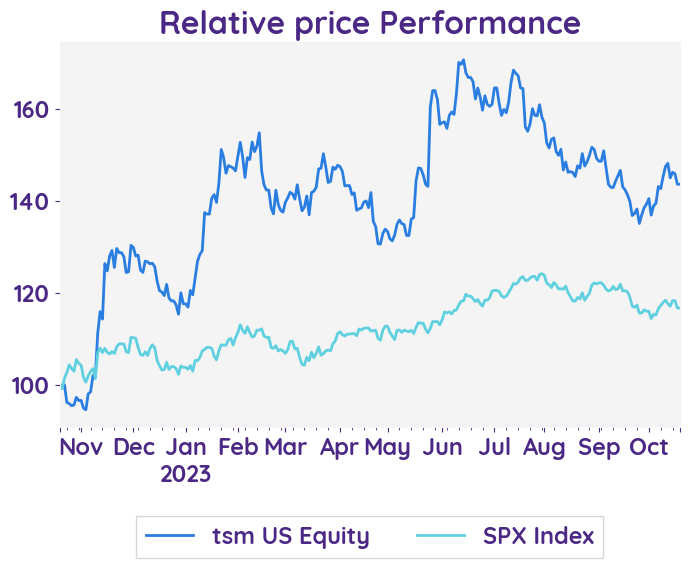

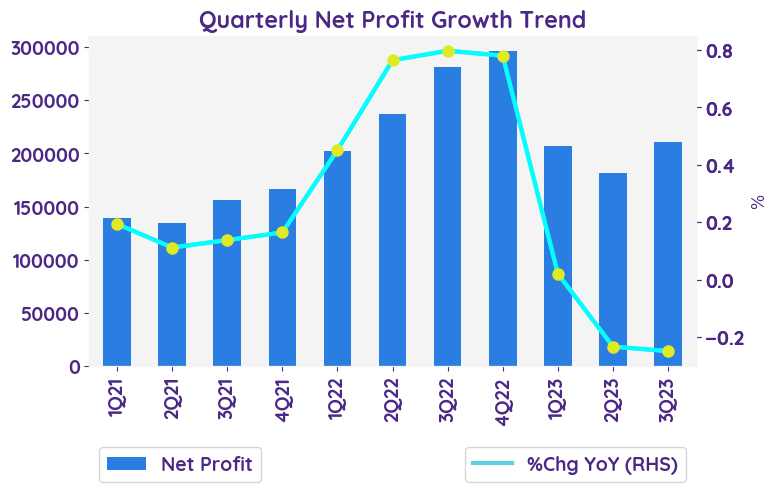

In Q3 2023, the company's net revenue grew by 13.7% from the last quarter but dropped 10.8% year-on-year. Gross and operating margins declined. Net income increased 16.1% quarterly but fell 24.9% annually. Net profit margin stood at 38.6% with EPS at NT$8.14.

Revenue Analysis

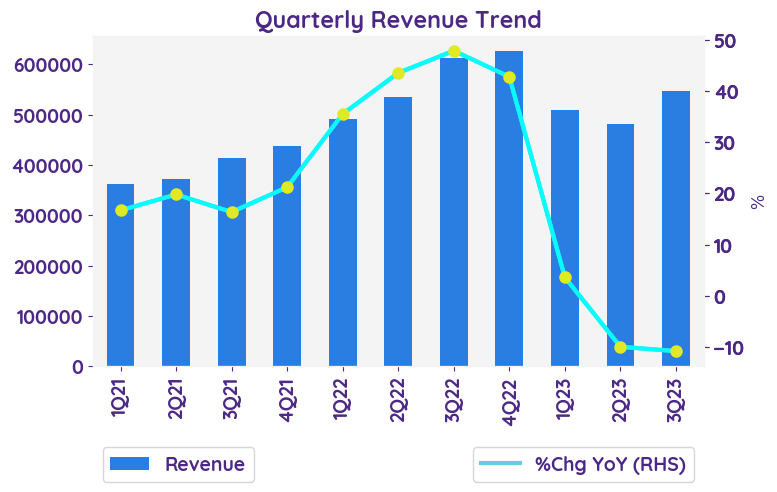

In the third quarter, the company's revenue increased by 13.7% compared to the previous quarter, reaching NT$546.73 billion. This growth was driven by the strong ramp of their industry-leading 3-nanometer technology and higher demand for 5-nanometer technologies. However, there was a 10.8% decrease in revenue compared to the same quarter last year.

Gross Profit Analysis

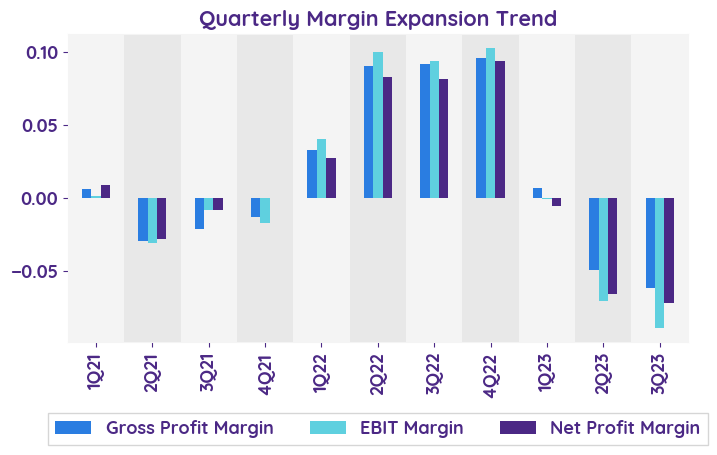

The gross margin for the company in 3Q23 was 54.3%, which was 0.2 percentage points higher than in 2Q23. This increase was primarily due to higher capacity utilization and a more favorable foreign exchange rate. However, it was partially offset by margin dilution from N3 ramp and the unfavorable technology mix.

Operating Income Analysis

In 3Q23, TSMC's operating income was NT$228.07 billion, up NT$26.11 billion from 2Q23 but down NT$82.25 billion from 3Q22. The 3Q23 operating margin was 41.7%, a 0.3% drop from 2Q23 and 8.9% less than 3Q22, due to higher R&D expenses.

Receivable and Inventory Days

Receivable and Inventory Days: In 3Q23, the days of receivable increased by 3 days to 35 days, while the days of inventory decreased by 3 days to 96 days. This change in inventory days was primarily due to an increase in wafer shipments.

Guidance in 4Q23

For Q4 2023, the company forecasts revenue between US$18.8 billion and US$19.6 billion, with an exchange rate of 1 US dollar to 32 NT dollars. Anticipated gross profit margin is 51.5%-53.5%, and operating profit margin is 39.5%-41.5%.

In Q3 2023, the company's net revenue grew by 13.7% from the last quarter but dropped 10.8% year-on-year. Gross and operating margins declined. Net income increased 16.1% quarterly but fell 24.9% annually. Net profit margin stood at 38.6% with EPS at NT$8.14.

Revenue Analysis

In the third quarter, the company's revenue increased by 13.7% compared to the previous quarter, reaching NT$546.73 billion. This growth was driven by the strong ramp of their industry-leading 3-nanometer technology and higher demand for 5-nanometer technologies. However, there was a 10.8% decrease in revenue compared to the same quarter last year.

Gross Profit Analysis

The gross margin for the company in 3Q23 was 54.3%, which was 0.2 percentage points higher than in 2Q23. This increase was primarily due to higher capacity utilization and a more favorable foreign exchange rate. However, it was partially offset by margin dilution from N3 ramp and the unfavorable technology mix.

Operating Income Analysis

In 3Q23, TSMC's operating income was NT$228.07 billion, up NT$26.11 billion from 2Q23 but down NT$82.25 billion from 3Q22. The 3Q23 operating margin was 41.7%, a 0.3% drop from 2Q23 and 8.9% less than 3Q22, due to higher R&D expenses.

Receivable and Inventory Days

Receivable and Inventory Days: In 3Q23, the days of receivable increased by 3 days to 35 days, while the days of inventory decreased by 3 days to 96 days. This change in inventory days was primarily due to an increase in wafer shipments.

Guidance in 4Q23

For Q4 2023, the company forecasts revenue between US$18.8 billion and US$19.6 billion, with an exchange rate of 1 US dollar to 32 NT dollars. Anticipated gross profit margin is 51.5%-53.5%, and operating profit margin is 39.5%-41.5%.

| Revenue - %Chg YoY | 3Q22 | 4Q22 | 1Q23 | 2Q23 | 3Q23 |

|---|---|---|---|---|---|

| Smartphone | 39.0% | 24.2% | -11.0% | -20.9% | 33.0% |

| High Performance Computing | 53.1% | 63.4% | 11.5% | -6.4% | 6.0% |

| Internet of Things | 63.7% | 42.5% | 9.4% | -14.5% | 24.0% |

| Automotive | 81.6% | 82.1% | 51.8% | 37.8% | -24.0% |

| Digital Consumer Electronics | 12.8% | -14.0% | -24.5% | -10.4% | -1.0% |

| Others | 56.4% | 63.8% | 22.4% | 7.8% | -2.0% |

| Sentiment | 4Q22 | 1Q23 | 2Q23 | 3Q23 |

|---|---|---|---|---|

| net profit | Positive | Negative | Negative | Positive |

| margin | Positive | Negative | Negative | Neutral |

| revenue | Positive | Negative | Negative | Positive |

| Stock data | |

|---|---|

| Market Cap (USD Million) | 464.70 |

| Beta | 0.92 |

| Last close | 89.60 |

| 12-m Low / High | 59.4 / 110.7 |

| Target price | 113.00 |

| Return Potential | 26.1 % |

| % of Buy / Sell rating | 87.0 % / 0.0 % |

| Valuation data | 12m Forward | 5-Yr Average |

|---|---|---|

| P/E | 17.1 | 19.2 |

| P/B | 3.7 | 4.6 |

| P/S | 5.9 | 7.3 |

| EV/EBITDA | 8.2 | 12.6 |

| Dividend Yield | 2.1 % |

Taiwan Semiconductor Manufacturing Company Limited

Taiwan Semiconductor Manufacturing Company, Ltd. manufactures and markets integrated circuits. The Company provides the following services: wafer manufacturing, wafer probing, assembly and testing, mask production, and design services. TSMC's ICs are used in computer, communication, consumer electronics, automotive, and industrial equipment industries.

Related Articles