สรุปสาระสำคัญ

Amazon (AMZN) เผยงบ 3Q23 ดีกว่าคาด โดยรายได้เพิ่มขึ้น 13%YoY หนุนจากยอดขายในกลุ่มค้าปลีกที่เติบโตและการลดต้นทุน อย่างไรก็ดีคลาวด์ AWS โตต่ำกว่าคาดเล็กน้อยที่ 12% แต่ตลาดกลับตอบสนองเชิงบวกหลัง 1) Operating income โตแกร่ง 2) ให้แนวโน้มงบไตรมาสหน้า 4Q23 ที่ดีกว่าตลาดคาด

27 October 2023

Amazon.com, Inc.

AMZN

27 October 2023

Amazon.com, Inc.

AMZN

Bloomberg AMZN.US

Reuters AMZN.OQ

Amazon’s robust performance indicates a potential uplift for its cloud business.

Earnings Result

In comparing the previous and current quarter financial reports of Amazon.com, it is evident that the company is experiencing significant growth in both net sales and operating income. In the previous quarter, net sales were projected to grow by 9% to 13% compared to the same period in the previous year, while operating income was expected to increase from $2.5 billion to between $5.5 billion and $8.5 billion. In the current quarter, net sales are projected to grow by 7% to 12% compared to the same period in the previous year, with operating income expected to increase from $2.7 billion to between $7.0 billion and $11.0 billion. These positive outlooks highlight Amazon.com's strong performance and potential for continued growth in the future.

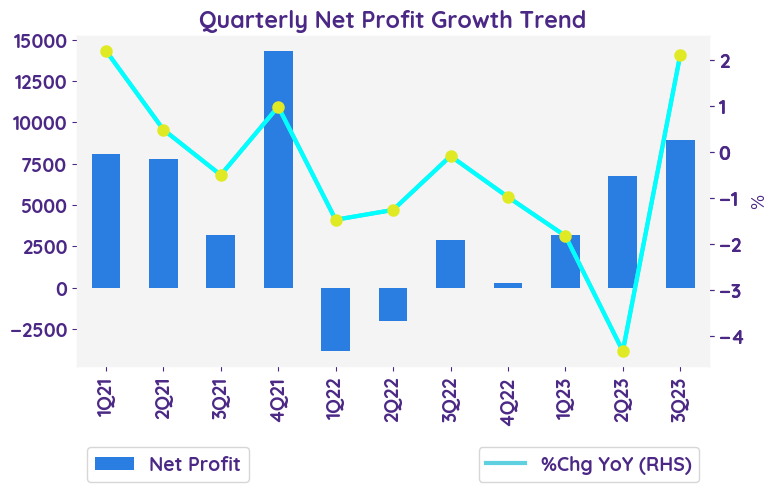

Net profit continue increased due to significant cost cutting

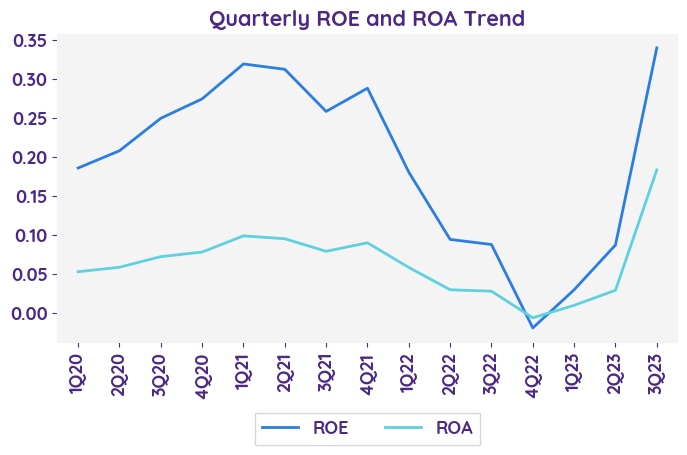

In the third quarter, Amazon reported a significant increase in net income, which rose to $9.9 billion compared to $2.9 billion in the same quarter last year. This represents a growth of 241% year-over-year, surpassing estimates.

Revenue beat estimates driven by rising sales in its retail unit and improvement in cloud segment

In Q3 2023, the company's total net sales surpassed projections, demonstrating a 13% year-over-year (Y/Y) increase. Within this, the North America segment experienced an 11% Y/Y growth, and the International segment witnessed a significant 16% Y/Y expansion. The growth in revenue across the various business divisions is outlined below: - Online stores: 7% year-over-year (Y/Y) growth in Q3 2023. - Physical stores: 6% Y/Y growth in Q3 2023. - Third-party seller services: 20% Y/Y growth in Q3 2023. - Subscription services: 14% Y/Y growth in Q3 2023. - Advertising services: 26% Y/Y growth in Q3 2023. - AWS: 12% Y/Y growth in Q3 2023. - Other: 26% Y/Y decline in Q3 2023.

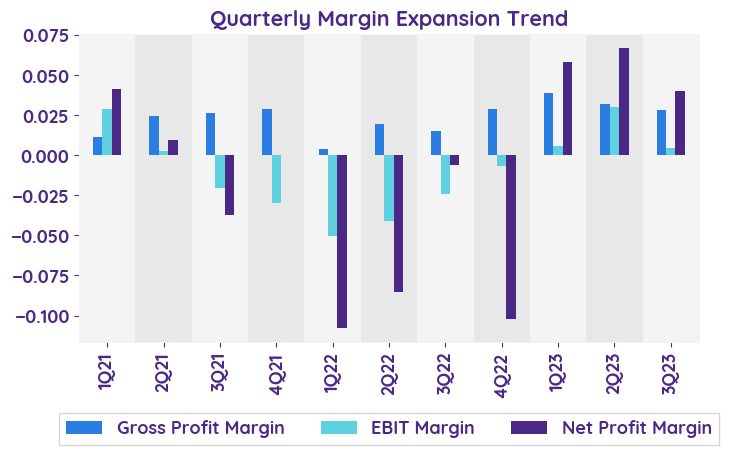

The operating income saw improvement as a result of cost-cutting measures.

The company's operating income grew 343% in the latest quarter, despite some year-over-year fluctuations. Operating margins reached 7.8%, while AWS's operating income rose 29%, achieving a robust 30.3% margin.

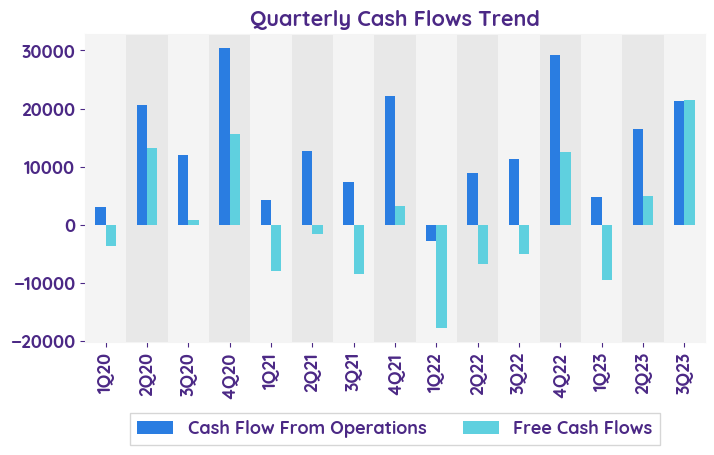

Balance sheet and cashflow

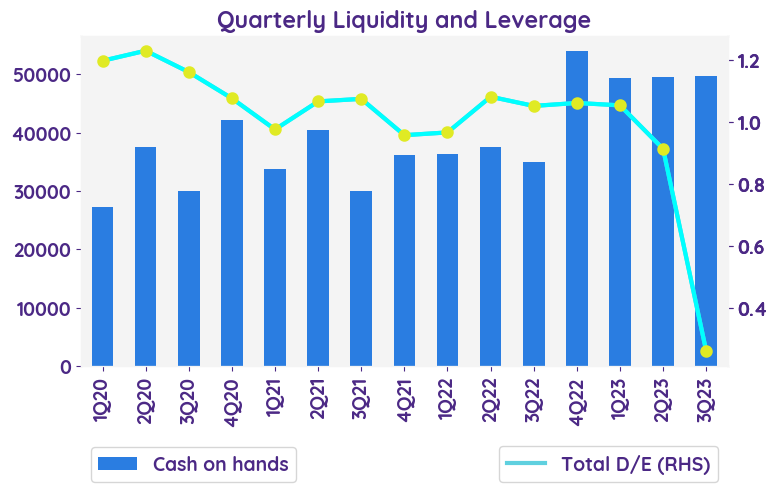

In 3Q23, the balance sheet shows an increase in cash and cash equivalents from $53.9 billion to $49.6 billion. Marketable securities decreased from $16.1 billion to $14.6 billion. Inventories increased from $34.4 billion to $35.4 billion. Accounts receivable and other assets also increased. The total assets increased from $462.7 billion to $486.9 billion. On the liabilities side, accounts payable decreased from $79.6 billion to $72 billion, while accrued expenses and other liabilities also decreased. Unearned revenue increased. The total liabilities decreased from $155.4 billion to $145.2 billion. Stockholders' equity increased from $146 billion to $183 billion. Overall, the balance sheet shows an improvement in cash and cash equivalents, as well as an increase in total assets and stockholders' equity.

Financial Guidance

The fourth quarter 2023 guidance for Amazon: - Net sales are expected to be between $160.0 billion and $167.0 billion, with a growth rate of 7% to 12% compared to the fourth quarter of 2022. - Operating income is expected to be between $7.0 billion and $11.0 billion, compared to $2.7 billion in the fourth quarter of 2022.

In comparing the previous and current quarter financial reports of Amazon.com, it is evident that the company is experiencing significant growth in both net sales and operating income. In the previous quarter, net sales were projected to grow by 9% to 13% compared to the same period in the previous year, while operating income was expected to increase from $2.5 billion to between $5.5 billion and $8.5 billion. In the current quarter, net sales are projected to grow by 7% to 12% compared to the same period in the previous year, with operating income expected to increase from $2.7 billion to between $7.0 billion and $11.0 billion. These positive outlooks highlight Amazon.com's strong performance and potential for continued growth in the future.

Net profit continue increased due to significant cost cutting

In the third quarter, Amazon reported a significant increase in net income, which rose to $9.9 billion compared to $2.9 billion in the same quarter last year. This represents a growth of 241% year-over-year, surpassing estimates.

Revenue beat estimates driven by rising sales in its retail unit and improvement in cloud segment

In Q3 2023, the company's total net sales surpassed projections, demonstrating a 13% year-over-year (Y/Y) increase. Within this, the North America segment experienced an 11% Y/Y growth, and the International segment witnessed a significant 16% Y/Y expansion. The growth in revenue across the various business divisions is outlined below: - Online stores: 7% year-over-year (Y/Y) growth in Q3 2023. - Physical stores: 6% Y/Y growth in Q3 2023. - Third-party seller services: 20% Y/Y growth in Q3 2023. - Subscription services: 14% Y/Y growth in Q3 2023. - Advertising services: 26% Y/Y growth in Q3 2023. - AWS: 12% Y/Y growth in Q3 2023. - Other: 26% Y/Y decline in Q3 2023.

The operating income saw improvement as a result of cost-cutting measures.

The company's operating income grew 343% in the latest quarter, despite some year-over-year fluctuations. Operating margins reached 7.8%, while AWS's operating income rose 29%, achieving a robust 30.3% margin.

Balance sheet and cashflow

In 3Q23, the balance sheet shows an increase in cash and cash equivalents from $53.9 billion to $49.6 billion. Marketable securities decreased from $16.1 billion to $14.6 billion. Inventories increased from $34.4 billion to $35.4 billion. Accounts receivable and other assets also increased. The total assets increased from $462.7 billion to $486.9 billion. On the liabilities side, accounts payable decreased from $79.6 billion to $72 billion, while accrued expenses and other liabilities also decreased. Unearned revenue increased. The total liabilities decreased from $155.4 billion to $145.2 billion. Stockholders' equity increased from $146 billion to $183 billion. Overall, the balance sheet shows an improvement in cash and cash equivalents, as well as an increase in total assets and stockholders' equity.

Financial Guidance

The fourth quarter 2023 guidance for Amazon: - Net sales are expected to be between $160.0 billion and $167.0 billion, with a growth rate of 7% to 12% compared to the fourth quarter of 2022. - Operating income is expected to be between $7.0 billion and $11.0 billion, compared to $2.7 billion in the fourth quarter of 2022.

| Revenue - %Chg YoY | 3Q22 | 4Q22 | 1Q23 | 2Q23 | 3Q23 |

|---|---|---|---|---|---|

| Online Stores | 7.1% | -2.3% | -0.1% | 4.2% | 7.1% |

| Physical Stores | 10.0% | 5.7% | 6.6% | 6.4% | 5.6% |

| Retail Third-Party Seller Services | 18.2% | 19.9% | 17.7% | 18.1% | 19.8% |

| Retail Subscription Services | 9.3% | 13.1% | 14.8% | 13.5% | 14.2% |

| Sentiment | 4Q22 | 1Q23 | 2Q23 | 3Q23 |

|---|---|---|---|---|

| net profit | Negative | Positive | Neutral | Positive |

| margin | Negative | Neutral | Neutral | Neutral |

| revenue | Positive | Positive | Neutral | Positive |

| Stock data | |

|---|---|

| Market Cap (USD Million) | 1233.69 |

| Beta | 1.47 |

| Last close | 119.57 |

| 12-m Low / High | 81.4 / 145.9 |

| Target price | 175.00 |

| Return Potential | 46.4 % |

| % of Buy / Sell rating | 98.0 % / 0.0 % |

| Valuation data | 12m Forward | 5-Yr Average |

|---|---|---|

| P/E | 31.05 | 83.64 |

| P/B | 5.15 | 13.49 |

| P/S | 1.94 | 3.17 |

| EV/EBITDA | 10.79 | 18.38 |

| Dividend Yield | 0.0 % |

Amazon.com, Inc.

Amazon.com, Inc. is an online retailer that offers a wide range of products. The Company products include books, music, computers, electronics, and numerous other products. Amazon offers personalized shopping services, Web-based credit card payment, and direct shipping to customers. Amazon also operates a cloud platform offering services globally.

Related Articles