สรุปสาระสำคัญ

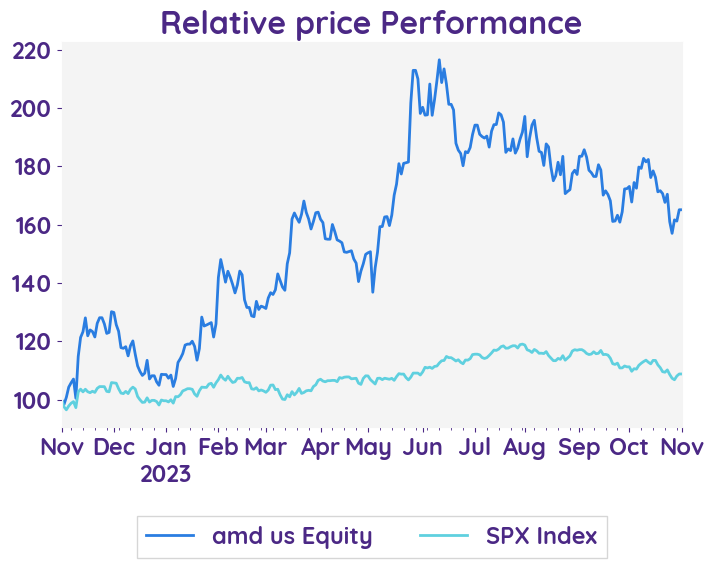

AMD เผยงบ 3Q23 ดีกว่าคาดทั้งรายได้และกำไร โดยรายได้โต 4% YoY ด้านกำไรโตแกร่ง 350% YoY แตะระดับ $0.18 ต่อหุ้น ด้าน Gross Profit เพิ่มขึ้น 17% YoY หลังมีแรงหนุนจากความต้องการ AI ที่เพิ่มขึ้นซึ่งช่วยเพิ่มการเติบโตของกลุ่ม Data Center และ Client ได้

อย่างไรก็ดีด้วยภาพ1) การคาดการณ์รายได้รวมใน 4Q23 ที่ราว $6.1bn ซึ่งต่ำกว่าตลาดคาดที่ $6.4bn 2) รายได้ในกลุ่มเกมที่ต่ำกว่าคาด และการเติบโตยังคงหดตัว 8%YoY เช่นเดียวกับส่วน embedded ที่รายได้ต่ำกว่าคาดและหดตัว 5%YoY ผลกระทบจากตลาด PC ที่ยังฟื้นตัวได้ไม่เต็มที่ จึงทำให้ตลาดตอบสนองเชิงลบต่อหุ้น โดยราคาในช่วง After Hour -6.1%

ด้าน Bloomberg ให้ราคาเป้าหมายไว้ที่ 137.6 USD

อย่างไรก็ดีด้วยภาพ1) การคาดการณ์รายได้รวมใน 4Q23 ที่ราว $6.1bn ซึ่งต่ำกว่าตลาดคาดที่ $6.4bn 2) รายได้ในกลุ่มเกมที่ต่ำกว่าคาด และการเติบโตยังคงหดตัว 8%YoY เช่นเดียวกับส่วน embedded ที่รายได้ต่ำกว่าคาดและหดตัว 5%YoY ผลกระทบจากตลาด PC ที่ยังฟื้นตัวได้ไม่เต็มที่ จึงทำให้ตลาดตอบสนองเชิงลบต่อหุ้น โดยราคาในช่วง After Hour -6.1%

ด้าน Bloomberg ให้ราคาเป้าหมายไว้ที่ 137.6 USD

01 November 2023 Advanced Micro Devices, Inc.,

01 November 2023 Advanced Micro Devices, Inc.,Bloomberg AMD.US

Reuters AMD.OQ

AMD surpasses earnings expectations but falls short in its Q4 projections.

Earnings Result

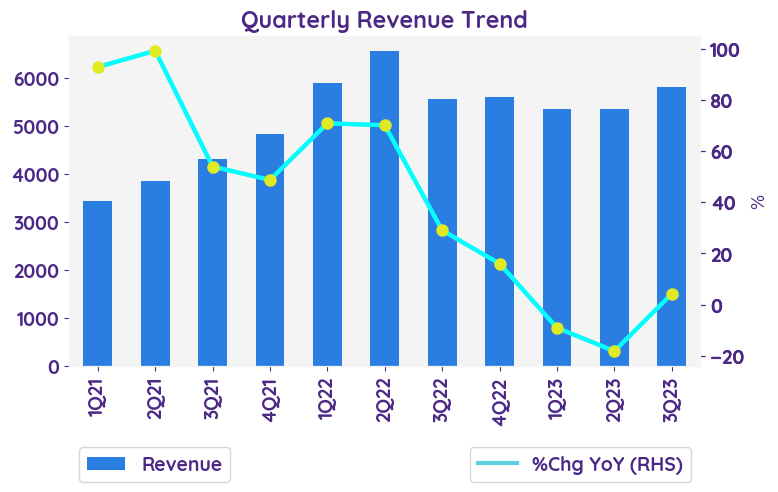

In 3Q23, there are several key highlights. Firstly, AMD's revenue increased by 4% to $5.8 billion in the current quarter compared to the previous quarter. Additionally, gross profit increased by 7% to $2.96 billion, with a gross margin of 51%. However, operating expenses rose by 12% to $1.7 billion, resulting in a slightly lower operating income of $1.28 billion. Net income and diluted earnings per share both increased by 4% to $1.14 billion and $0.70, respectively. It is important to note that the company's outlook for gross margin remains the same and is subject to risks and uncertainties.

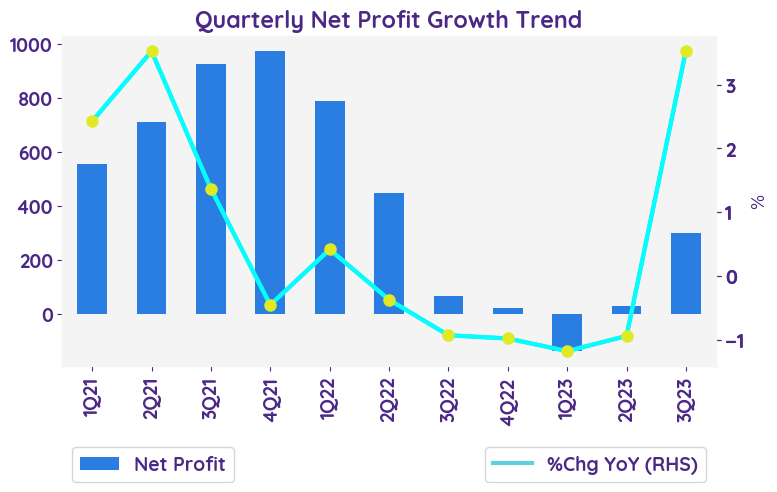

Net profit growth QoQ and YoY

In Q3 2023, net profit grew by 4% from Q2 and 20% from the previous year, outperforming expectations and showcasing the company's strong financial growth and stability.

Revenue growth for each business

AMD's adjusted revenue for the third quarter exceeded expectations, increasing by 4% to reach $5.8 billion, surpassing the estimated $5.7 billion. In the Quarterly Segment Summary, the Data Center segment revenue remained flat year-over-year at $1.6 billion, with growth in 4th Gen AMD EPYC CPU sales offset by a decline in adaptive SoC data center products. The Client segment revenue increased by 42% year-over-year to $1.5 billion, driven by higher Ryzen mobile processor sales. The Gaming segment revenue decreased by 8% year-over-year to $1.5 billion, primarily due to a decline in semi-custom revenue. The Embedded segment revenue decreased by 5% year-over-year to $1.2 billion, primarily due to a decrease in revenue in the communications market.

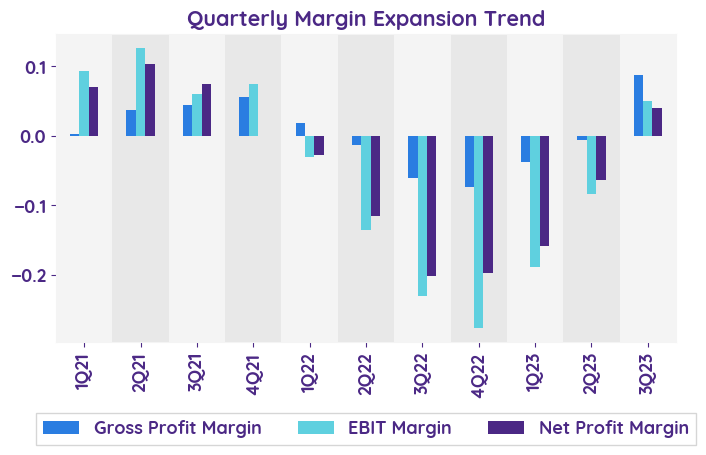

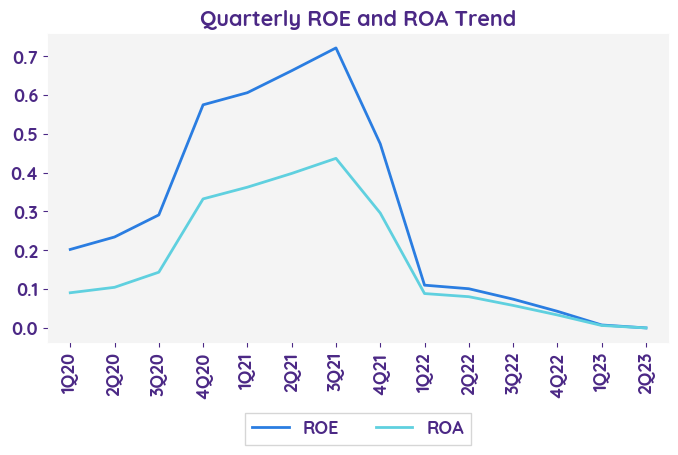

Operating margin

The operating margin for Q3 2023 was 22%, which is a decrease of 1 percentage point compared to Q3 2022. However, it increased by 2 percentage points compared to Q2 2023. This indicates that the company's profitability from its core operations has slightly decreased year-over-year but improved quarter-over-quarter.

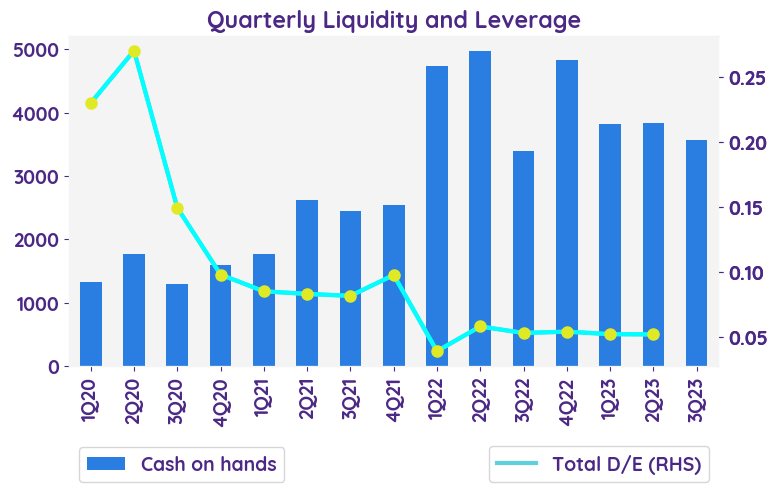

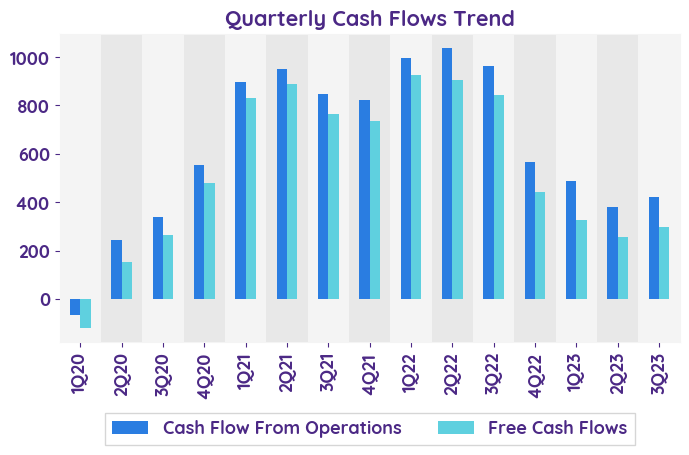

Balance sheet and cashflow

In Q3 2023, the company generated $421 million in operating cash, with a 7% margin, and invested $124 million in property and equipment, resulting in a free cash flow of $297 million and a 5% margin. Over nine months, these figures were $1,286 million, $407 million, and $842 million, respectively.

Risks and concerns

The current risk that the company is facing includes Intel Corporation's dominance in the microprocessor market, global economic uncertainty, and the cyclical nature of the semiconductor industry. The company also mentions the potential impact after the COVID-19 pandemic on its business.

Current Outlook

For Q4 2023, AMD anticipates $6.1 billion in revenue, marking a 9% YoY and 5% sequential increase, driven by robust performance in Data Center and Client segments, though tempered by weaker Gaming sales and softer embedded market demand. Despite surpassing estimates in Q3, AMD’s Q4 guidance fell short, causing an initial 4% drop in after-hours trading, which subsequently recovered. The projected non-GAAP gross margin stands at 51.5%.

In 3Q23, there are several key highlights. Firstly, AMD's revenue increased by 4% to $5.8 billion in the current quarter compared to the previous quarter. Additionally, gross profit increased by 7% to $2.96 billion, with a gross margin of 51%. However, operating expenses rose by 12% to $1.7 billion, resulting in a slightly lower operating income of $1.28 billion. Net income and diluted earnings per share both increased by 4% to $1.14 billion and $0.70, respectively. It is important to note that the company's outlook for gross margin remains the same and is subject to risks and uncertainties.

Net profit growth QoQ and YoY

In Q3 2023, net profit grew by 4% from Q2 and 20% from the previous year, outperforming expectations and showcasing the company's strong financial growth and stability.

Revenue growth for each business

AMD's adjusted revenue for the third quarter exceeded expectations, increasing by 4% to reach $5.8 billion, surpassing the estimated $5.7 billion. In the Quarterly Segment Summary, the Data Center segment revenue remained flat year-over-year at $1.6 billion, with growth in 4th Gen AMD EPYC CPU sales offset by a decline in adaptive SoC data center products. The Client segment revenue increased by 42% year-over-year to $1.5 billion, driven by higher Ryzen mobile processor sales. The Gaming segment revenue decreased by 8% year-over-year to $1.5 billion, primarily due to a decline in semi-custom revenue. The Embedded segment revenue decreased by 5% year-over-year to $1.2 billion, primarily due to a decrease in revenue in the communications market.

Operating margin

The operating margin for Q3 2023 was 22%, which is a decrease of 1 percentage point compared to Q3 2022. However, it increased by 2 percentage points compared to Q2 2023. This indicates that the company's profitability from its core operations has slightly decreased year-over-year but improved quarter-over-quarter.

Balance sheet and cashflow

In Q3 2023, the company generated $421 million in operating cash, with a 7% margin, and invested $124 million in property and equipment, resulting in a free cash flow of $297 million and a 5% margin. Over nine months, these figures were $1,286 million, $407 million, and $842 million, respectively.

Risks and concerns

The current risk that the company is facing includes Intel Corporation's dominance in the microprocessor market, global economic uncertainty, and the cyclical nature of the semiconductor industry. The company also mentions the potential impact after the COVID-19 pandemic on its business.

Current Outlook

For Q4 2023, AMD anticipates $6.1 billion in revenue, marking a 9% YoY and 5% sequential increase, driven by robust performance in Data Center and Client segments, though tempered by weaker Gaming sales and softer embedded market demand. Despite surpassing estimates in Q3, AMD’s Q4 guidance fell short, causing an initial 4% drop in after-hours trading, which subsequently recovered. The projected non-GAAP gross margin stands at 51.5%.

| Revenue - %Chg YoY | 1Q23 | 2Q23 | 3Q23 | 4Q23E | 1Q24E |

|---|---|---|---|---|---|

| Data Center | 42.3% | 0.2% | -11.1% | 1.0% | 37.8% |

| Client | -50.6% | -65.2% | -53.6% | 20.6% | 49.4% |

| Gaming | -6.7% | -6.3% | -4.5% | -6.0% | -11.2% |

| Embedded | 1867.6% | 162.5% | 16.1% | 0.5% | -8.4% |

| Sentiment | 4Q22 | 1Q23 | 2Q23 | 3Q23 |

|---|---|---|---|---|

| net profit | Negative | Negative | Negative | Positive |

| margin | Negative | Negative | Negative | Positive |

| revenue | Positive | Negative | Negative | Positive |

| Stock data | |

|---|---|

| Market Cap (USD Million) | 159.14 |

| Beta | 1.70 |

| Last close | 98.50 |

| 12-m Low / High | 58 / 132.8 |

| Target price | 136.90 |

| Return Potential | 39.0 % |

| % of Buy / Sell rating | 78.0 % / 2.0 % |

| Valuation data | 12m Forward | 5-Yr Average |

|---|---|---|

| P/E | 26.36 | 73.23 |

| P/B | 2.79 | 15.55 |

| P/S | 5.80 | 7.28 |

| EV/EBITDA | 21.45 | 28.33 |

| Dividend Yield | 0.0 % |

Advanced Micro Devices, Inc.,

Advanced Micro Devices, Inc. (AMD) produces semiconductor products and devices. The Company offers products such as microprocessors, embedded microprocessors, chipsets, graphics, video and multimedia products and supplies it to third-party foundries, as well as provides assembling, testing, and packaging services. AMD serves customers worldwide.

Stocks Mentioned

Related Articles