สรุปสาระสำคัญ

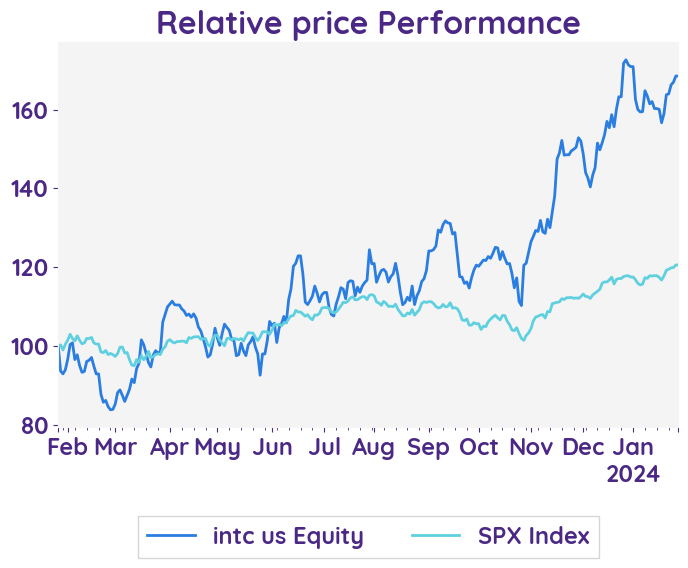

• INTC รายได้ใน 4Q23 เพิ่มขึ้นดีกว่าคาด 10% เช่นเดียวกันกับกำไรที่ปรับตัวเพิ่มขึ้น 440% หนุนจากทุกธุรกิจที่ฟื้นตัวได้ต่อเนื่อง

แต่อย่างไรก็ดีคาดการณ์กำไรใน 1Q24 ที่เพิ่มขึ้น 8% YoY และกำไรที่เพิ่มขึ้นแตะ 13cents ต่อหุ้น นั้นทำให้ภาพรวมคาดการณ์ 1Q24 ออกมาต่ำกว่าคาด ทำให้ราคาหุ้นในช่วง After Hour ตอบสนองในเชิงลบและปรับตัวลงราว 10%

• ด้าน Bloomberg ให้ราคาเป้าหมายไว้ที่ 45USD ซึ่งมี Upside -9% จากราคาปัจจุบัน

26 January 2024

Intel

INTC

26 January 2024

Intel

INTC

Bloomberg INTC.US

Reuters INTC.OQ

Intel's Stock Dives Following Pessimistic Outlook, Raising Questions About Its Recovery Efforts

Earnings Result

In comparing the previous quarter summary to the current quarter summary, it is evident that the company's outlook and forecast remain focused on anticipated growth, market share, and industry trends. Both summaries mention the consideration of government incentives, future technology trends, and macroeconomic conditions. Financial performance projections, including revenue, gross margins, and capital expenditures, are also highlighted in both summaries. Additionally, the company emphasizes its plans for future products, services, and technologies, as well as investment and manufacturing expansion. The completion and impacts of restructuring activities and cost-saving initiatives are also mentioned in both summaries. Overall, the company's focus on growth, market trends, and financial performance remains consistent between the two quarters.

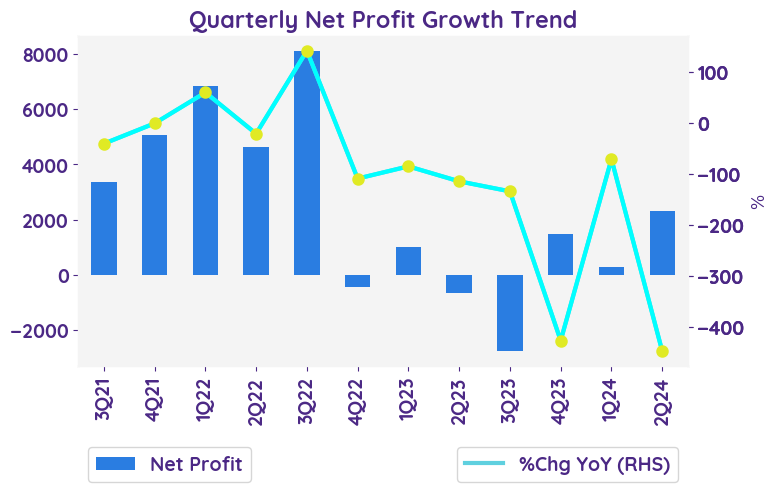

Net profit growth QoQ and YoY

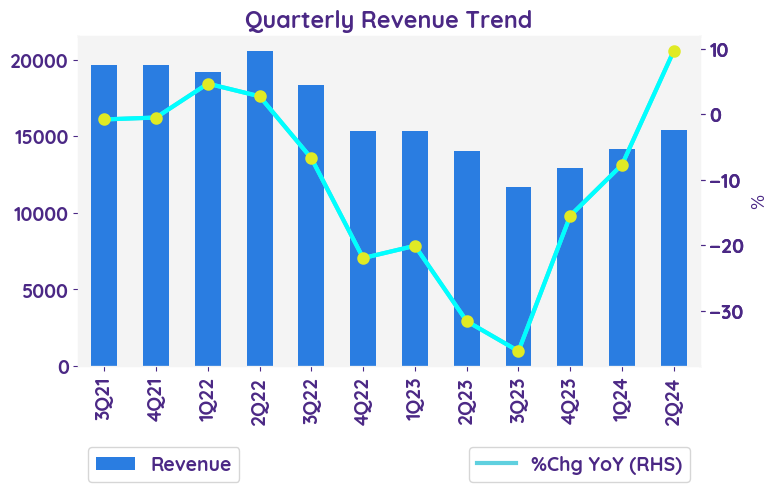

Earnings Growth Surpasses Expectations: In the fourth quarter, Intel reported earnings of 54 cents per share, significantly exceeding the 15 cents per share from the same period last year. This performance also surpassed analysts' forecasts, which anticipated a profit of 44 cents per share. Furthermore, Intel's sales reached $15.4 billion, outpacing the expected $15.2 billion.

Revenue growth of each business

In 4Q23, Intel's revenue was beat expectation to $15.4 billion, with the Client Computing Group (CCG) experiencing a 33% increase in revenue, while the Data Center and AI (DCAI) segment saw a 10% decrease. For the full year, Intel's revenue was $54.2 billion, with CCG revenue down 8% and DCAI revenue down 20%. Other segments, such as Network and Edge, Mobileye, and Intel Foundry Services, also experienced declines in revenue.

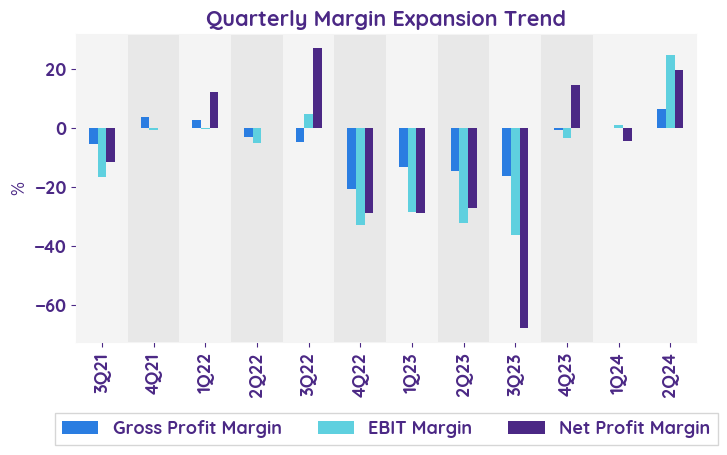

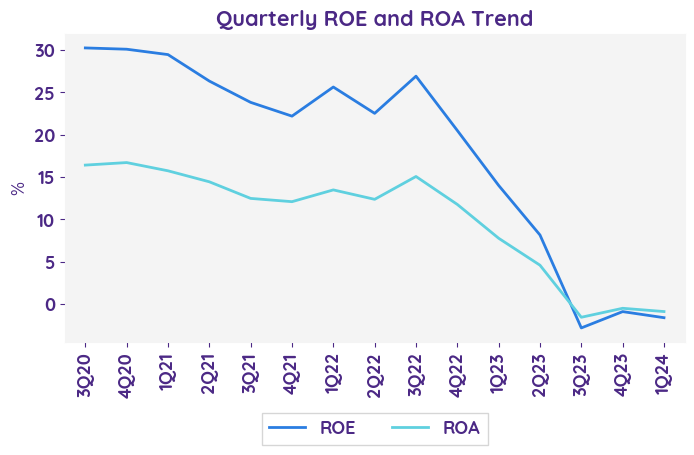

Operating margin

The operating margin for Intel Corporation improved from a loss of 8.1% in the previous year to a positive margin of 16.8% in the current year. This improvement can be attributed to the decrease in restructuring and other charges and the increase in non-GAAP operating income. The non-GAAP operating margin also increased from 4.3% to 16.7% during the same period. These positive trends indicate improved operational efficiency and profitability for the company.

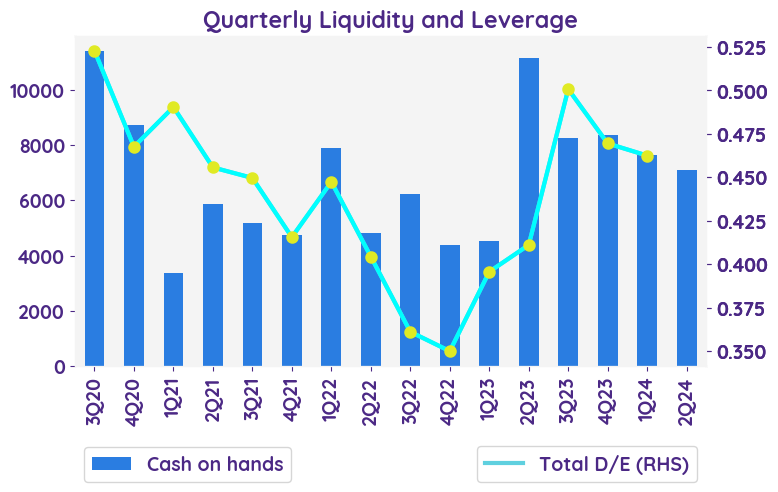

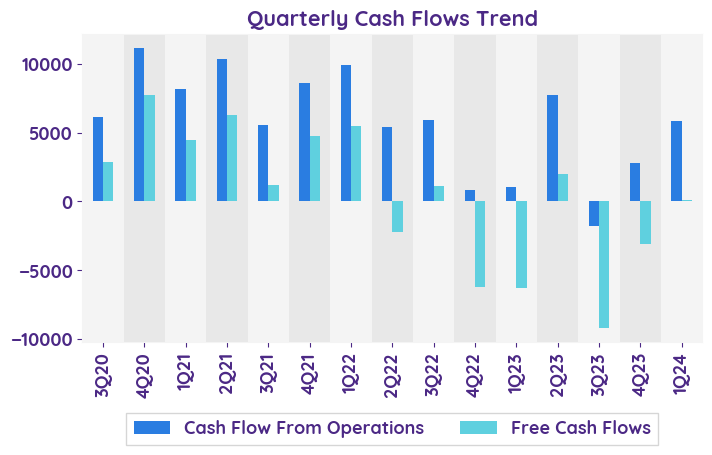

Balance sheet and cashflow

Intel's 2023 balance sheet reveals higher total assets and shareholder equity, but reduced current assets and liabilities. Cash flow shows decreased operating cash and higher investing outflows, with a notable decrease in cash and cash equivalents.

Business Outlook

Intel projects its revenue for the first quarter of 2024 to be between $12.2 billion and $13.2 billion, with an anticipated first-quarter earnings per share (EPS) of negative $0.25, or a non-GAAP EPS of $0.13

In comparing the previous quarter summary to the current quarter summary, it is evident that the company's outlook and forecast remain focused on anticipated growth, market share, and industry trends. Both summaries mention the consideration of government incentives, future technology trends, and macroeconomic conditions. Financial performance projections, including revenue, gross margins, and capital expenditures, are also highlighted in both summaries. Additionally, the company emphasizes its plans for future products, services, and technologies, as well as investment and manufacturing expansion. The completion and impacts of restructuring activities and cost-saving initiatives are also mentioned in both summaries. Overall, the company's focus on growth, market trends, and financial performance remains consistent between the two quarters.

Net profit growth QoQ and YoY

Earnings Growth Surpasses Expectations: In the fourth quarter, Intel reported earnings of 54 cents per share, significantly exceeding the 15 cents per share from the same period last year. This performance also surpassed analysts' forecasts, which anticipated a profit of 44 cents per share. Furthermore, Intel's sales reached $15.4 billion, outpacing the expected $15.2 billion.

Revenue growth of each business

In 4Q23, Intel's revenue was beat expectation to $15.4 billion, with the Client Computing Group (CCG) experiencing a 33% increase in revenue, while the Data Center and AI (DCAI) segment saw a 10% decrease. For the full year, Intel's revenue was $54.2 billion, with CCG revenue down 8% and DCAI revenue down 20%. Other segments, such as Network and Edge, Mobileye, and Intel Foundry Services, also experienced declines in revenue.

Operating margin

The operating margin for Intel Corporation improved from a loss of 8.1% in the previous year to a positive margin of 16.8% in the current year. This improvement can be attributed to the decrease in restructuring and other charges and the increase in non-GAAP operating income. The non-GAAP operating margin also increased from 4.3% to 16.7% during the same period. These positive trends indicate improved operational efficiency and profitability for the company.

Balance sheet and cashflow

Intel's 2023 balance sheet reveals higher total assets and shareholder equity, but reduced current assets and liabilities. Cash flow shows decreased operating cash and higher investing outflows, with a notable decrease in cash and cash equivalents.

Business Outlook

Intel projects its revenue for the first quarter of 2024 to be between $12.2 billion and $13.2 billion, with an anticipated first-quarter earnings per share (EPS) of negative $0.25, or a non-GAAP EPS of $0.13

| Revenue - %Chg YoY | 2Q23 | 3Q23 | 4Q23 | 1Q24E | 2Q24E |

|---|---|---|---|---|---|

| Client Computing | -11.7% | -3.2% | 33.1% | 29.5% | 15.4% |

| Datacenter and AI | -14.7% | -10.4% | -9.8% | 0.4% | -1.0% |

| Network and Edge | -38.3% | -32.0% | -23.7% | -1.4% | 11.8% |

| Mobileye | -1.3% | 17.8% | 12.7% | -22.0% | 8.0% |

| Sentiment | 1Q23 | 2Q23 | 3Q23 | 4Q23 |

|---|---|---|---|---|

| net profit | Negative | Positive | Positive | Negative |

| margin | Negative | Negative | Neutral | Negative |

| revenue | Negative | Negative | Negative | Negative |

| Stock data | |

|---|---|

| Market Cap (USD Million) | 208.90 |

| Beta | 1.33 |

| Last close | 49.55 |

| 12-m Low / High | 24.7 / 51.3 |

| Target price | 45.00 |

| Return Potential | -9.2 % |

| % of Buy / Sell rating | 24.0 % / 15.0 % |

| Valuation data | 12m Forward | 5-Yr Average |

|---|---|---|

| P/E | 28.63 | |

| P/B | 2.06 | 2.35 |

| P/S | 3.47 | 2.73 |

| EV/EBITDA | 14.19 | 15.77 |

| Dividend Yield | 0.0 % |

Intel

Intel Corporation designs, manufactures, and sells computer components and related products. The Company major products include microprocessors, chipsets, embedded processors and microcontrollers, flash memory, graphic, network and communication, systems management software, conferencing, and digital imaging products.

Related Articles