สรุปสาระสำคัญ

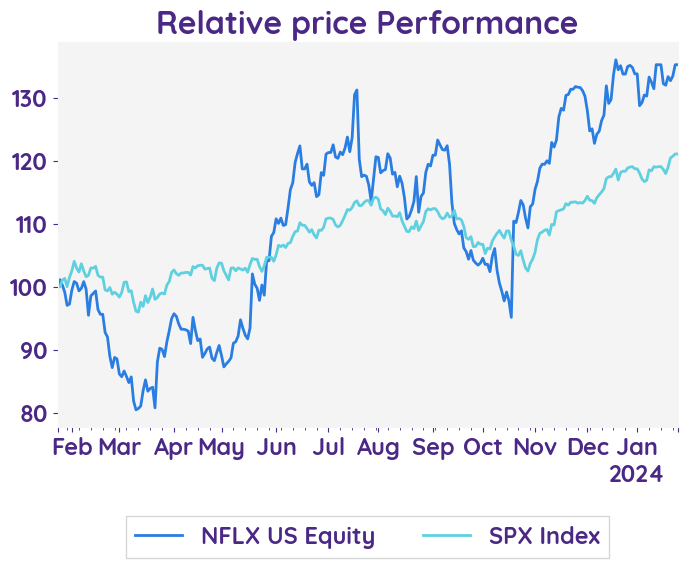

• Netflix เผยงบ 4Q23 ดีกว่าคาด โดยรายได้เติบโต 12 %YoY หนุนจากค่าใช้จ่าย Streaming ที่เพิ่มขึ้นแกร่ง 71%YoY และสมาชิกใหม่ทั่วโลกเพิ่มขึ้นมากกว่า 13 ล้านราย ขณะที่บริษัทให้คาดการณ์รายได้ใน 1Q24 เติบโต 13% และมองอัตรากำไรจากการดำเนินงานจะสูงถึง 24% ในปี 2024

• ภาพงบและคาดการณ์ที่ดีกว่าคาดส่งผลให้ราคาหุ้นของ Netflix ปิดตัวลงที่ +1.3% ในช่วงคืนที่ผ่านมา ด้าน Bloomberg ให้ราคาเป้าหมายไว้ที่ 518.5USD ซึ่งมี Upside 5.3% จากราคาปัจจุบัน

Bloomberg NFLX.US

Reuters NFLX.O

Netflix's Q4 2023 earnings show solid streaming growth and an impressive 21.9% operating margin, exceeding expectations.

Earnings Result

In comparing the previous quarter's financial report summary to the current quarter's, Netflix continues to emphasize their adoption and growth in streaming entertainment, as well as their competitive position and core strategy. However, in the current quarter, they also highlight their focus on ad-supported tiers and their prospects in the ads business. Additionally, they discuss their acquisitions, paid net additions, membership growth, and engagement. The company provides detailed information on their operating margin, revenue, operating expenses, and operating profit for multiple years, as well as the impact of foreign exchange rates. They also announce an earnings interview with their Co-CEOs, CFO, and VP of Finance/IR/Corporate Development, indicating a strong focus on investor communication and transparency.

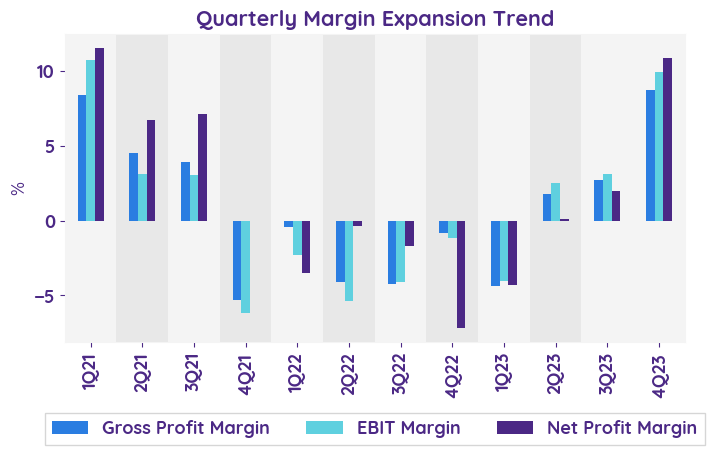

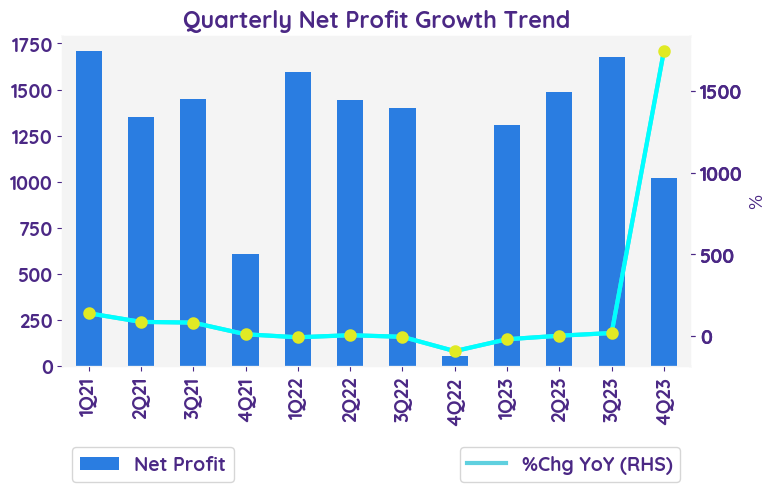

Net profit growth QoQ and YoY

The net profit growth for the fourth quarter of 2023 was significant, with operating income amounting to $1.5B, up from $0.5B in the same period last year. The operating margin also improved to 17% compared to 7% in the previous year. For the full year of 2023, operating income increased by 23% year over year, with an operating margin of 21%.

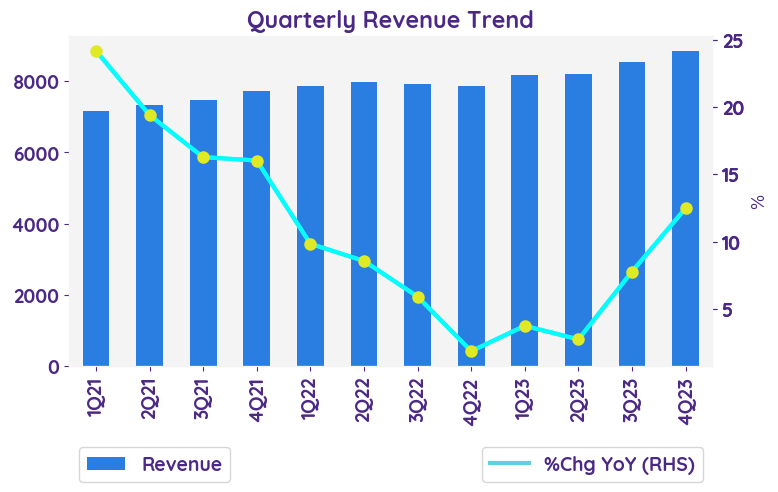

Revenue growth of each business

In 4Q23, UCAN Streaming exhibited a steady 3% year-over-year growth in Q4'23, with average revenue per membership also rising by 3%. EMEA's revenue grew 3% year-over-year, despite a 1% drop in average revenue per member. LATAM continued its consistent growth, achieving a 4% increase, maintaining stable membership revenue. However, APAC faced a downturn, with both revenue and average revenue per membership decreasing by 5% year-over-year. Overall, while UCAN and LATAM beat expectations with growth, EMEA was mixed, and APAC declined. The overall revenue growth surpassed expectations.

Outlook

For 1Q24, revenue growth prediction is 13%, tempered by a 3% F/X headwind, mainly from the Argentine peso's fall against the US dollar. The full-year 2024 operating margin forecast is upped from 22-23% to 24%, reflecting the US dollar's decline since October and an unexpectedly robust Q4’23, likely influencing 2024's performance.

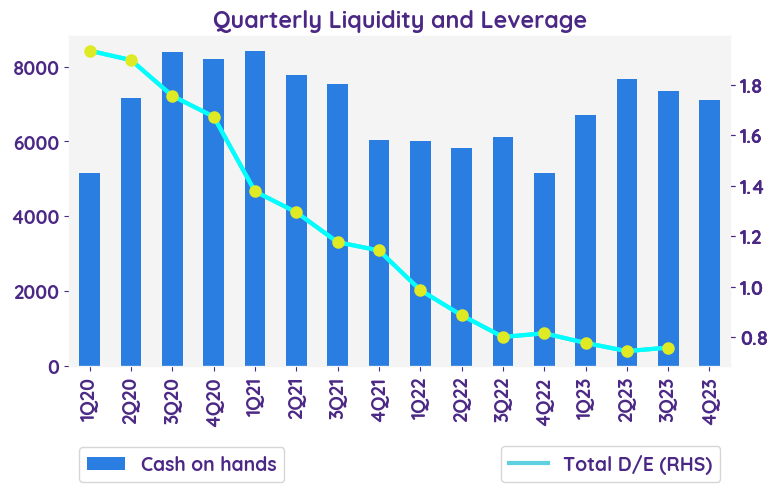

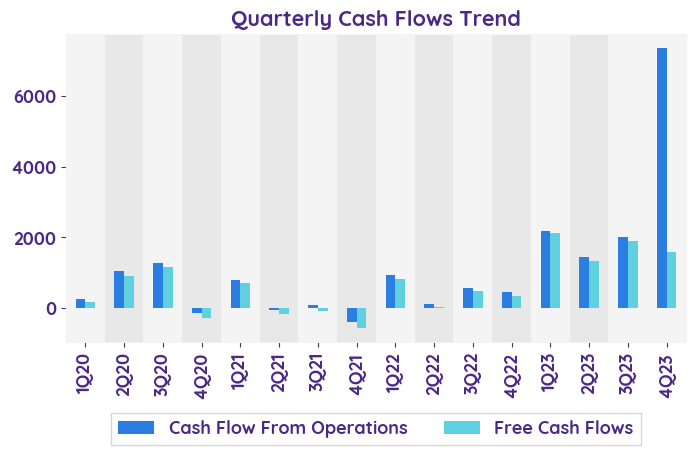

Balance sheet and cashflow

The balance sheet shows that Netflix's current assets increased from $9.27 billion in 2022 to $9.92 billion in 2023. The cash and cash equivalents also increased from $5.15 billion to $7.12 billion. The cash flow statement indicates that net cash provided by operating activities in Q4 2023 was $1.66 billion, compared to $0.44 billion in the same period in 2022. This suggests improved cash flow and a stronger capital structure for the company.

Risks and concerns

The current risk that the company is facing is the uncertainty of actual performance varying from forecast numbers. The plan is to update forward-looking statements and reflect events or circumstances occurring after the date of the shareholder letter.

In comparing the previous quarter's financial report summary to the current quarter's, Netflix continues to emphasize their adoption and growth in streaming entertainment, as well as their competitive position and core strategy. However, in the current quarter, they also highlight their focus on ad-supported tiers and their prospects in the ads business. Additionally, they discuss their acquisitions, paid net additions, membership growth, and engagement. The company provides detailed information on their operating margin, revenue, operating expenses, and operating profit for multiple years, as well as the impact of foreign exchange rates. They also announce an earnings interview with their Co-CEOs, CFO, and VP of Finance/IR/Corporate Development, indicating a strong focus on investor communication and transparency.

Net profit growth QoQ and YoY

The net profit growth for the fourth quarter of 2023 was significant, with operating income amounting to $1.5B, up from $0.5B in the same period last year. The operating margin also improved to 17% compared to 7% in the previous year. For the full year of 2023, operating income increased by 23% year over year, with an operating margin of 21%.

Revenue growth of each business

In 4Q23, UCAN Streaming exhibited a steady 3% year-over-year growth in Q4'23, with average revenue per membership also rising by 3%. EMEA's revenue grew 3% year-over-year, despite a 1% drop in average revenue per member. LATAM continued its consistent growth, achieving a 4% increase, maintaining stable membership revenue. However, APAC faced a downturn, with both revenue and average revenue per membership decreasing by 5% year-over-year. Overall, while UCAN and LATAM beat expectations with growth, EMEA was mixed, and APAC declined. The overall revenue growth surpassed expectations.

Outlook

For 1Q24, revenue growth prediction is 13%, tempered by a 3% F/X headwind, mainly from the Argentine peso's fall against the US dollar. The full-year 2024 operating margin forecast is upped from 22-23% to 24%, reflecting the US dollar's decline since October and an unexpectedly robust Q4’23, likely influencing 2024's performance.

Balance sheet and cashflow

The balance sheet shows that Netflix's current assets increased from $9.27 billion in 2022 to $9.92 billion in 2023. The cash and cash equivalents also increased from $5.15 billion to $7.12 billion. The cash flow statement indicates that net cash provided by operating activities in Q4 2023 was $1.66 billion, compared to $0.44 billion in the same period in 2022. This suggests improved cash flow and a stronger capital structure for the company.

Risks and concerns

The current risk that the company is facing is the uncertainty of actual performance varying from forecast numbers. The plan is to update forward-looking statements and reflect events or circumstances occurring after the date of the shareholder letter.

| Net Streaming Subscriber Additions - %Chg YoY | 1Q23 | 2Q23 | 3Q23 | 4Q23 | 1Q24E |

|---|---|---|---|---|---|

| United States & Canada | 116.0% | 190.5% | 1582.7% | 208.8% | 620.2% |

| Europe, Middle East & Africa | 312.5% | 417.3% | 596.0% | 58.2% | 124.2% |

| Latin America | -28.2% | 8592.9% | 277.9% | 33.4% | 245.1% |

| Asia Pacific | 33.9% | -1.1% | 31.6% | 62.2% | -4.7% |

| Sentiment | 1Q23 | 2Q23 | 3Q23 | 4Q23 |

|---|---|---|---|---|

| net profit | Neutral | Neutral | Neutral | Neutral |

| margin | Positive | Neutral | Positive | Positive |

| revenue | Positive | Neutral | Neutral | Positive |

| Stock data | |

|---|---|

| Market Cap (USD Million) | 215.42 |

| Beta | 1.58 |

| Last close | 492.19 |

| 12-m Low / High | 285.3 / 503.4 |

| Target price | 518.50 |

| Return Potential | 5.3 % |

| % of Buy / Sell rating | 61.0 % / 9.0 % |

| Valuation data | 12m Forward | 5-Yr Average |

|---|---|---|

| P/E | 30.65 | 66.61 |

| P/B | 8.20 | 17.17 |

| P/S | 5.63 | 7.42 |

| EV/EBITDA | 23.61 | 26.54 |

| Dividend Yield | 0.0 % |

Netflix, Inc.

Netflix, Inc. operates as a subscription streaming service and production company. The Company offers a wide variety of TV shows, movies, anime, and documentaries on internet-connected devices. Netflix serves customers worldwide.

Stocks Mentioned

Related Articles