17 October 2023 PepsiCo PEP

17 October 2023 PepsiCo PEPBloomberg PEP

Reuters PEP

Strong Performance with Upward Revision of Full-Year Projections

Earnings Result

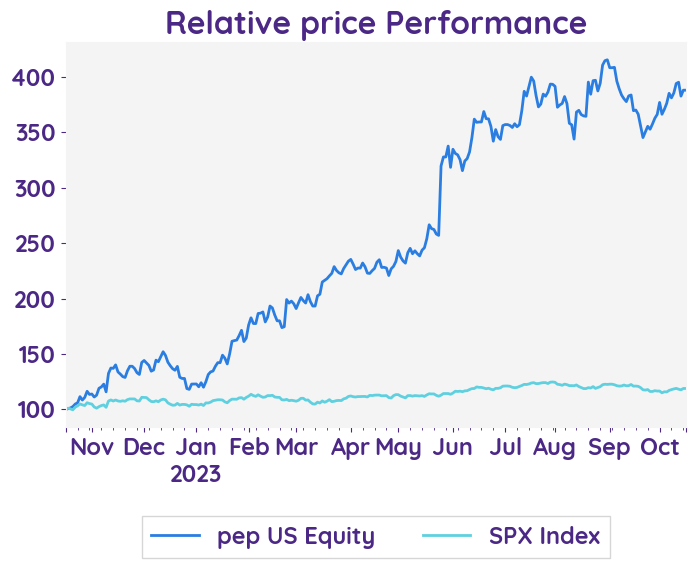

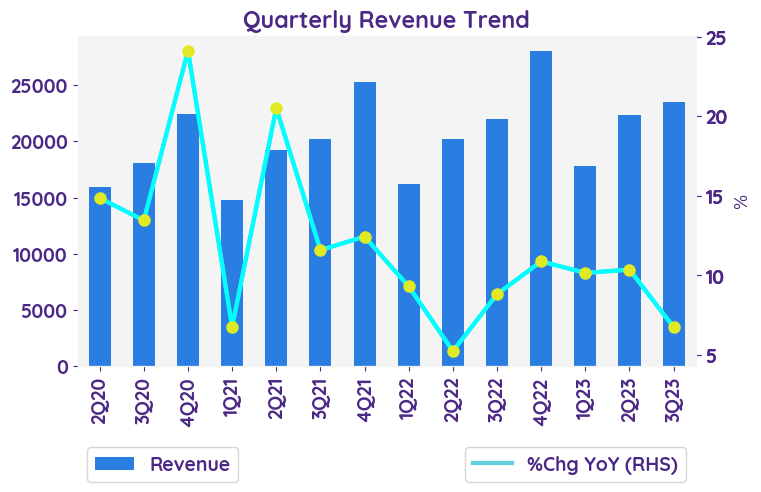

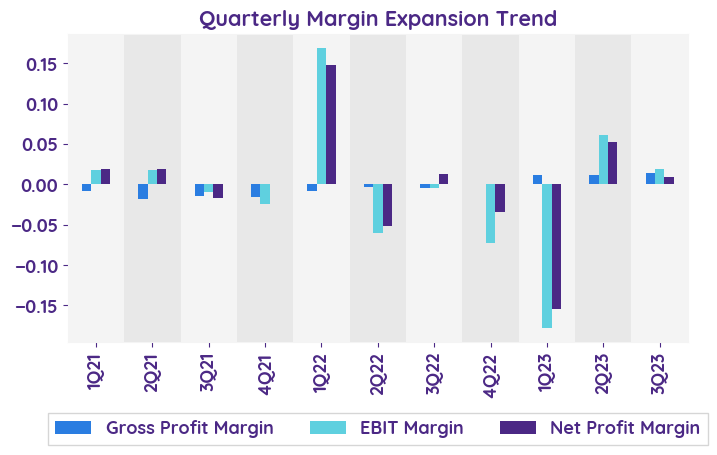

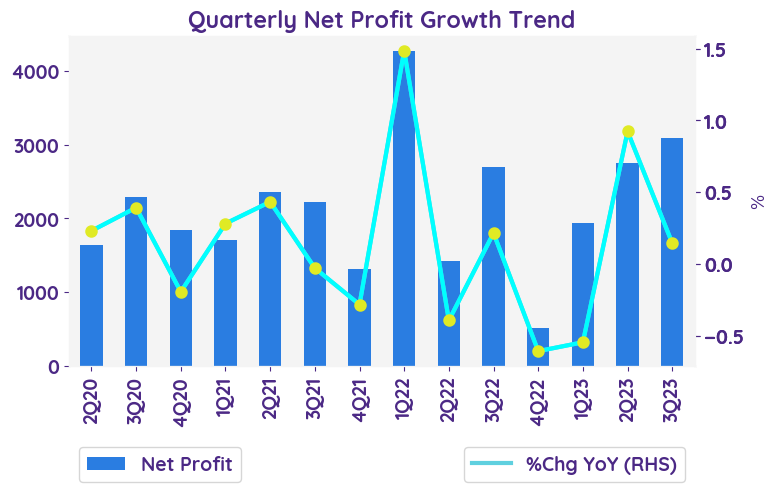

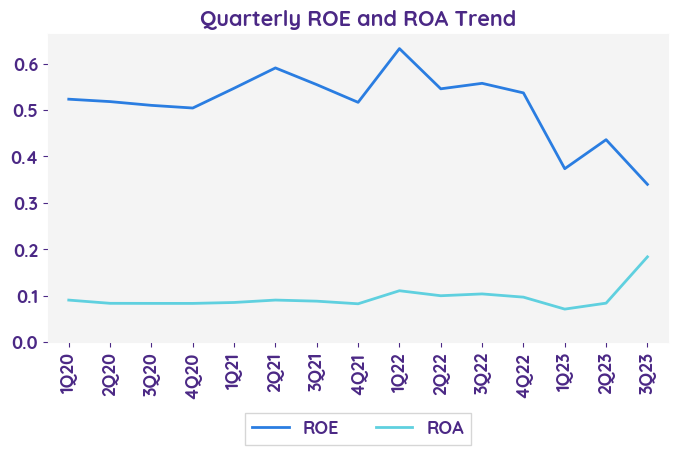

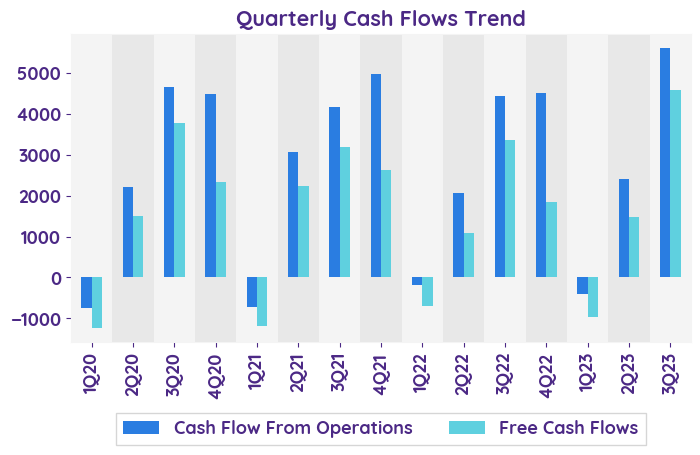

In Q3 2023, PepsiCo surpassed expectations with an 8.8% organic revenue growth and a core EPS of $2.25, prompting an upward revision of its 2023 core EPS growth to 13%. CEO Ramon Laguarta praised the company's resilience amid global challenges. With strategic investments and a 2024 projection aligned with upper-end long-term targets, PepsiCo is poised for leadership in its sector.

Revenue growth for each business

In Q3 2023, PepsiCo's segments reported strong revenue. Frito-Lay North America and Quaker Foods thrived on diverse offerings and health trends. PepsiCo Beverages saw growth from sodas and non-carbonated drinks. Latin America benefited from strategic marketing, Europe combined acquisitions with organic growth, and the Africa, Middle East, and South Asia capitalized on demographic trends. APAC leveraged urbanization for significant growth, reinforcing PepsiCo's global presence.

Positive Performance

In 3Q23, PepsiCo saw a 6.7% rise in net revenue and 8.8% in organic revenue, with EPS up by 15%. Crediting business agility, investments, and resilient associates, the company anticipates growth in 2024, targeting upper-end projections.

Full-Year Projection

The company raised its full-year 2023 core constant currency EPS growth expectation to 13% and maintained its organic revenue growth projection at 10%.

Outlook

Looking ahead, PepsiCo expects its 2024 organic revenue and core constant currency EPS growth to align with the upper end of their long-term targets as they work towards becoming a global leader in beverages and convenient foods.

Risks and concerns

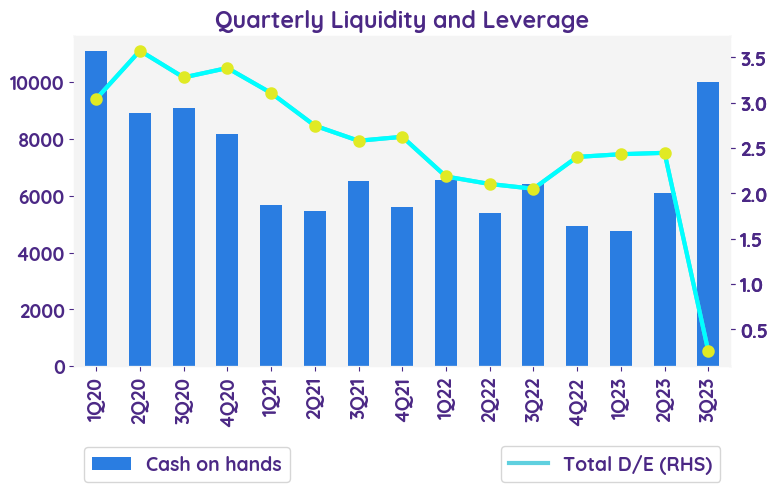

Amidst PepsiCo's resilient performance, potential risks loom. Geopolitical and pandemic-induced supply chain disruptions, currency variances in emerging markets, and regulatory challenges could strain finances. Rapid shifts to healthier consumer preferences, intense competition, and climate-related agricultural disruptions pose threats to market position and product offerings.

In Q3 2023, PepsiCo surpassed expectations with an 8.8% organic revenue growth and a core EPS of $2.25, prompting an upward revision of its 2023 core EPS growth to 13%. CEO Ramon Laguarta praised the company's resilience amid global challenges. With strategic investments and a 2024 projection aligned with upper-end long-term targets, PepsiCo is poised for leadership in its sector.

Revenue growth for each business

In Q3 2023, PepsiCo's segments reported strong revenue. Frito-Lay North America and Quaker Foods thrived on diverse offerings and health trends. PepsiCo Beverages saw growth from sodas and non-carbonated drinks. Latin America benefited from strategic marketing, Europe combined acquisitions with organic growth, and the Africa, Middle East, and South Asia capitalized on demographic trends. APAC leveraged urbanization for significant growth, reinforcing PepsiCo's global presence.

Positive Performance

In 3Q23, PepsiCo saw a 6.7% rise in net revenue and 8.8% in organic revenue, with EPS up by 15%. Crediting business agility, investments, and resilient associates, the company anticipates growth in 2024, targeting upper-end projections.

Full-Year Projection

The company raised its full-year 2023 core constant currency EPS growth expectation to 13% and maintained its organic revenue growth projection at 10%.

Outlook

Looking ahead, PepsiCo expects its 2024 organic revenue and core constant currency EPS growth to align with the upper end of their long-term targets as they work towards becoming a global leader in beverages and convenient foods.

Risks and concerns

Amidst PepsiCo's resilient performance, potential risks loom. Geopolitical and pandemic-induced supply chain disruptions, currency variances in emerging markets, and regulatory challenges could strain finances. Rapid shifts to healthier consumer preferences, intense competition, and climate-related agricultural disruptions pose threats to market position and product offerings.

| Operating Income - %Chg YoY | 1Q23 | 2Q23 | 3Q23 | 4Q23E | 1Q24E |

|---|---|---|---|---|---|

| North America | -27.9% | 9.7% | 3.9% | 21.4% | -25.0% |

| Europe | 5.0% | 13.4% | 1.6% | 2.9% | 1.1% |

| Latin America | 20.6% | 18.3% | 21.4% | 15.0% | 8.6% |

| Africa, Middle East & South Asia | 1.5% | -7.5% | -6.4% | -2.6% | -0.6% |

| Asia Pacific, Australia, New Zealand & China | -1.4% | 1.1% | 3.9% | 2.9% | 1.7% |

| Sentiment | 3Q22 | 4Q22 | 1Q23 | 2Q23 |

|---|---|---|---|---|

| net profit | Negative | Positive | Neutral | Neutral |

| margin | Neutral | Neutral | Positive | Neutral |

| revenue | Negative | Positive | Neutral | Positive |

| Stock data | |

|---|---|

| Market Cap (USD Million) | 221.46 |

| Beta | 0.48 |

| Last close | 161.08 |

| 12-m Low / High | 155.8 / 196.9 |

| Target price | 190.00 |

| Return Potential | 18.0 % |

| % of Buy / Sell rating | 54.0 % / 4.0 % |

| Valuation data | 12m Forward | 5-Yr Average |

|---|---|---|

| P/E | 20.18 | 24.94 |

| P/B | 9.89 | 13.53 |

| P/S | 2.29 | 2.79 |

| EV/EBITDA | 14.20 | 20.58 |

| Dividend Yield | 0.0 % |

PepsiCo

PepsiCo, Inc. operates foods and beverages businesses. The Company manufactures markets and sells a variety of grain-based snacks, carbonated and non-carbonated beverages, and foods. PepsiCo serves customers worldwide.

Related Articles