สรุปสาระสำคัญ

• Tesla เผยงบ 2Q24 กำไรผิดคาดและหดตัวผลจากการปรับลดราคาขาย EV รวมถึงยังปรับลดราคาขายส่งผลให้อัตรากำไรขั้นต้น EV อย่างไรก็ดีผลกำไรจากธุรกิจอื่น ๆ โดยเฉพาะธุรกิจพลังงานและรายได้จากเครดิตด้านกฎระเบียบสูงขึ้น

Bloomberg tsla.us

Reuters tsla.oq

Tesla กำไรผิดคาดและหดตัวผลจากการปรับลดราคาขาย EV

Earnings Result

Tesla เผยงบ 2Q24 ต่ำกว่าคาดในส่วนกำไรหลังภาพรวมงบกดดันจากธุรกิจ EV ที่ชะลอตัวหลังมีการแข่งขันสูง รวมถึงยังปรับลดราคาขายส่งผลให้อัตรากำไรขั้นต้น EV อย่างไรก็ดีผลกำไรจากธุรกิจอื่น ๆ โดยเฉพาะธุรกิจพลังงานและรายได้จากเครดิตด้านกฎระเบียบสูงขึ้น

กำไรยังคงมีแรงกดดันจากการลดราคาขาย

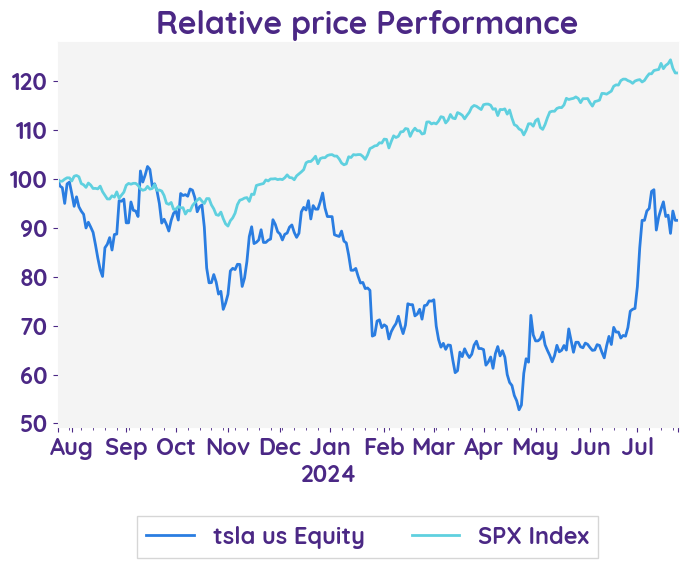

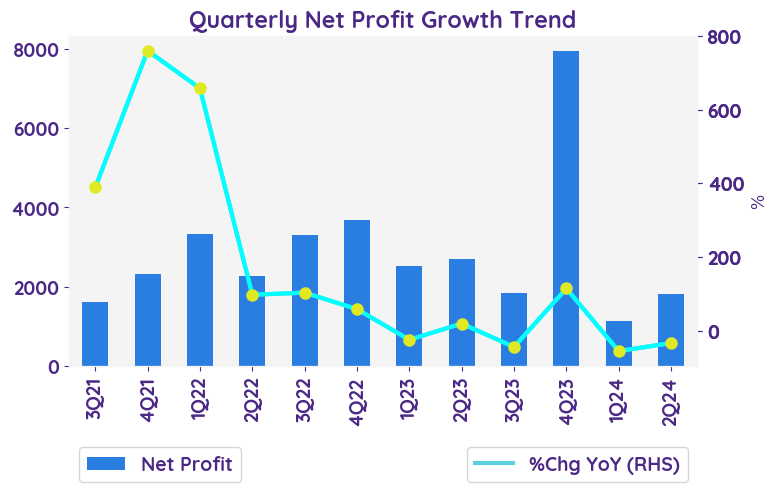

กำไรในไตรมาส 2 ปี 2024 แย่กว่าคาดและหดตัวลง YoY โดยกำไรต่อหุ้นอยู่ที่ 52 เซนต์เทียบกับคาดที่ 60 เซนต์ และปีก่อนที่ 78 เซนต์ ภาพนี้สะท้อนให้เห็นผลกระทบจากการปรับลดราคาขายของบริษัทที่ยังคงดำเนินต่อเนื่อง

ยอดขายเพิ่มขึ้นเล็กน้อยหนุนจากธุรกิจที่ไม่ใช่ EV

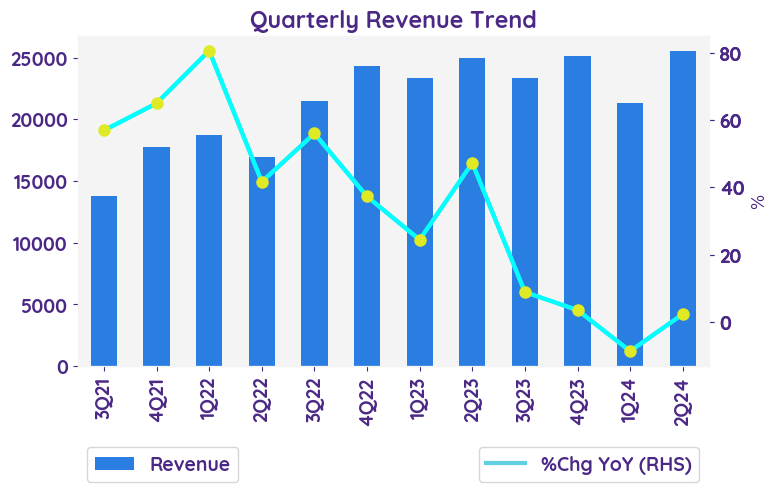

รายได้ในไตรมาส 2 ปี 2024 ดีกว่าคาดโดยรายได้จากการขายรถยนต์เพิ่มขึ้นจาก 16,460 ล้านดอลลาร์เป็น 18,530 ล้านดอลลาร์ ขณะที่รายได้จากการผลิตและจัดเก็บพลังงานเพิ่มขึ้นอย่างมากจาก 1,635 ล้านดอลลาร์เป็น 3,014 ล้านดอลลาร์ และรายได้จากบริการอื่น ๆ ก็แสดงการเติบโตจาก 2,288 ล้านดอลลาร์เป็น 2,608 ล้านดอลลาร์ ทั้งหมดรวมรายได้ทั้งหมดเพิ่มขึ้น 2.3%YoY

Operating Income ยังมีแรงกดดันจากค่าใช้จ่ายปรับโครงสร้างที่เพิ่มขึ้น

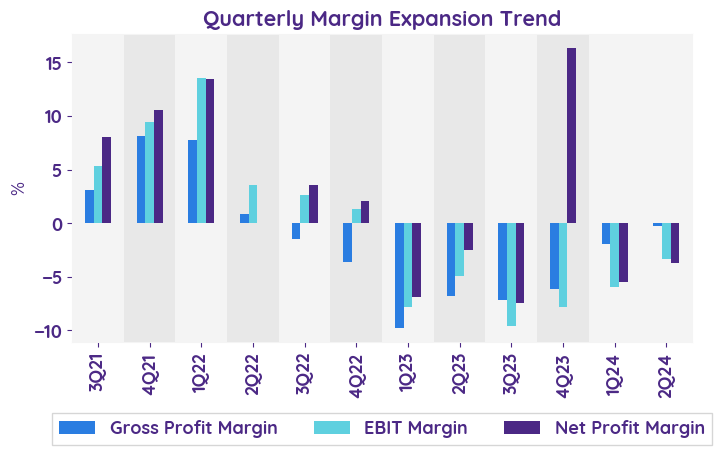

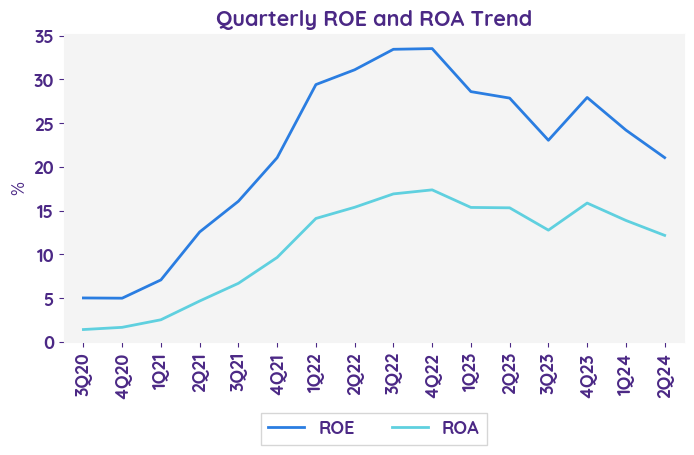

รายได้จากการดำเนินงานของบริษัทลดลงจาก 9.6% ในไตรมาส 2 ปี 2023 เป็น 6.3% ในไตรมาส 2 ปี 2024 ลดลง 333 จุดฐานหลังค่าใช้จ่ายในการปรับโครงสร้างและการเพิ่มขึ้นของรายจ่ายการดำเนินงานเป็นสาเหตุหลักที่ทำให้รายได้จากการดำเนินงานลดลง แต่มีปัจจัยบวกเช่น รายได้เครดิตทางกฎหมายที่สูงขึ้นและกำไรจากการขายพลังงานและเก็บกักข้อมูลที่เพิ่มขึ้น ผลกระทบที่มีต่อความสามารถในการทำกำไรของบริษัททำให้รายได้จากการดำเนินงานลดลง

Balance sheet และ cashflow

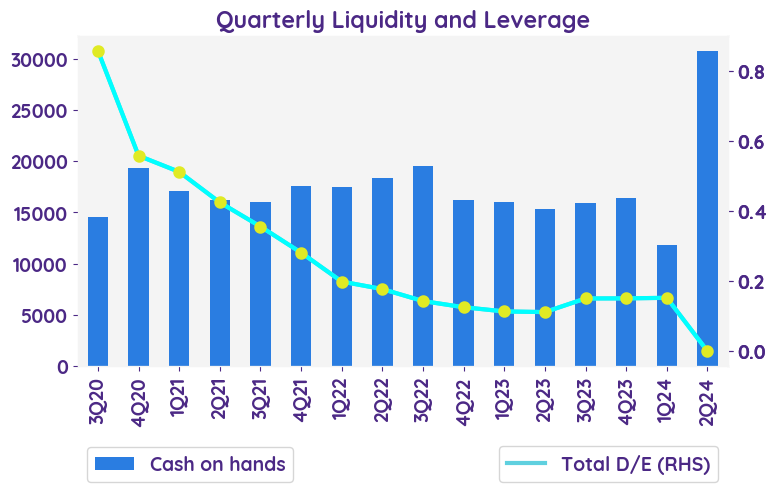

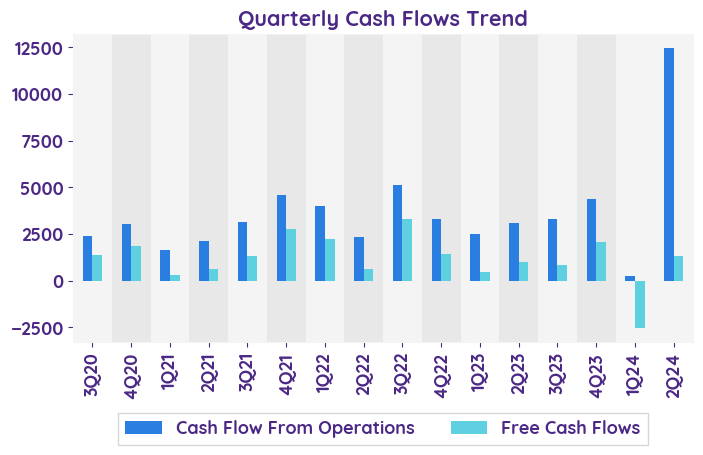

งบดุลแสดงให้เห็นการเพิ่มขึ้นของสินทรัพย์หมุนเวียนในช่วงเวลาที่กำหนด โดยมีเงินสด, เงินฝาก, และการลงทุนเพิ่มขึ้นจาก 23,075 ล้านดอลลาร์ เป็น 30,720 ล้านดอลลาร์ อย่างไรก็ตาม มีการเพิ่มขึ้นของภาระผูกพันหมุนเวียนด้วย ซึ่งค่าใช้จ่ายที่ต้องชำระเพิ่มขึ้นจาก 15,273 ล้านดอลลาร์ เป็น 13,056 ล้านดอลลาร์ ขณะที่งบกระแสเงินสดแสดงให้เห็นกระแสเงินสดรวมที่ได้รับจากการดำเนินงานที่เป็นบวก มีการเพิ่มขึ้นอย่างมากจาก 2,614 ล้านดอลลาร์ ในไตรมาส 2 ปี 2023 เป็น 3,612 ล้านดอลลาร์ ในไตรมาส 2 ปี 2024 การเพิ่มขึ้นนี้เกิดจากผลกำไรสุทธิที่สูงขึ้นและการปรับปรุงสำหรับการเสื่อมค่า, การลดมูลค่า, และการลดมูลค่า ในด้านการลงทุน มีการลดลงของการใช้เงินสดเกิดจากการจ่ายเงินทุนน้อยลงและการซื้อการลงทุน ส่วนกิจกรรมทางการเงินสดเพิ่มขึ้นเกิดจากการตอบแทนเงินและกู้ยืมภายใต้การเงินการผลิตและสินค้าพลังงาน

แนวโน้มในระยะถัดไป

บริษัทมีแผนเตรียมเปิดตัวรถใหม่และสินค้าพลังงาน ประกอบกับมุ่งเน้นการลดต้นทุนทั่วทั้งบริษัท ขณะที่มองยอดขายรถปี 2024 ชะลอตัวจึงเตรียมเน้นธุรกิจพลังงาน, พัฒนารถใหม่,เน้น AI และซอฟต์แวร์บริการ นอกจากนี้เตรียมเริ่มผลิตรถรุ่นใหม่ในช่วงต้นปี 2568

Tesla เผยงบ 2Q24 ต่ำกว่าคาดในส่วนกำไรหลังภาพรวมงบกดดันจากธุรกิจ EV ที่ชะลอตัวหลังมีการแข่งขันสูง รวมถึงยังปรับลดราคาขายส่งผลให้อัตรากำไรขั้นต้น EV อย่างไรก็ดีผลกำไรจากธุรกิจอื่น ๆ โดยเฉพาะธุรกิจพลังงานและรายได้จากเครดิตด้านกฎระเบียบสูงขึ้น

กำไรยังคงมีแรงกดดันจากการลดราคาขาย

กำไรในไตรมาส 2 ปี 2024 แย่กว่าคาดและหดตัวลง YoY โดยกำไรต่อหุ้นอยู่ที่ 52 เซนต์เทียบกับคาดที่ 60 เซนต์ และปีก่อนที่ 78 เซนต์ ภาพนี้สะท้อนให้เห็นผลกระทบจากการปรับลดราคาขายของบริษัทที่ยังคงดำเนินต่อเนื่อง

ยอดขายเพิ่มขึ้นเล็กน้อยหนุนจากธุรกิจที่ไม่ใช่ EV

รายได้ในไตรมาส 2 ปี 2024 ดีกว่าคาดโดยรายได้จากการขายรถยนต์เพิ่มขึ้นจาก 16,460 ล้านดอลลาร์เป็น 18,530 ล้านดอลลาร์ ขณะที่รายได้จากการผลิตและจัดเก็บพลังงานเพิ่มขึ้นอย่างมากจาก 1,635 ล้านดอลลาร์เป็น 3,014 ล้านดอลลาร์ และรายได้จากบริการอื่น ๆ ก็แสดงการเติบโตจาก 2,288 ล้านดอลลาร์เป็น 2,608 ล้านดอลลาร์ ทั้งหมดรวมรายได้ทั้งหมดเพิ่มขึ้น 2.3%YoY

Operating Income ยังมีแรงกดดันจากค่าใช้จ่ายปรับโครงสร้างที่เพิ่มขึ้น

รายได้จากการดำเนินงานของบริษัทลดลงจาก 9.6% ในไตรมาส 2 ปี 2023 เป็น 6.3% ในไตรมาส 2 ปี 2024 ลดลง 333 จุดฐานหลังค่าใช้จ่ายในการปรับโครงสร้างและการเพิ่มขึ้นของรายจ่ายการดำเนินงานเป็นสาเหตุหลักที่ทำให้รายได้จากการดำเนินงานลดลง แต่มีปัจจัยบวกเช่น รายได้เครดิตทางกฎหมายที่สูงขึ้นและกำไรจากการขายพลังงานและเก็บกักข้อมูลที่เพิ่มขึ้น ผลกระทบที่มีต่อความสามารถในการทำกำไรของบริษัททำให้รายได้จากการดำเนินงานลดลง

Balance sheet และ cashflow

งบดุลแสดงให้เห็นการเพิ่มขึ้นของสินทรัพย์หมุนเวียนในช่วงเวลาที่กำหนด โดยมีเงินสด, เงินฝาก, และการลงทุนเพิ่มขึ้นจาก 23,075 ล้านดอลลาร์ เป็น 30,720 ล้านดอลลาร์ อย่างไรก็ตาม มีการเพิ่มขึ้นของภาระผูกพันหมุนเวียนด้วย ซึ่งค่าใช้จ่ายที่ต้องชำระเพิ่มขึ้นจาก 15,273 ล้านดอลลาร์ เป็น 13,056 ล้านดอลลาร์ ขณะที่งบกระแสเงินสดแสดงให้เห็นกระแสเงินสดรวมที่ได้รับจากการดำเนินงานที่เป็นบวก มีการเพิ่มขึ้นอย่างมากจาก 2,614 ล้านดอลลาร์ ในไตรมาส 2 ปี 2023 เป็น 3,612 ล้านดอลลาร์ ในไตรมาส 2 ปี 2024 การเพิ่มขึ้นนี้เกิดจากผลกำไรสุทธิที่สูงขึ้นและการปรับปรุงสำหรับการเสื่อมค่า, การลดมูลค่า, และการลดมูลค่า ในด้านการลงทุน มีการลดลงของการใช้เงินสดเกิดจากการจ่ายเงินทุนน้อยลงและการซื้อการลงทุน ส่วนกิจกรรมทางการเงินสดเพิ่มขึ้นเกิดจากการตอบแทนเงินและกู้ยืมภายใต้การเงินการผลิตและสินค้าพลังงาน

แนวโน้มในระยะถัดไป

บริษัทมีแผนเตรียมเปิดตัวรถใหม่และสินค้าพลังงาน ประกอบกับมุ่งเน้นการลดต้นทุนทั่วทั้งบริษัท ขณะที่มองยอดขายรถปี 2024 ชะลอตัวจึงเตรียมเน้นธุรกิจพลังงาน, พัฒนารถใหม่,เน้น AI และซอฟต์แวร์บริการ นอกจากนี้เตรียมเริ่มผลิตรถรุ่นใหม่ในช่วงต้นปี 2568

| Revenue - %Chg YoY | 3Q23 | 4Q23 | 1Q24 | 2Q24 | 3Q24E |

|---|---|---|---|---|---|

| Automotive | 55.0% | 2.7% | -9.8% | -3.9% | 9.4% |

| Services & Other | 84.0% | 30.8% | 24.6% | 21.3% | 18.3% |

| Energy Generation & Storage | 38.6% | 49.2% | 6.9% | 99.7% | 58.4% |

| Sentiment | 3Q23 | 4Q23 | 1Q24 | 2Q24 |

|---|---|---|---|---|

| net profit | Negative | Positive | Positive | Negative |

| margin | Negative | Negative | Negative | Neutral |

| revenue | Positive | Positive | Neutral | Positive |

| Stock data | |

|---|---|

| Market Cap (USD Million) | 785.75 |

| Beta | 1.84 |

| Last close | 246.38 |

| 12-m Low / High | 138.8 / 279 |

| Target price | 220.00 |

| Return Potential | -10.7 % |

| % of Buy / Sell rating | 44.0 % / 22.0 % |

| Valuation data | 12m Forward | 5-Yr Average |

|---|---|---|

| P/E | 87.18 | |

| P/B | 11.49 | 19.89 |

| P/S | 7.93 | 11.23 |

| EV/EBITDA | 47.98 | 47.97 |

| Dividend Yield | 0.0 % |

Tesla, Inc.

Tesla Inc. operates as a multinational automotive and clean energy company. The Company designs and manufactures electric vehicles, battery energy storage from home to grid-scale, solar panels and solar roof tiles, and related products and services. Tesla owns its sales and service network and sells electric power train components to other automobile manufacturers.

Related Articles