สรุปสาระสำคัญ

• Taiwan Semiconductor Manufacturing (TSM) เผยงบ 4Q23 ดีกว่าคาดทั้งรายได้และกำไร โดยรายได้เติบโต 14.4% QoQ อยู่ที่ $19.6bn ขณะที่กำไรฟื้นตัวต่อเนื่องและขาดทุนน้อยลง โดยลดลง 19% YoY อยู่ที่ $7.6bn นอกจากนี้บริษัทให้คาดการณ์รายได้ในช่วง 1Q24 ดีกว่าคาดอยู่ที่ราว

18.0-$18.8bn หนุนจากการฟื้นตัวของความต้องการ

สมาร์ทโฟนและคอมพิวเตอร์

สมาร์ทโฟนและคอมพิวเตอร์

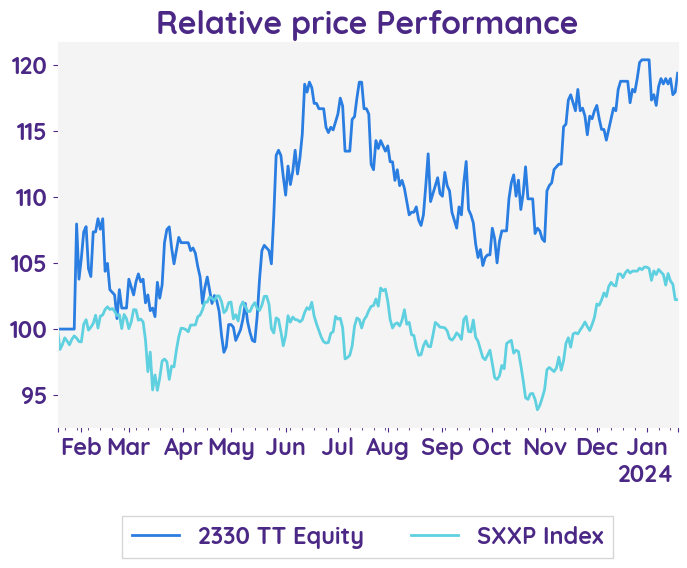

• ภาพงบและคาดการณ์ที่ออกมาดีกว่าตลาดคาดส่งผลให้ราคาหุ้น ADR ในตลาดสหรัฐฯช่วง After Hours +0.8% ด้าน Bloomberg ให้ราคาเป้าหมายเฉลี่ยไว้ที่ 717 TWD ซึ่งมี Upside 21.9% จากราคาปัจจุบัน (ข้อมูล 17 ม.ค. 67)

18 January 2024

Taiwan Semiconductor Manufacturing Company Limited

2330.TT

18 January 2024

Taiwan Semiconductor Manufacturing Company Limited

2330.TT

Bloomberg 2330.TT

Reuters TSM.N

TSMC anticipates consistent investment following a Q4 earnings triumph that exceeded forecasts.

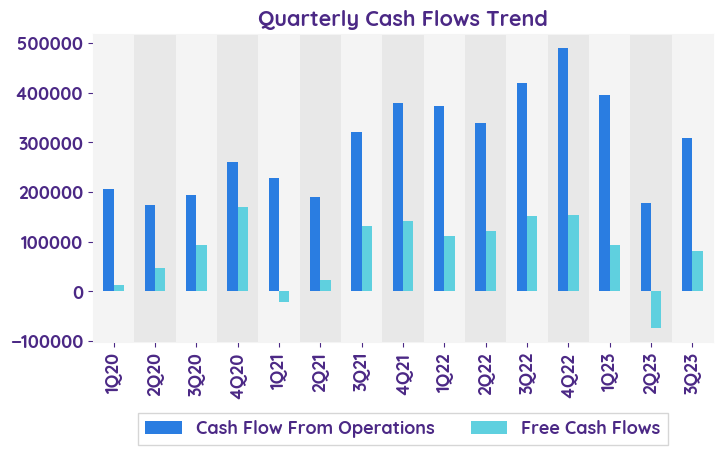

Earnings Result

Comparing the previous quarter to the current quarter, the company's net revenue has decreased from 2022 to 2023. However, there has been a slight increase in gross profit, although the gross margin has decreased. Operating income has also decreased, mainly due to higher research and development expenses. On the positive side, non-operating items such as interest income have increased, resulting in a higher net profit for the company. Despite this, the net profit margin has decreased compared to the previous year. Overall, the company's earnings results show a mixed outlook, with areas of improvement in controlling costs and increasing revenue.

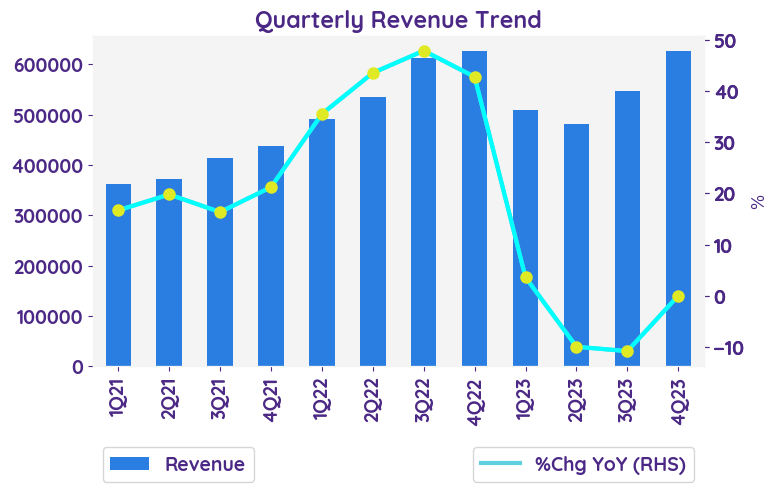

Revenue Analysis

In 4Q23, revenue surged 14.4%, beating estimates with 3nm technology's strong performance, contributing 15% to wafer revenue. HPC and Smartphone sectors dominated at 43% each, while North America led geographically with 72%. Advanced technologies (7nm and below) comprised 67%.

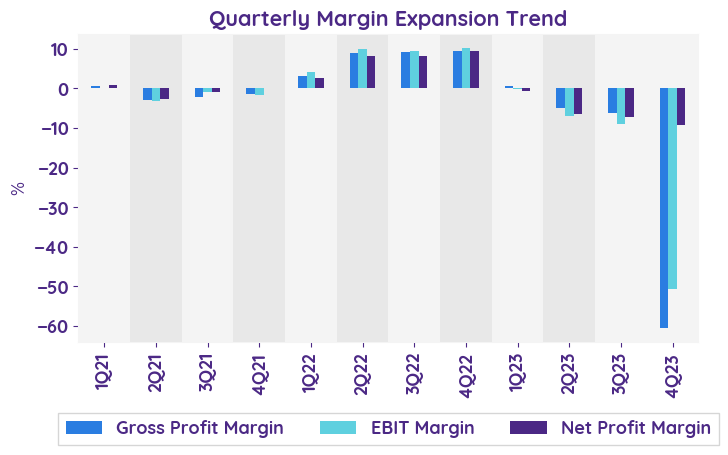

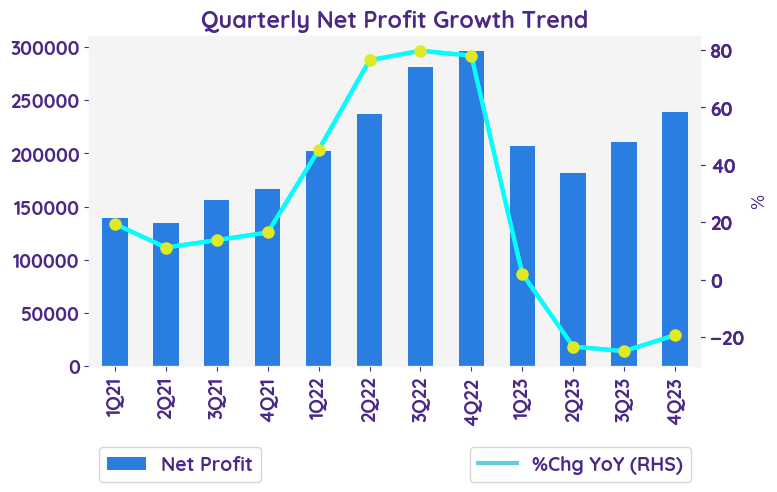

Profit Analysis

In 4Q23, TSMC's gross profit dropped to 331.77 billion NT$ from 389.19 billion in 4Q22, with the gross margin falling from 62.2% to 53.0%. This decline was due to reduced capacity utilization and N3 ramp, despite gains from favorable exchange rates. Nevertheless, Q4 net profit fell 19% to $7.6B, surpassing estimates.

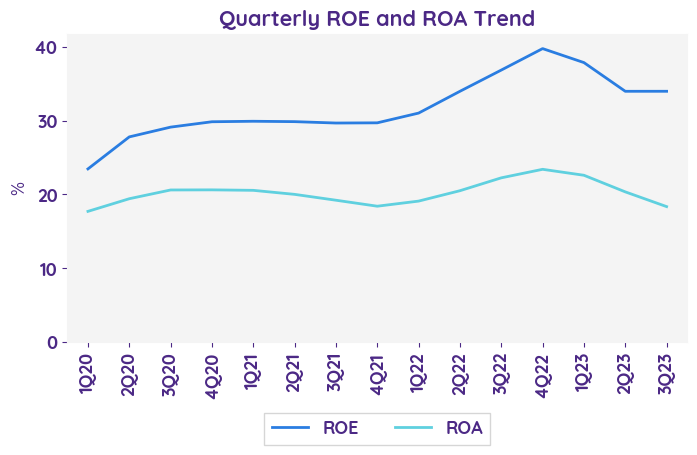

Operating Income Analysis

In 4Q23, TSMC's operating income was NT$260.21 billion, which decreased from NT$325.04 billion in 4Q22. The operating margin also declined to 41.6% in 4Q23. For the full year 2023, total operating expenses represented 11.8% of net revenue, higher than the 10.0% in 2022, mainly due to higher R&D expenses and a lower revenue base. This indicates a decrease in profitability and efficiency in TSMC's operations.

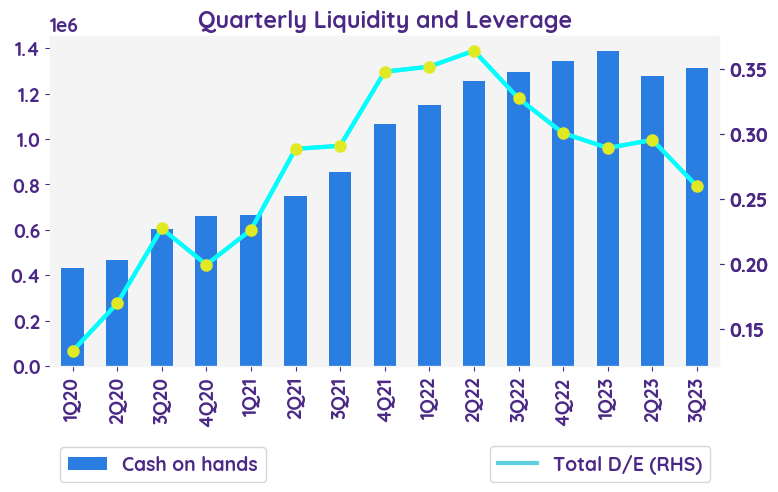

Receivable and Inventory Days

Receivable and Inventory Days: In 4Q23, the days of receivable decreased by 4 days to 31 days, and the days of inventory decreased by 11 days to 85 days. This was primarily due to higher N3 wafer shipments. Overall, the company showed improvements in receivable and inventory management, as well as increased liquidity and net cash reserves.

1Q24 guidance

For 1Q24, we project revenue between $18.0-$18.8 billion, with a 52-54% gross profit margin and 40-42% operating profit margin, based on a USD to NT dollar exchange rate of 1:31.1.

Comparing the previous quarter to the current quarter, the company's net revenue has decreased from 2022 to 2023. However, there has been a slight increase in gross profit, although the gross margin has decreased. Operating income has also decreased, mainly due to higher research and development expenses. On the positive side, non-operating items such as interest income have increased, resulting in a higher net profit for the company. Despite this, the net profit margin has decreased compared to the previous year. Overall, the company's earnings results show a mixed outlook, with areas of improvement in controlling costs and increasing revenue.

Revenue Analysis

In 4Q23, revenue surged 14.4%, beating estimates with 3nm technology's strong performance, contributing 15% to wafer revenue. HPC and Smartphone sectors dominated at 43% each, while North America led geographically with 72%. Advanced technologies (7nm and below) comprised 67%.

Profit Analysis

In 4Q23, TSMC's gross profit dropped to 331.77 billion NT$ from 389.19 billion in 4Q22, with the gross margin falling from 62.2% to 53.0%. This decline was due to reduced capacity utilization and N3 ramp, despite gains from favorable exchange rates. Nevertheless, Q4 net profit fell 19% to $7.6B, surpassing estimates.

Operating Income Analysis

In 4Q23, TSMC's operating income was NT$260.21 billion, which decreased from NT$325.04 billion in 4Q22. The operating margin also declined to 41.6% in 4Q23. For the full year 2023, total operating expenses represented 11.8% of net revenue, higher than the 10.0% in 2022, mainly due to higher R&D expenses and a lower revenue base. This indicates a decrease in profitability and efficiency in TSMC's operations.

Receivable and Inventory Days

Receivable and Inventory Days: In 4Q23, the days of receivable decreased by 4 days to 31 days, and the days of inventory decreased by 11 days to 85 days. This was primarily due to higher N3 wafer shipments. Overall, the company showed improvements in receivable and inventory management, as well as increased liquidity and net cash reserves.

1Q24 guidance

For 1Q24, we project revenue between $18.0-$18.8 billion, with a 52-54% gross profit margin and 40-42% operating profit margin, based on a USD to NT dollar exchange rate of 1:31.1.

| Revenue - %Chg YoY | 1Q23 | 2Q23 | 3Q23 | 4Q23 | 1Q24E |

|---|---|---|---|---|---|

| Smartphone | -11.0% | -20.9% | 33.0% | 13.2% | 9.1% |

| High Performance Computing | 11.5% | -6.4% | 6.0% | 2.4% | 9.2% |

| Internet of Things | 9.4% | -14.5% | 24.0% | -37.5% | 28.6% |

| Automotive | 51.8% | 37.8% | -24.0% | -16.7% | -1.2% |

| Digital Consumer Electronics | -24.5% | -10.4% | -1.0% | 0.0% | -3.4% |

| Others | 22.4% | 7.8% | -2.0% | -50.0% | 2.1% |

| Sentiment | 1Q23 | 2Q23 | 3Q23 | 4Q23 |

|---|---|---|---|---|

| net profit | Negative | Negative | Positive | Negative |

| margin | Negative | Negative | Neutral | Negative |

| revenue | Negative | Negative | Positive | Neutral |

| Stock data | |

|---|---|

| Market Cap (TWD Billion) | 15248.06 |

| Beta | 1.48 |

| Last close | 588.00 |

| 12-m Low / High | 489 / 594 |

| Target price | 717.00 |

| Return Potential | 21.9 % |

| % of Buy / Sell rating | 95.0 % / 0.0 % |

| Valuation data | 12m Forward | 5-Yr Average |

|---|---|---|

| P/E | 15.66 | 21.24 |

| P/B | 3.67 | 5.50 |

| P/S | 5.82 | 7.83 |

| EV/EBITDA | 8.35 | 8.21 |

| Dividend Yield | 2.38 % |

Taiwan Semiconductor Manufacturing Company Limited

Taiwan Semiconductor Manufacturing Company, Ltd. manufactures and markets integrated circuits. The Company provides the following services: wafer manufacturing, wafer probing, assembly and testing, mask production, and design services. TSMC's ICs are used in computer, communication, consumer electronics, automotive, and industrial equipment industries.

Related Articles