สรุปสาระสำคัญ

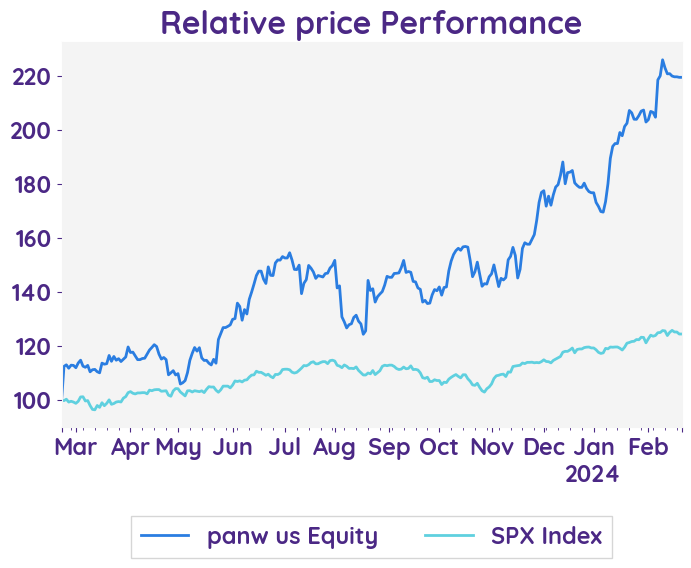

• Palo Alto Networks (PANW) เผยงบดีกว่าคาดใน 2Q24 โดยรายได้โต 19% YoY ด้าน RPO ดีกว่าคาดเล็กน้อยและยังคงเติบโต 23% YoY

• อย่างไรก็ดีราคาหุ้นในช่วงก่อนตลาดเปิดปรับตัวลงราว -21.0% หลัง 1) ระดับการเติบโตในไตรมาสนี้ถือว่าชะลอตัวลง โดยเฉพาะการเรียกชำระเงิน (billings) 2) การปรับลดประมาณการรายได้ประจำปี 24 ลง โดยมองยอดขายจะอยู่ที่ $7.95bn- $8bn จากคาดการณ์ก่อนที่ $8.2bn และถือว่าเป็นระดับการเติบโตที่หดตัวลงจากปีก่อน

21 February 2024

Palo Alto Networks, Inc.

PANW

21 February 2024

Palo Alto Networks, Inc.

PANW

Bloomberg PANW.US

Reuters PAN.NLB

Palo Alto Networks experiences a sharp decline following a reduction in revenue forecast.

Earnings Result

In comparing the previous and current quarter financial reports of Palo Alto Networks, it is evident that the company continues to highlight key factors such as competition, customer purchasing decisions, and debt repayment obligations as potential risks to its financial results. Additionally, the company emphasizes its share repurchase program and the potential impact on stock prices. It is worth noting that the company provides non-GAAP financial measures and highlights that the financial information in the press release has not been prepared in accordance with GAAP. This suggests that investors should carefully consider these factors when evaluating the company's outlook and forecast for the future.

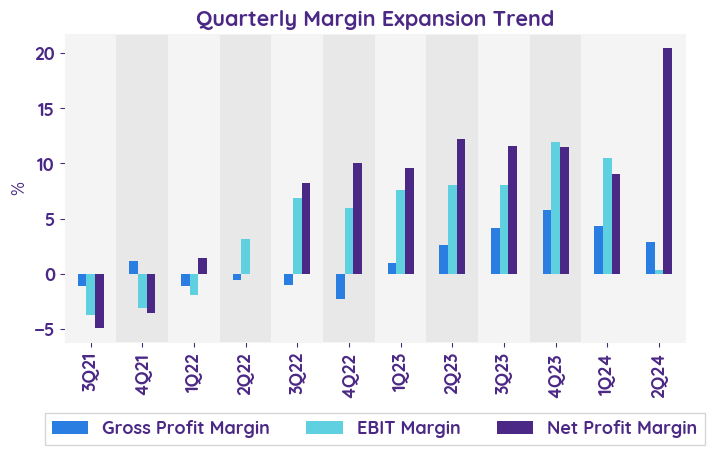

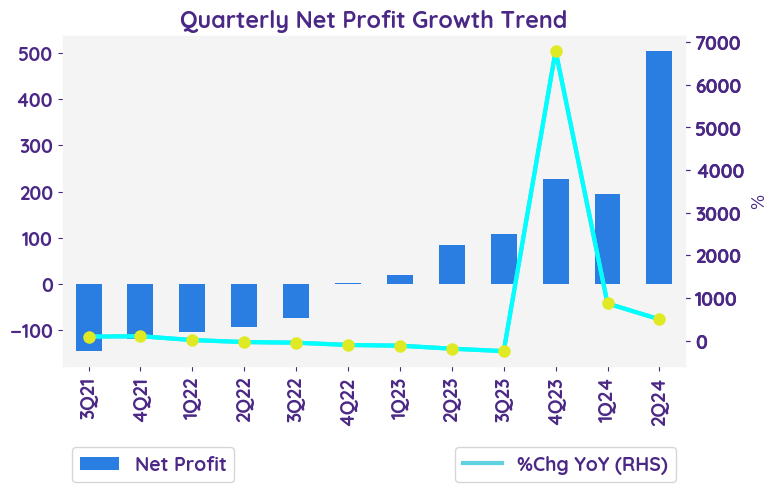

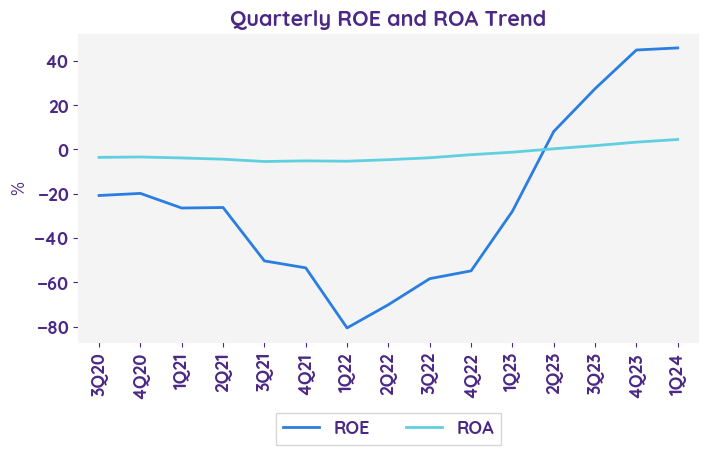

Net profit growth QoQ and YoY

The net income for Palo Alto Networks in the fiscal second quarter of 2024 was $1.7 billion, compared to $0.1 billion in the same quarter of the previous year and also beat expectation. This represents a significant year-over-year growth in net income.

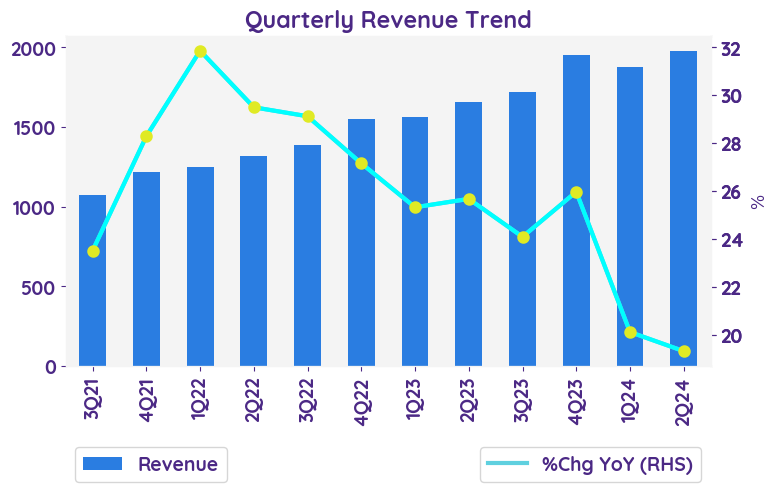

Revenue growth of each business

The earnings report states that Palo Alto Networks experienced a 19% year-over-year revenue growth in the fiscal second quarter of 2024, reaching $2.0 billion and beating expectation. This growth indicates positive performance for the company in terms of generating revenue.

Remaining performance obligation

In the second quarter of fiscal year 2024, the remaining performance obligation saw a significant 22% year-over-year increase to $10.8 billion, exceeding market expectations. However, the growth rate in this quarter was lower compared to the previous quarter.

Financial Outlook

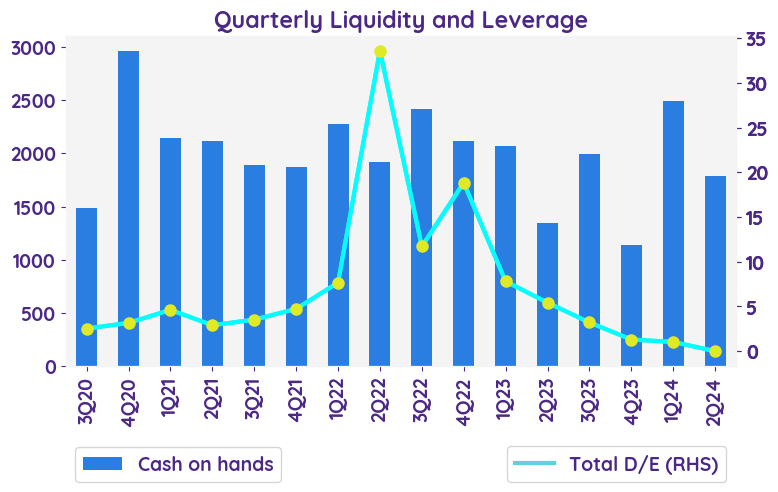

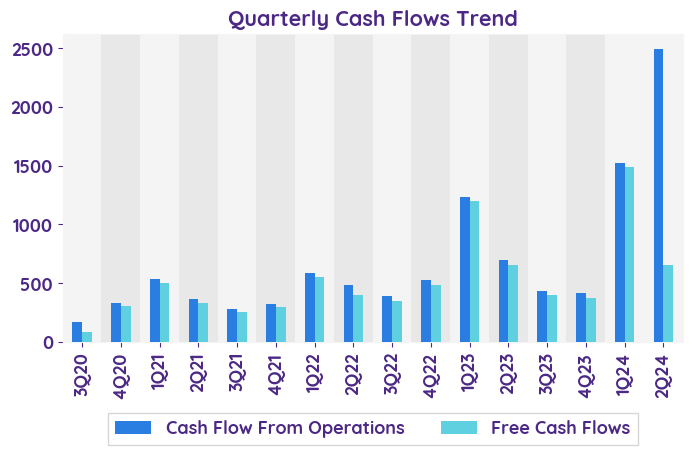

Despite a positive financial outlook for Palo Alto Networks, including anticipated growth in total billings, revenue, and non-GAAP net income per share compared to the previous year, the company is planning to increase investments in platformization and consolidation strategies to drive long-term growth. However, the decision to reduce its revenue forecast for the year has raised concerns that customers may be scaling back on technology expenses. The guidance offered does not account for specific expenses and one-time cash flows.

Risks and concerns

The current risk that the company is facing includes factors such as market conditions, managing growth, development and release of new offerings, competition, customer purchasing decisions, debt repayment obligations, and share repurchase program. The company's plan is to continuously monitor and manage these risks to mitigate their impact on financial results.

In comparing the previous and current quarter financial reports of Palo Alto Networks, it is evident that the company continues to highlight key factors such as competition, customer purchasing decisions, and debt repayment obligations as potential risks to its financial results. Additionally, the company emphasizes its share repurchase program and the potential impact on stock prices. It is worth noting that the company provides non-GAAP financial measures and highlights that the financial information in the press release has not been prepared in accordance with GAAP. This suggests that investors should carefully consider these factors when evaluating the company's outlook and forecast for the future.

Net profit growth QoQ and YoY

The net income for Palo Alto Networks in the fiscal second quarter of 2024 was $1.7 billion, compared to $0.1 billion in the same quarter of the previous year and also beat expectation. This represents a significant year-over-year growth in net income.

Revenue growth of each business

The earnings report states that Palo Alto Networks experienced a 19% year-over-year revenue growth in the fiscal second quarter of 2024, reaching $2.0 billion and beating expectation. This growth indicates positive performance for the company in terms of generating revenue.

Remaining performance obligation

In the second quarter of fiscal year 2024, the remaining performance obligation saw a significant 22% year-over-year increase to $10.8 billion, exceeding market expectations. However, the growth rate in this quarter was lower compared to the previous quarter.

Financial Outlook

Despite a positive financial outlook for Palo Alto Networks, including anticipated growth in total billings, revenue, and non-GAAP net income per share compared to the previous year, the company is planning to increase investments in platformization and consolidation strategies to drive long-term growth. However, the decision to reduce its revenue forecast for the year has raised concerns that customers may be scaling back on technology expenses. The guidance offered does not account for specific expenses and one-time cash flows.

Risks and concerns

The current risk that the company is facing includes factors such as market conditions, managing growth, development and release of new offerings, competition, customer purchasing decisions, debt repayment obligations, and share repurchase program. The company's plan is to continuously monitor and manage these risks to mitigate their impact on financial results.

| Revenue - %Chg YoY | 4Q23 | 1Q24 | 2Q24 | 3Q24 | 4Q24 |

|---|---|---|---|---|---|

| Subscription & Support | 26.6% | 24.6% | 21.7% | 22.2% | 21.4% |

| Product | 24.3% | 3.4% | 10.7% | 1.8% | -0.2% |

| Sentiment | 1Q24 | 2Q24 | 3Q24 | 4Q24 |

|---|---|---|---|---|

| net profit | Positive | Positive | Positive | Positive |

| margin | Neutral | Positive | Positive | Positive |

| revenue | Positive | Positive | Positive | Positive |

| Stock data | |

|---|---|

| Market Cap (USD Million) | 115.43 |

| Beta | 1.17 |

| Last close | 366.09 |

| 12-m Low / High | 165.4 / 380.8 |

| Target price | 378.00 |

| Return Potential | 3.3 % |

| % of Buy / Sell rating | 76.0 % / 4.0 % |

| Valuation data | 12m Forward | 5-Yr Average |

|---|---|---|

| P/E | 62.75 | |

| P/B | 31.14 | 73.57 |

| P/S | 14.11 | 8.73 |

| EV/EBITDA | 45.20 | 144.48 |

| Dividend Yield | 0.0 % |

Palo Alto Networks, Inc.

Palo Alto Networks, Inc. provides network security solutions. The Company offers firewalls that identify and control applications, scan content to stop threats, prevent data leakage, integrated application, user, and content visibility. Palo Alto Networks serves customers worldwide.

Related Articles